Dominic Diongson; Canva

What Is Return on Equity (ROE)?

Return on equity is a profitability ratio and it is calculated by dividing net income by book value. When investors assess how much money a company is earning relative to its book value of equity, or shareholders’ equity, they turn to ROE. Another interpretation of ROE is judging whether executive management has utilized capital on its past investments efficiently or effectively to produce earnings.

From executive management’s point of view, two goals are to raise the company’s profitability and to increase its book value. Its influence on either can be direct: Buying back stock or paying dividends can affect book value, while reducing costs to manage expenses can boost profits.

For example, high net income during one quarter can allow a company in a subsequent quarter to dispense cash to stockholders via dividends, which can impact its book value. At the same time, a company’s ability to generate profit—via purchasing property and investing in plants or equipment to produce more goods—can also have an impact on book value. Thus, from an investor’s point of view, ROE becomes an important metric in measuring how executives are managing a company’s earnings.

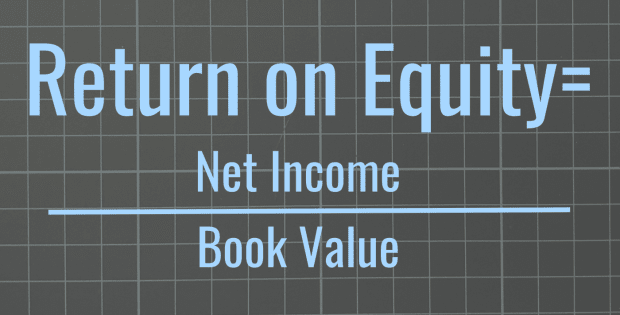

How to Calculate Return on Equity

The ratio is calculated by dividing net income by book value. Net income can be found on the income statement of a company’s regular quarterly or annual filing with the Securities and Exchange Commission. Book value is typically found in the assets, liabilities and equity section of the balance sheet and usually reads as total shareholders’ equity, or a line item similar to that.

ROE Formula

Return on Equity = Net Income / Book Value

Dominic Diongson; Canva

When book values change dramatically from one year to the next, taking the average of the two years makes sense. There are variables within book value that can change ROE. If a company pays large dividends or is on a spending spree with stock repurchases, that can depress book value and lead to a higher ratio or ROE.

When viewing historical data, such as a five-year period, if net income increases at a faster rate than book value does, ROE will rise. The same applies with a slower rate of decline for net income than book value. Conversely, ROE is likely to be down if net income increases at a rate slower than book value does, or if net income decreases at a rate faster than book value decreases.

Below is a table comparing the ROE for Tesla, Ford Motor, and General Motors—each of which is in the automotive industry. Tesla’s ROE turned positive in 2020 after being negative for the prior five years. At the same time, Ford’s ROE turned negative in 2019, while GM’s has wavered from high to negative before turning positive again.

Here’s one way to interpret the data. For Tesla, spending on property, plants, and equipment for the manufacturing of electric vehicles to meet high demand has paid off, resulting in its first year of profitability in 2020. Meanwhile, the 2020 pandemic pushed people to work from home and drive less, causing demand for Ford and GM cars to plummet, ultimately hurting their bottom line.

How to Interpret Return on Equity

ROE can rise or fall from one year to the next, but it depends on whether profit has increased faster than book value, or book value has declined faster than earnings.

Analyzing beyond the ratio can be important. Looking at the components of net income and book value and interpreting their changes over time can help investors make decisions about whether to buy stock in a company. For example, if a company’s return on equity rose in one quarter after being consistently low over several quarters, it could be that executives decided to issue a special, one-time dividend payment to stockholders after recording high profits in past quarters. Alternatively, it could be that the company borrowed more by taking out loans from banks or selling bonds to finance its expansion plans via the construction of new manufacturing facilities and warehouses.

Interpreting the direction of return on equity can help investors with their investment decisions, which can in turn influence a company’s stock price.

What Are the Limitations of Return on Equity?

Because book value is historical and based on the assets and liabilities of a past quarter, ROE is considered a lagging indicator. Estimating a company’s future book value depends on estimating future profit as well as how management is handling its assets and liabilities.

What Is the DuPont Formula, and How Is It Related to ROE?

The DuPont Formula, or the DuPont Identity, is named after the chemicals maker that popularized its use. It factors in more items to elaborate and express ROE by profitability, asset efficiency, and financial leverage.

The formula consists of multiplying three items: net profit margin (net income divided by sales), asset turnover (sales divided by total assets), and the equity multiplier (total assets divided by book value).

Net profit margin measures profitability, which can help a company understand how to better manage its costs. Asset turnover measures a company’s ability to use assets to generate sales. Both of these measure a company’s return on assets. The equity multiplier indicates assets per shareholder equity, and it’s a way for executive management to manage debt. High levels of debt can lead to a higher ROE.

Breaking it down into these components can help executive management understand changes in their company’s ROE and help them learn on how to make adjustments to boost ROE in future quarters.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about return on equity.

Can Return on Equity Be Negative?

ROE can be negative if a company reports a loss in net income. In rare cases, book value can become negative if liabilities exceed assets, which might indicate an insolvent company.

What Is Considered a Good Return on Equity?

One study showed that for companies with market value exceeding $1 billion in Fall 2015, the median average ROE was 11 percent. The average could serve as a benchmark, and being above it could mean having good ROE.