When investors analyze a company's financial performance, they turn to profitability ratios such as return on assets.

Canva

What Is Return on Assets (ROA)?

Return on assets is a profitability ratio that’s helpful in determining a company’s ability to generate profits from its assets. Investors often compare it to return on equity, another ratio related to analyzing a company’s profitability. And like return on equity, return on assets is more useful in comparing companies within the same industry.

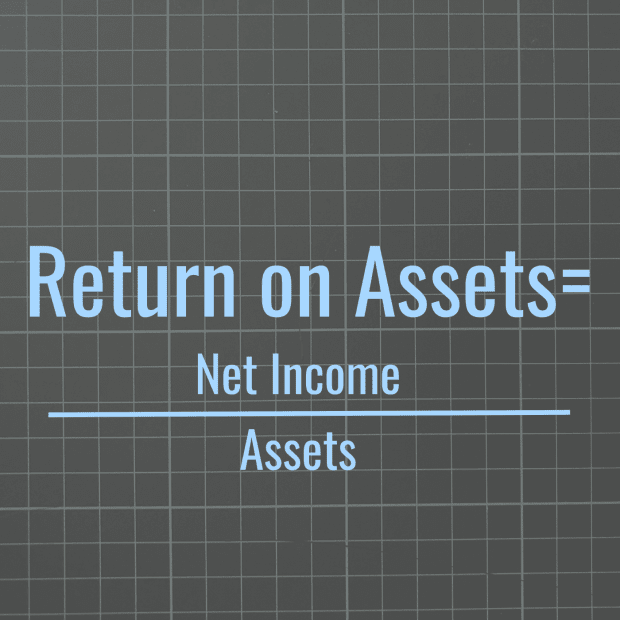

How to Calculate Return on Assets

The simplest way to calculate return on assets is to divide net income by assets (this formula is related to return on equity’s).Return on assets is likely to be a lower ratio than return on equity because while return on equity takes into account book value by subtracting liabilities from assets, return on assets doesn’t. Expressed as a percentage, return on assets indicates how much per dollar of assets translates into earnings. A higher ratio suggests that a company’s executive management is using its assets, such as cash, inventory—as well as property, plants, and equipment—efficiently and effectively in generating profits.

Net income is found in the income section of the financial statement of a publicly traded company’s regular quarterly and annual financial statement filing with the Securities and Exchange Commission. Assets are found in the assets, liabilities, and equity section of the balance sheet. It appears as the line item “Total Asset”s and is netted against “Liabilities and Equity,” a separate line item (because assets must equal liabilities and equity on the balance sheet).

Return on Assets = Net Income / Assets

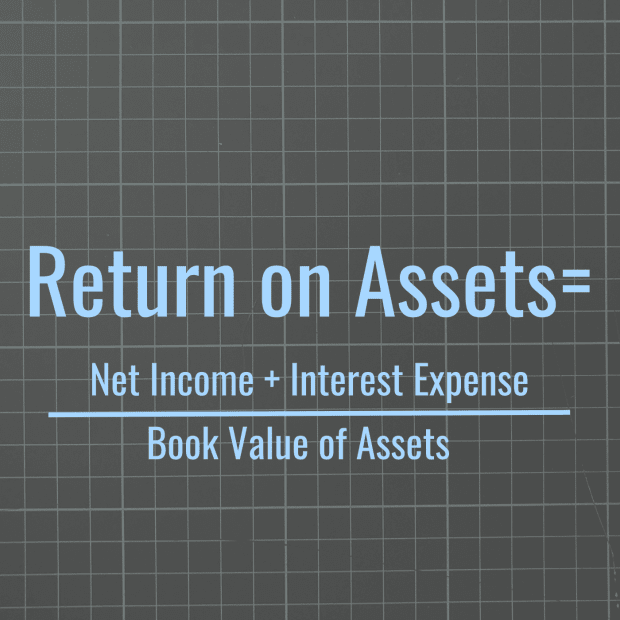

Another version of calculating return of assets is via book value. When a company’s executive management is looking to take over another company, they review the targeted company’s long-term assets, typically the book value of assets, which is the acquisition, or original, costs of assets minus their accumulated depreciation, or depreciation over the lifetime of the assets. Property, plant, and equipment—on a net basis—shows up as the assets’ book value. If not, then it would be a matter of calculating those assets and their depreciation. Executives would then review the company’s net income and add back interest expense for the period.

Note: Book value of assets differs from book value of equity, which is simply net assets—calculated as assets minus liabilities. Another term for book value of equity is shareholders' equity.

Return on Assets = (Net Income + Interest Expense) / Book Value of Assets

How to Interpret Return on Assets

In the table below, return on assets is compiled for Tesla, Ford Motor, and General Motors, all of which are in the automotive industry. Their assets and profits vary, but because they are in the same industry, their performances can be compared by using profitability ratios. To smooth out any volatility in assets between two years, the average is also calculated. GM posted the best return on assets in five of the six years—in 2017, however, Ford performed better. The data suggest GM was best at utilizing its assets to generate earnings, and the returns on assets were largely in line with the returns on equity over that six-year period. Meanwhile, Tesla was catching up with Ford and GM in 2020, when it posted its first year of annual profits.

What Are the Limitations of Return on Assets?

Return on assets works best in comparing companies within the same industry because their assets are likely to be similar, as opposed to comparing companies from different industries—like banks and retailers, which have different sources of revenue and different assets.

The ratio takes into account assets and net income from a past period of time, and that would make it a lagging indicator.

While return on equity focuses on shareholders’ investments into the company, return on assets assesses the company’s ability to generate profits without taking into consideration liabilities as part of its financial leverage. It is sensitive to working capital, so an increase in inventories could lead to a lower ratio. Still, ROA is not as sensitive on financial leverage than ROE is.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about return on assets.

Can Return on Assets Be Negative?

The ratio can be negative if a company reports a loss for the reporting period. It’s unlikely for a company to report negative assets.

What Is Considered a Good Return on Assets?

Based on data from a recent report, the median return on assets ratio for companies with market capitalization exceeding $1 billion was 3 percent. Companies with ROA at or above the average could be considered to have good ratios.

Are There Other Ratios Similar to Return on Assets?

Aside from return on equity, investors would also look at return on invested capital (ROIC), which measures the after-tax profit generated by a company and excludes either expenses or income from interest divided by book value of equity and debt on a net basis.