NEW DELHI: Global indices service provider MSCI had earlier this month announced a couple of inclusion and exclusion, along with changes in weightages of a few Indian stocks, which has influenced flows in these stocks. While it has added four stocks to its MSCI India index, namely Tata Elxsi, Adani Power, Jindal Steel & Power and AU Small Finance Bank, HDFC Asset Management Company was booted out from the index. Another Gautam Adani-owned group stock Adani Green’s weighting in the MSCI India Index was cut as it admitted new stocks.

Adani Green Energy Ltd., the group’s biggest firm by market value, led the rout, plunging a record 12% in trading volume on Wednesday, June 1, about nine times the average of the past three months. Adani Total Gas Ltd. Adani Transmission Ltd. and Adani Power Ltd. fell by at least 5% each.

MSCI Inc. published additions and deletions to its global indexes last month but the announcement didn’t detail changes to the weightings of individual stocks in its indexes. The changes took effect at close of trading on Tuesday and analysts said Adani Green’s weighting in the MSCI India Index was cut as it admitted new stocks.

What is the MSCI index?

The index includes a collection of stocks of all the developed markets in the world, as defined by MSCI.

The index includes securities from 23 countries but excludes stocks from emerging and frontier economies making it less worldwide than the name suggests. A related index, the MSCI All Country World Index (ACWI), incorporated both developed and emerging countries. MSCI also produces a Frontier Markets index, including another 31 markets.

What is the MSCI India Index

The MSCI ( Morgan Stanley Capital International) India Index is designed to measure the performance of the large and mid cap segments of the Indian market. With 106 constituents, the index covers approximately 85% of the Indian equity universe. There are four consitutents:

Largest

Smallest

Average

Median

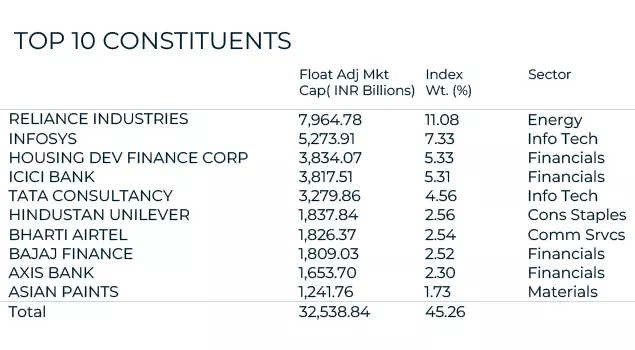

The top ten constituents of the index as of 29 April, 2022 are

Many reputed Indian companies across sectors are included in the index.

The index includes 10 major sectors of the economy such as IT, finance and energy sectors.

Index methodoology: The index is based on the MSCI Global Investable Indexes (GIMI) Methodology—a comprehensive and consistent approach to index construction that allows for meaningful global views and cross regional comparisons across all market capitalization size, sector and style segments and combinations.

This methodology aims to provide exhaustive coverage of the relevant investment opportunity set with a strong emphasis on index liquidity, investability and replicability.

The index is reviewed quarterly—in February, May, August and November—with the objective of reflecting change in the underlying equity markets in a timely manner, while limiting undue index turnover.

During the May and November semi-annual index reviews, the index is rebalanced and the large and mid capitalization cutoff points are recalculated.

The MSCI India is a weighted index just like the Sensex. This means every stock on the index has a particular weightage, which depends on a number of parameters. The three most important are: the returns (dividend) that investors receive on the shares; the company's total turnover, and its market capitalization, according to Kotak Securities.

Turnover and market capitalization represent how big or small a company is. Bigger the market capitalization of the company, higher the weightage allotted to it. This means, the index comprises of some of the biggest companies in India. The index is reviewed four times in a year. New companies are listed after a review, while some are delisted for not meeting the parameters set by the index.

Why FIIs use MSCI India index:

Foreign investors want to know more about the stability and volatility in the prices of shares. "The amount of funds that a foreigner will invest in an Indian share will be directly dependent on the stock's weightage on the MSCI index. If the weightage of a company is reduced then there is always a possibility of foreign investors withdrawing their funds.Often many investors prefer to follow a benchmark index for their stock investments. So, suppose they have to invest Rs 1 crore, they will divide this amount and invest in different stocks that form an index. How much portion will be invested in a single stock depends on its weightage. If a stock has 10% weightage in the index, then they will invest 10% of the Rs 1 crore-Rs 10 lakh, in the stock. Similarly, they invest in all the stocks that form the index depending on the weightage. This is called passive investing. Every time the index components are re-formed or the weightages are changed, foreign investors too re-adjust the portion of their investment in the individual shares," noted Kotak Securities in a note.

What is the May 2022 rejig all about?

MSCI has included Adani Power, AU Small Finance Bank, Jindal Steel and Power (JSPL), and Tata Elxsi in the MSCI India Index, whereas HDFC Asset Management (AMC) has been dropped. These changes in the MSCI India Standard Index came into effect from June 1. However, index funds are expected to rejig portfolio on May 31 itself.

The semi-annual index review has also included 50 small-cap firms to the MSCI India Domestic SmallCap Index and dropped 10 stocks.

The additions include Apollo Tricoat Tubes, Aptus Value HSG Finance, Bharat Dynamics, CE Info Systems, Easy Trip Planners, Equitas Small Finance, ESAB India, GHCL, Go Fashions India, Godawari Power and Ispat, Greaves Cotton, Greenpanel Industries, among others. Adani Power Ltd, Bajaj Consumer Care, Cholamandalam Investment, Future Retail, GMR Power & Urban Infra, IOL Chemicals and Pharma, Jindal Steel & Power, NCL India, Solara Active Pharma, Spandana Sphoorty Fin, have been removed from the smallcap India index.

To be eligible for inclusion in a MSCI index, a leading provider of research-based indexes and analytics, a security’s Foreign Inclusion Factor (FIF) must reach a certain threshold. The FIF of a security is defined as the proportion of shares outstanding that is available for purchase in the public equity markets by international investors.

According to a note by Edelweiss, Tata Elxsi is likely to see flows of $188 million, followed by $150 million each in Adani Power and Jindal Steel & Power.

Among the stocks, whose weightage has increased, Reliance Industries tops the list, followed by Sun Pharma, Godrej Consumers, United Spirits, ICICI Lombard and Page Industries.

"On expected lines, Reliance Industriesshare count will increase due to partly paid conversion to ordinary shares seen in November 2021 and the consequent weight up will lead to approximately inflow of $335 million," Edelweiss said.

Sun Pharma could see inflows worth $90 million, Page Industries could see inflows of $55 million, Godrej Consumer could see inflows of $35 million, United Spirits could gain by $25 million worth of flows and ICICI Lombard ($20 million) due to a rise in their weightages in the MSCI index.

Meanwhile, Bharti Airtel may see $225 million in outflows following a cut in index weightage. Adani Green Energy, NTPC, Vedanta, Maruti Suzuki and Hindalco Industries are expected to see $100-220 million outflows.

Following the change in Adani Green’s weight in the MSCI India Index, the stock could see outflows of about $220 million, Abhilash Pagaria, an analyst with Edelweiss Alternative & Quantitative Research, wrote in the note.

NTPC could see outflows worth $155 million, while Maruti Suzuki and Vedanta could each lose $125 in outflows due to a cut in the index weightage.

Others that could see otflows due to a cut in weightage include JSW Steel ( $85 million), Info Edge ( $25 million) Tech Mahindra ( %70 million), HDFC ( $55 million), Tata Consumer ( $40 million) Ambuja Cements ( $40 million) and Pidilite Industries ( $20 million).

With inputs from Bloomberg