ThanumpornThongkongkaew from Getty Images; Canva

What Is Trading Volume?

How much trading interest does a security have? One way to measure it is by looking at its trading volume. This represents the total number of shares that were traded over a specific timeframe—usually one trading day.

When trading volume is high, that means that more shares were actively traded; when trading volume is low, that means that fewer shares were traded. It’s important to note that trading volume includes both buy and sell orders.

Trading volume can be measured for most types of securities, including stocks, bonds, options, futures, and commodities.

Why Is Trading Volume Important?

Trading volume matters because it represents investor interest in a company. It can also illustrate momentum, which happens when stocks, assets, or sectors are trending higher—and perhaps just as importantly, volume can also help to indicate when a trend is ending. Often, the heaviest volume occurs at a peak.

When considered alongside other indicators, such as a stock’s fundamentals, trading volume can help investors decide whether it’s the right time to buy or sell shares. For example, if a company has reported consistent earnings that beat expectations and trading volume continues to rise, this may be a sign that the company is gaining momentum—and that it’s worth investing in.

How Is Trading Volume Calculated?

Because trading volume simply refers to the number of shares of a given security traded over a given timeframe, it isn’t really calculated—it’s simply counted and reported.

That being said, when discussing trading volume, it’s important to note the timeframe in question (e.g., Stock A had a trading volume of 1,000,000 during the market session on 8/31/22). Most often, trading volume is discussed in reference to a single day or trading session, but it can also be useful to look at a security’s trading volume over both shorter (like one hour) and longer (like one week) timeframes

What Does High Volume Trading Indicate?

High trading volume means there is greater market interest in a stock, which makes for higher liquidity. Large-cap stocks, for example, are considered to be very liquid because their trading volume is high, and the price buyers are willing to pay, which is known as the bid, is close to the price a seller will accept, known as the ask.

What Does Low Trading Volume Indicate?

Low-volume stocks like small-caps are traded more infrequently than larger-cap companies and sometimes trade on smaller, less-liquid exchanges. They are characterized by low volume as well as low liquidity. This means that the price per share a buyer offers could be very different than the price a seller will accept. The difference between a stock’s bid and ask prices is known as its spread, and stocks with lower volume tend to have larger spreads. When this type of stock experiences a surge in demand, it can also experience a lot of volatility. Thus, low volume is a risk associated with smaller market-cap companies.

Does Trading Volume Affect Stock Price?

Everything in finance is said to boil down to supply and demand. And while trading volume doesn’t directly affect share prices, it can impact the manner in which stocks move.

Large-cap stocks have narrow bid/ask spreads, so they also have more opportunities to be traded, and thus trading activity happens easily—one investor may see an opportunity to buy, while another could see an opportunity to sell, and there might only be a penny’s difference between the bid and the ask. Here, the impact of trading volume would be negligible.

But on thinly traded stocks, like small-caps and micro-caps, which experience lower volume, there simply are fewer shares to go around. Therefore, share prices will often move haphazardly since their trading activity creates greater price swings due to much wider bid/ask spreads.

Where Can I Find the Trading Volume of a Stock? What About After Hours?

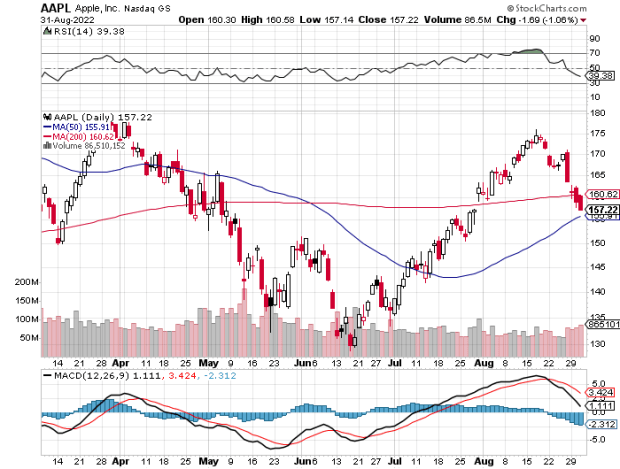

Nearly every trading and charting platform displays trading volume in a bar chart at the bottom of the price chart. Here is an example of Apple (NASDAQ: AAPL) shares from Stockcharts.com.

Here, the red and black bars at the bottom of the chart represent the trading volume for each day shown.

While standard trading hours are between 9:30 AM ET and 4:00 PM ET, after-hours trading takes place after the stock market closes from 4:15 PM ET to 8:15 PM ET, and before it opens, between 4:15 AM ET and 9:30 AM ET. After-hours trading volume can be found on exchange websites, such as the NASDAQ and the NYSE.

How Much Volume Is Considered “Good” for Day Trading?

It’s hard to objectively define what “good” is, since trading volume is often analyzed in combination with other indicators, like volatility, momentum, and liquidity. In fact, investors might consider trading volume to be synonymous with the audience a security has at any given time, how big or small that audience is, and how often it acts in a “herd mentality.” After all, successful investing can just as easily be a matter of mastery over one’s emotions and expectations as one’s ability to read charts and data.