EBITDA stands for earnings before interest, taxes, depreciation, and amortization.

What Is EBITDA?

EBITDA is the acronym for earnings before interest, taxes, depreciation, and amortization. As its name implies, it is income before interest expenses, tax payments, and costs for depreciation, and amortization are deducted.

For companies that are highly leveraged (having a lot more debt than equity usually indicates that interest costs can be high), have a high corporate tax rate, and have costs tied to the deteriorating value of equipment and intangible assets, explaining income on an EBITDA basis can be useful because it excludes expenses for interest, taxes, depreciation, and amortization.

For some companies that report low net income or a loss, executive management will say in their reports that profit was high or losses were narrower on an EBITDA basis to deflect the results of the bottom line. Like EBIT, EBITDA is not a measure of standard under generally accepted accounting principles.

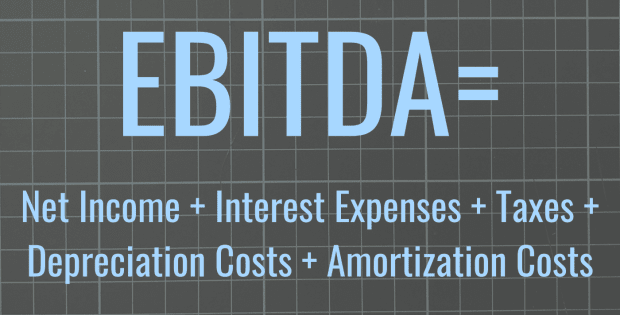

How to Calculate EBITDA

EBITDA is calculated by adding costs for interest, taxes, depreciation, and amortization to net income. These line items can be found in a company’s income statement, which is part of the financial statement filed quarterly and annually with the Securities and Exchange Commission. However, some companies don’t place costs tied to depreciation and amortization in the income statement and instead include that line item in another part of the financial statement.

EBITDA = Net Income + Interest Expenses + Tax Payments + Depreciation Costs + Amortization Costs

EBITDA may be useful for companies that have many businesses and have been around for a long time. The Coca-Cola Company, which was founded in 1892, operates in many countries and has equipment and machinery that depreciate in value as newer technologies are developed and adapted. And since the company has been in operation for more than a century, it is likely to hold many patents and trademarks that have lost value due to obsolescence or lack of use. But Coca-Cola doesn’t include depreciation and amortization in its income statement. Instead, those appear on its cash flow statement to account for depreciation and amortization on the value of its property, plants, and equipment.

Some companies that have gone public since 2010 or so, though, put depreciation and amortization in their income statement and argue that on an EBITDA basis, their profit was high or their losses narrowed. The ride-sharing app Uber Technologies takes defining EBITDA a step further by creating its own measure, the “Adjusted EBITDA,” which includes adding back to its net loss such items as loss from equity method investments, stock-based compensation expense, and other income or expenses.

Below are table examples of Uber’s quarterly income statement, and the straightforward calculation shows that EBITDA in the third quarter of 2021 was a loss of $1.997 billion. But Uber’s Adjusted EBITDA method shows an $8 million profit, which includes items not in the typical EBITDA formula. Other expenses were the biggest factor in its Adjusted EBITDA calculation.

Uber’s approach to EBITDA shows how a company’s executive management can use non-GAAP measures to explain profitability to investors. Yet, no matter what measure Uber uses to highlight or to communicate profitability to investors, the income statement’s bottom-line figure shows a loss, mitigated by a large expense outside its normal operations.

Still, it’s important to understand how each company interprets EBITDA by reading the notes included in the financial statement or press release. As Uber shows, the company includes a wider range of items in its Adjusted EBITDA calculation.

Straightforward EBITDA Calculation

Adjusted EBITDA Calculation

What Are the Limitations of EBITDA?

Like EBIT, EBITDA doesn’t show the costs tied to interest and tax payments, both of which can be significant for companies with more debt than equity or that are operating in a country with a high corporate tax rate.

Frequently Asked Questions (FAQ)

The following are answers to common questions investors ask about EBITDA.

What Is the Difference Between EBIT and EBITDA?

The difference between EBITDA and EBIT is that costs for depreciation and amortization are added back to net income for EBITDA.

Can EBITDA Be Negative?

Based on the method of calculation, EBITDA can be negative if net income is negative, which suggests that operating expenses and/or cost of goods sold exceeded revenue.

EBITDA stands for earnings before interest, taxes, depreciation, and amortization (sometimes called operational cash flow). It signifies a company’s financial achievement expressed as expenses subtracted from revenue.