bernie photo from Getty Images Signature

What Is the Great Wealth Transfer?

Forget Succession-style plotting and backstabbing. These days, the most common way to come into riches is much easier.

The great wealth transfer, also known as the intergenerational wealth transfer, is the transmission of family assets from one generation to the next.

U.S. Adult Generations

This phenomenon started in the mid-2010s, as the Baby Boomer generation began retiring. Born at a time of prosperity following WWII, Boomers entered the workforce during the strongest economic “boom” the world has ever seen, amassing wealth through real estate and the stock market.

Between 1983 and 2023, home values grew 500% while the stock market’s gains were even bigger. According to the Federal Reserve, household wealth skyrocketed from $38 trillion in 1989 to $140 trillion in 2022.

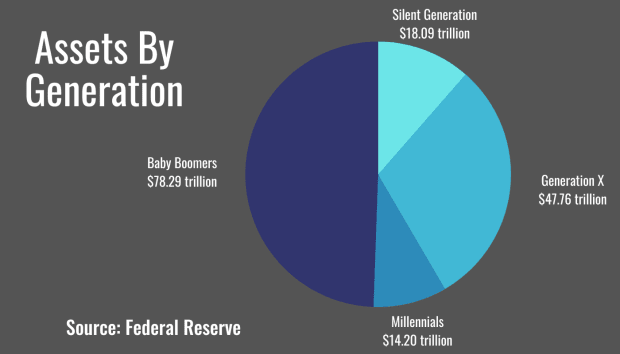

And by 2023, half of that wealth, or roughly $78 trillion in assets, belonged to members of the Baby Boomer generation.

Federal Reserve

According to market research firm Cerulli and Associates, Baby Boomers and the Silent Generation, who preceded the Boomers, will be passing down most of their wealth to members of their immediate families, as the amount they have saved exceeds their retirement living expenses—even healthcare costs—and will last long after their lives end.

Cerulli estimates that recipients of the great wealth transfer will inherit $84 trillion in assets by around 2043, with $72.6 trillion going directly to heirs and $11.9 trillion going to charity. That’s a spectacular amount of money poised to be handed down to the Boomers’ children and grandchildren. These assets will be distributed in the form of gifts and charitable donations, with the rest transferred through bequests after their deaths.

This financial shift will serve as a tipping point for the U.S. economy, and it’s already being seen through asset gains from younger generations, like Millennials, who according to the Federal Reserve, have added $4 trillion to their assets since 2020 alone.

Who Gets the Great Wealth Transfer?

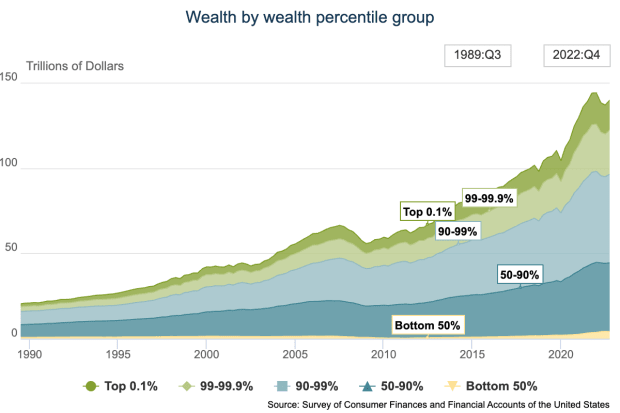

Unfortunately, the great wealth transfer is a pretty one-sided transaction. It’s a case of “the rich getting richer” since the majority of accumulated wealth will remain in the same lineages.

Federal Reserve

Forty-two percent, or $35.8 trillion of the assets being distributed, will come from high-net-worth or ultra-high-net-worth individuals, who have between $5 and $20 million in liquid assets like cash. These groups account for about 1% of all Americans.

In a 2019 report on wealth disparity by the Board of Governors of the Federal Reserve, analysts noted that “the typical White family has eight times the wealth of the typical Black family and five times the wealth of the typical Hispanic family.”

However, 8% of the total expected in the great wealth transfer will come from the 50% percentile of American households. That amounts to nearly $6 trillion and can include anything from small inheritances to assets, such as a parent’s IRA accounts or their paid-off houses. These bequests could help the younger generations pay off their student loans or become first-time homeowners themselves. And that’s not too shabby, either.

What Does the Great Wealth Transfer Mean for the Financial Industry?

So, we know that a whole lot of money is set to be transferred in the coming years—but the question is, how?

High-net-worth and ultra-high-net-worth individuals typically transition their assets through trusts or even offshore accounts, but people with less at stake, such as the bulk of Americans who average less than $100,000 in investable assets, might not even know the best financial vehicle to use for their needs.

A few are:

- Grantor trusts, which helps families avoid going to probate court after the trustor dies.

- Spousal lifetime access trusts, a type of irrevocable trust, where one spouse makes gifts to the other.

- Strategic gifting, which allows families to pass on wealth without incurring taxes.

In addition, the changing needs of younger demographics will be reflected in what they do with their wealth—especially their investment choices. Millennials and Gen Zers, in particular, favor companies that are environmentally and socially conscious. After they receive their inheritances, most will place their funds with a new financial advisor. Even the way they purchase stocks will be changing as they opt out of wealth management services and instead make their transactions through robo-advisors and other fintech tools.

The financial services industry will have to work hard to keep up with this pace of change.

What Does the Great Wealth Transfer Mean for Tax Laws?

Obviously, the great wealth transfer will have enormous implications for the U.S. tax system, although many argue that Uncle Sam’s share won’t be big enough.

The wealthiest families currently pay little to no taxes, since many live off the interest on their investments and thus don’t pay capital gains taxes.

However, President Biden has proposed adding a 25% annual “wealth tax” to households with a net worth totaling $100 million or more, although opponents believe the Supreme Court would consider taxing an individual’s net worth, and not their income, to be unconstitutional.

If you are a Baby Boomer nearing retirement, you should understand the ins and outs of estate planning so that your heirs can enjoy as much of your hard-earned money as possible.

But the best advice might simply be to be open with your family. Include them in your wealth management discussions instead of leaving them in the dark until the very end because while you may have been managing your money for 30 or 40 years, your kids will have much less time to get up to speed when settling your estate. And that way, they, too, can start to plan for the future—and can say thank you for your incredible generosity.