What Is Shareholders’ Equity?

Shareholders’ equity represents the net value of a company. As an accounting measure, shareholders’ equity (also referred to as stockholders’ equity) is the difference between a company’s assets and liabilities. It is also called book value of equity.

Shareholders’ equity is found at the bottom of a company’s balance sheet, after assets and liabilities. And, as the balance sheet’s name implies, assets must equal the sum of liabilities and shareholders’ equity. For publicly traded companies, the balance sheet is found in the financial statement filed quarterly and annually with the Securities and Exchange Commission.

Some investors, though, don’t view the book value of shareholders’ equity as a meaningful measure for assessing the value of a company because it’s based on historical data. Some would focus on alternative valuation measures, such as market capitalization, which is calculated by multiplying a company’s most recent stock price by the number of shares outstanding.

How to Calculate Shareholders’ Equity

There are two ways to calculate shareholders’ equity on the balance sheet.

1. Difference Between Assets and Liabilities

Shareholders’ equity can be calculated by subtracting assets from liabilities.

Formula One

Shareholders’ Equity = Assets – Liabilities

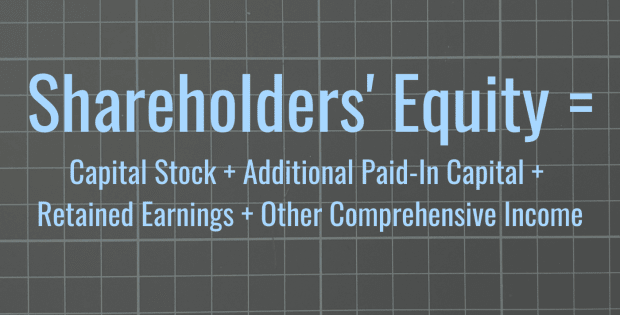

2. Sum of Its Parts

Shareholders’ equity also can be calculated by adding the line items that would usually appear on a company’s balance sheet: capital stock (common and preferred stock), retained earnings, and other comprehensive income.

Formula Two

Shareholders’ Equity = Capital Stock + Additional Paid-In Capital + Retained Earnings + Other Comprehensive Income

What Items Are Included in Shareholders’ Equity?

Below are some line items that would typically appear under shareholders’ equity on the balance sheet.

Capital Stock

Capital stock includes common and preferred stock. Voting rights are conferred onto common stockholders, while dividends, including special dividends, are paid first to preferred shareholders. Stock that has been repurchased and placed as treasury stock are deducted from the number of shares outstanding. Shares are based on par value, which is the value set by a company’s charter and tend to be well below market value.

Additional Paid-In Capital

Additional paid-in capital is the value of shares above par value. Examples include the issuance of new shares, which would boost paid-in capital, and stock repurchases, which would reduce paid-in capital.

Retained Earnings

Accumulated earnings from current and past reporting periods are accounted for in shareholders’ equity.

Other Comprehensive Income

Revenues, expenses, gains, and losses that are not yet realized make up other comprehensive income.

Shareholders’ Equity Example: Apple (NASDAQ: AAPL)

Below is Apple’s shareholders’ equity on its balance sheet, broken down into its components. Shareholders’ equity declined in 2021 from the year before. The company reported in notes on its 2021 financial statement that it underwent a large stock repurchase program and had issued common shares. The share buybacks resulted in reducing retained earnings.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about shareholders’ equity.

How Does Book Value Differ From Shareholders’ Equity?

Book value is the same as shareholders’ equity, but they are used in different contexts. One investor may view shareholders’ equity as its book value of equity and as a measure of a company’s valuation if it were being sold. Another investor may want to view components within shareholders’ equity such as retained earnings to measure a company’s value.

How Do Stock Repurchases Affect Shareholders’ Equity?

Companies that repurchase stock in the open market tend to repurpose them as treasury stock, which means that they aren’t included in the number of shares outstanding. Reducing the number of shares outstanding lowers shareholders’ equity.

Can Shareholders Equity Be Negative?

It would be highly unusual for shareholders’ equity to be negative. Since the value of a company’s stock cannot go below zero, other components such as unrealized losses would have to be negative. If a company’s shareholders’ equity were to become negative, it would indicate insolvency.

Is Shareholders’ Equity the Same as Market Capitalization?

Market capitalization is based on a company’s stock price and its number of shares outstanding. While shares outstanding make up a part of shareholders’ equity, there are other components including retained earnings.