Thor Industries (NYSE:THO) is set to give its latest quarterly earnings report on Wednesday, 2024-12-04. Here's what investors need to know before the announcement.

Analysts estimate that Thor Industries will report an earnings per share (EPS) of $0.70.

The announcement from Thor Industries is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It's worth noting for new investors that guidance can be a key determinant of stock price movements.

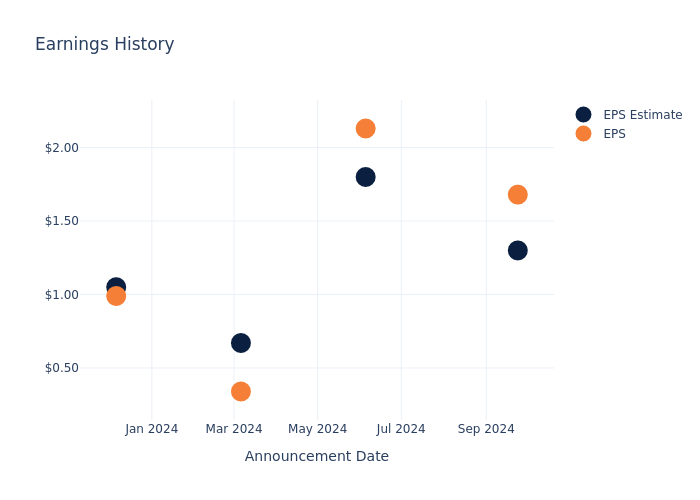

Historical Earnings Performance

The company's EPS beat by $0.38 in the last quarter, leading to a 2.77% drop in the share price on the following day.

Here's a look at Thor Industries's past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 1.30 | 1.80 | 0.67 | 1.05 |

| EPS Actual | 1.68 | 2.13 | 0.34 | 0.99 |

| Price Change % | -3.0% | 1.0% | -1.0% | 2.0% |

Performance of Thor Industries Shares

Shares of Thor Industries were trading at $110.95 as of December 02. Over the last 52-week period, shares are up 5.57%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Observations about Thor Industries

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Thor Industries.

The consensus rating for Thor Industries is Neutral, derived from 4 analyst ratings. An average one-year price target of $111.0 implies a potential 0.05% upside.

Analyzing Analyst Ratings Among Peers

In this analysis, we delve into the analyst ratings and average 1-year price targets of and Thor Industries, three key industry players, offering insights into their relative performance expectations and market positioning.

Peers Comparative Analysis Summary

Within the peer analysis summary, vital metrics for and Thor Industries are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Thor Industries | Neutral | -7.45% | $401.33M | 2.23% |

Key Takeaway:

Thor Industries is positioned in the middle among its peers based on consensus rating. It ranks at the bottom for revenue growth compared to its peers. In terms of gross profit, Thor Industries is at the top among its peers. However, it ranks at the bottom for return on equity.

Get to Know Thor Industries Better

Based in Elkhart, Indiana, Thor Industries manufactures Class A, Class B, and Class C motor homes along with travel trailers and fifth-wheel towables across about 35 brands. Through the acquisition of Erwin Hymer in 2019, the company expanded its geographic footprint and now produces various motorized and towable recreational vehicles for Europe, including motor caravans, camper vans, urban vehicles, caravans, and other RV-related products and services. The company has also begun generating revenue through aftermarket component parts via the acquisition of Airxcel in 2021; however, this is still a nascent part of the business as it accounts for less than 10% of total sales. In fiscal 2024, the company wholesaled 186,908 units and generated over $10 billion in revenue.

Understanding the Numbers: Thor Industries's Finances

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Decline in Revenue: Over the 3 months period, Thor Industries faced challenges, resulting in a decline of approximately -7.45% in revenue growth as of 31 July, 2024. This signifies a reduction in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Thor Industries's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 3.55%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Thor Industries's ROE stands out, surpassing industry averages. With an impressive ROE of 2.23%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.26%, the company showcases effective utilization of assets.

Debt Management: Thor Industries's debt-to-equity ratio is below the industry average at 0.28, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for Thor Industries visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.