Dominic Diongson; Canva

What Is Profit Margin?

Profit margin shows how much earnings are generated from a company’s revenue, and it is expressed as a percentage. It can be used to analyze any company but is particularly useful in comparing companies within the same industry. Generally, the higher the ratio, the more profitable the company is.

What Are the Types of Profit Margin?

Gross profit margin, operating margin, and net profit margin are the three main types of profit margin. Investors and analysts refer to the margins with different names, and that can often lead to confusion.

Each type of profit margin has a different equation based on calculating expenses, but they all share revenue as the common denominator. The components for their formulas can be found in the income statement section of the company’s financial statement. (If it’s a publicly traded company, the filing will be on a quarterly and annual basis.)

From gross profit margin to operating margin and net profit margin, those deductions work their way down along the income statement, from top to bottom. Each type of profit margin analyzes how expenses are affecting profitability, and whether the company’s executives are managing sales effectively and efficiently. For gross profit margin, expenses are associated with the production and sale of goods, and the line items typically appear at the top of the income statement. Operating margin involves calculating operating expenses against revenue, but that excludes interest expenses and tax charges. Net income includes all costs, and the bottom line figure is divided by revenue.

From an investor’s point of view, gross profit margin helps to understand how a company’s costs for raw materials and labor cut into its profitability during a specific period. A high ratio could mean either costs are under control or sales might be above the company’s expectations. Conversely, a low ratio could mean expenses are close to matching sales and need to be addressed. On that same income statement, a high ratio for operating margin could indicate that administrative and selling expenses are low, while a low ratio could mean high costs. For net profit margin, a high ratio suggests a very profitable period for the company, while a low ratio suggests profits have taken a hit relative to revenue. Still, the reasons for the low ratio might be ambiguous because net income is the bottom line figure of the income statement, so looking upward along the statement helps. At the same time, it helps to have calculations on gross and operating margins to offer quick clues.

How Are Profit Margins Calculated?

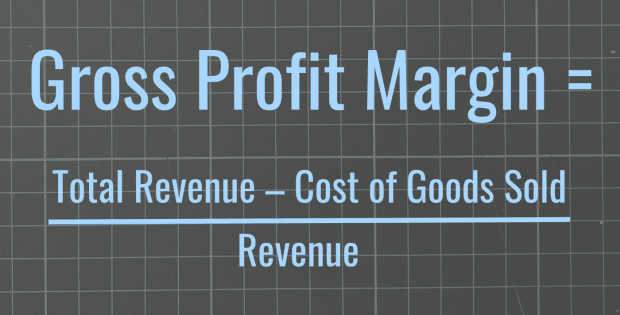

Gross Profit Margin

(Total Revenue – Cost of Goods Sold) / Revenue

Canva

Gross profit margin is calculated by subtracting expenses referred to as costs of goods sold (such as raw materials and labor) from revenue. Revenue minus COGS is known as gross profit, and that difference is then divided by revenue. The ratio is simply referred to as gross margin.

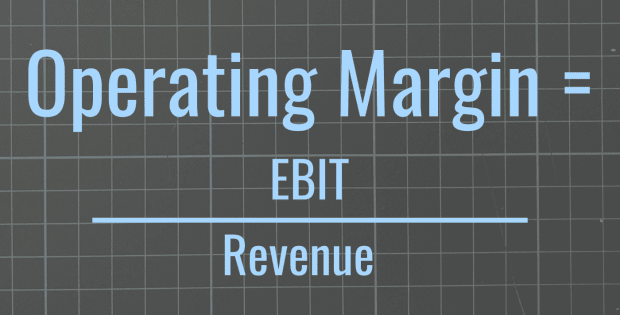

Operating Margin

EBIT / Revenue

Canva

The ratio calculates earnings before interest and tax (EBIT) payments are made, and it focuses on expenses tied to the company's operations. Operating margin involves subtracting costs relating to administrative work and research and development from gross profit, and that difference is then divided by revenue. For some companies, a line item for income before taxes is listed and interest expense has to be added to get operating income. Operating margin also takes on many names: operating income margin, operating profit margin, EBIT margin, and return on sales.

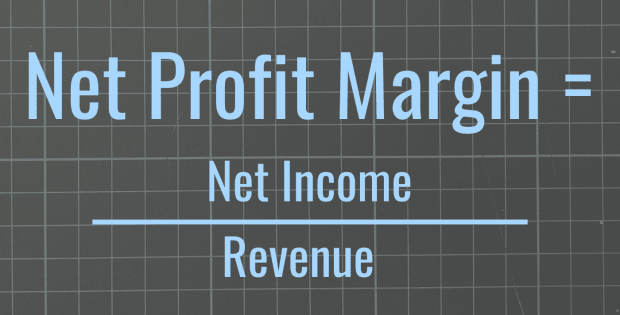

Net Profit Margin

Net Income / Revenue

Canva

Net profit margin is often referred to as profit margin, but there is a distinction from the general term because net income is profit after all expenses and payments, including for interest and tax, have been made. And net profit margin is a simple calculation: net income divided by revenue.

How to Interpret Profit Margin

The table below shows portions of the quarterly income statements of Tesla over the past two years to the third quarter of 2021. Tesla reported its first annual profit in 2020, and the data show how its profit margins (gross profit margin, operating margin, and net profit margin) have performed over the seven quarters. As demand for its electric vehicles picked up, production and sales increased, while Tesla managed to keep its costs—namely raw materials and interest expenses—under control. Should Tesla continue to maintain the pace of its COGS, gross profit margin could trend higher.

What Are the Limitations of Profit Margin?

Profit margin only shows the profitability ratios of the company. It doesn’t show how assets and investments are utilized to generate profit. The income statement doesn’t indicate how cash from earnings is being utilized, whether executive management uses the money to buy back stock or pay dividends to shareholders.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about return on assets.

Can Profit Margin Be Over 100 Percent?

Net profit margin could exceed 100 percent if an extraordinary, or one-time, item exceeded its income after tax and interest expenses.

Can Profit Margin Be Negative?

Profit margin could be negative if costs of goods sold or revenue exceeded total revenue.

How Much Profit Margin Is Good?

A recent report put the average gross profit margin for companies with market capitalization exceeding $1 billion at 42 percent, operating margin 13 to 14 percent, and net profit margin 7 percent. Having the margin at or above average would be considered good.

Are There Other Ratios Similar to Profit Margin?

Other profitability ratios include return on equity, return on assets and return on total capital, though those largely measure on how assets and investments generate sales.