When investors eye a company for a potential takeover, they look at its market capitalization, and debt and cash levels.

Dominic Diongson; Canva

What Is the Enterprise Value (EV) of a Company?

Enterprise value is a bare-bones approach to the valuation of a company. If it were the target of an acquisition, potential buyers would value a publicly traded company based on its market capitalization and debt, subtracting the amount of cash it holds. That can be viewed as the total cost of the company being taken over.

Because the acquirer would be taking on debt following the acquisition, any cash the company holds could potentially be used to reduce that debt. So, if a company has more cash than debt, then the cost of acquisition would be lower, and therefore, it becomes more attractive to the potential investor.

Note: There is a nuance between market capitalization and equity value, though both refer to the stock valuation of a company. Equity value is often used for companies that are privately held, whereas market capitalization is typically used for publicly traded companies since their shares trade on public markets. In explaining enterprise value here, we alternate between market capitalization and equity value.

For private equity investors, enterprise value is market capitalization plus net debt (debt minus cash). It provides a glimpse into the costs of attempting a leveraged buyout of a targeted company. Taking on too much debt while borrowing to pay for an acquisition increases the risk of repayment, and consequently, that could raise the cost for financing.

For bond investors, enterprise value can also show the costs of conducting a leveraged buyout. It offers clues on how a company might be able to repay its bondholders: the higher the cash levels, the bigger the so-called “cushion” it provides to repay debt. At the same time, it gives a sense as to how much more debt a company can take on.

How Do You Calculate Enterprise Value?

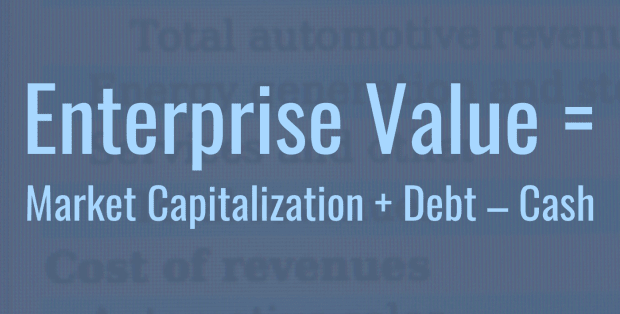

The basic formula for enterprise value is market value of equity plus debt minus cash. There are variations in which preferred stock, minority interest, investments, and cash equivalents are included.

Basic Enterprise Value Formula

Enterprise Value = Market Capitalization + Debt – Cash

A company's enterprise value is the sum of its market capitalization and debt, minus cash.

Dominic Diongson; Canva

For a publicly traded company, market capitalization is calculated by multiplying the number of outstanding shares by the share price. Looking at the balance sheet, debt entails total debt, including liabilities and long-term debt. Cash is made up of cash and cash equivalents, and other items including marketable securities. All of these items can be found on the financial statements (income statement and balance sheet) of a company’s regular and periodic filing (Form 10-Q for quarterly reporting and Form 10-K for annual) with the Securities and Exchange Commission.

Popular Ratios Related to Enterprise Value

See table above for examples of these ratios.

EV/EBITDA

This ratio compares enterprise value to earnings before interest, tax, debt and amortization (EBITDA), which measures a company’s profitability or ability to generate cash. A multiple of 10 is often viewed by some investors as fair, though a lower ratio could be ideal. A multiple of 1 means that the company’s enterprise value is equivalent to the company’s profitability, which makes it a potential investment.

EV/Revenue or EV/Sales

This ratio compares enterprise value to revenue or sales. A high ratio shows that the company’s revenue or sales are lower than its enterprise value. On the flip side, low multiples could indicate the company is undervalued.

EV/Gross Profit

This ratio compares enterprise value to gross profit. Like EV/revenue, a low ratio is ideal.

EV/Market Capitalization

This ratio compares enterprise value to market capitalization. It can indicate the company’s debt position, though a high ratio indicates large debts.

For future reference, another metric to look out for: debt-to-equity ratio. That shows a company’s debt leverage. The higher the ratio, the more debt it carries.

Frequently Asked Questions (FAQs)

The following are answers to some of the most common questions investors ask about enterprise value.

How Does Enterprise Value Compare to Equity Value or Market Capitalization?

Because enterprise value’s calculation includes debt and cash, that would be of interest to debt holders, whereas equity value would be of interest only to shareholders. A company’s equity value, also known as market capitalization for publicly traded companies, is based on the number of shares outstanding multiplied by price per share.

Why Is Debt Included in Enterprise Value?

Debt is part of the cost of a potential acquisition of a company. Investors would assume the debt held by the targeted company, following completion of the purchase.

Can Enterprise Value Be Negative?

Enterprise value can be negative if debt and/or cash exceeds the market capitalization of a company. If debt exceeded market capitalization, that would make the company look highly leveraged and appear to be a high-risk investment. On the flip side, if cash exceeded market capitalization and debt, it would attract investors’ attention.

What’s the Difference Between Enterprise Value and Book Value?

Book value is a valuation measure that includes depreciation, which is the deduction of the value of a company’s fixed assets. Enterprise value does not record depreciation.

What if There Is No Debt and/or Cash, and Enterprise Value Equals Market Capitalization?

That could mean the company is fairly valued. But if the enterprise value is less than market capitalization, then the company could be viewed as undervalued.