For most consumers, the concept of inflation is all too familiar. Inflation describes the process of goods and services going up in price over time, thus decreasing the purchasing power of every dollar. Deflation, on the other hand, refers to falling prices and a lower cost of living. So just what do we mean by disinflation?

What Does Disinflation Mean?

Disinflation refers to the process of goods and services going up in price over time but at a slower rate than they have in the past. For instance, if the year-over-year inflation rate hovers around 5% for several months then falls to 4% and then 3% in the subsequent months, the economy could be described as experiencing disinflation—prices are still going up in general, but they’re doing so at a slower rate.

Disinflation vs. Deflation: What’s the Difference?

It’s important not to confuse disinflation with deflation. Deflation describes a period of falling prices—goods and services become cheaper, and the cost of living goes down. During disinflation, on the other hand, prices go up—just not as rapidly as they were before.

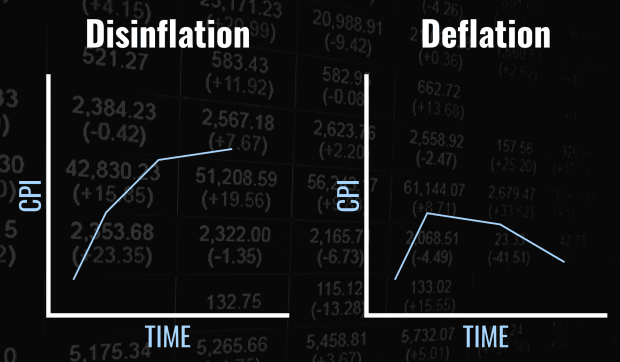

Take a look at the graphs below, which plot the consumer price index (a gauge of the average prices of consumer goods and services) on the Y axis and time on the X axis.

The first graph, in which the slope of the line remains positive but becomes less steep, illustrates a period of disinflation. The second graph, in which the slope of the line actually becomes negative, illustrates a period of deflation.

What Causes Disinflation?

Disinflation is a normal part of the economic cycle, and it tends to occur after periods of rising inflation. Often, disinflation occurs as a result of the Federal Reserve instituting quantitative tightening measures in order to slow down rising inflation. Quantitative easing is the process of reducing or tightening the money supply.

Recessions (or more minor economic contractions) can also lead to disinflation as businesses refrain from raising prices in order to attract and retain customers during periods when discretionary spending has fallen.

Disinflation Example: The Early 1980s

During a period known as the Great Inflation, consumer prices approximately doubled over the course of the 1970s due to the abandonment of the Bretton-Woods system, an oil embargo, an energy crisis, and other factors. In 1979, Paul Volcker became the chairman of the Federal Reserve and began a quantitative tightening campaign with the hope of wrangling inflation down to a reasonable level.

At one point in 1981, Volcker raised the Federal funds rate to an unprecedented 19%. His efforts caused a recession and a spike in unemployment, but in the end, they were successful in jumpstarting a period of disinflation that brought the inflation rate down to near the Fed’s target of 2% in 1983.

Is Disinflation Good or Bad? How Does It Impact the Economy?

Disinflation is not a bad thing, as a positive rate of inflation implies that the economy is growing, which is generally seen as a healthy sign. One of the two main goals of the Federal Reserve is to maintain an inflation rate of around 2%, so if the rate of inflation begins to fall toward that level after a period of higher-than-usual inflation, the country’s central bank views this as a positive sign.

That being said, unemployment often rises during periods of disinflation, and the other half of the Fed’s mandate is to keep unemployment as low as possible, so if disinflation continues for too long a period before the rate stabilizes, there can be negative consequences. Overall, if disinflation occurs for a short time, especially after a period of rising inflation, there is not really much cause for concern. In fact, brief periods of disinflation can spell relief for consumers and help boost spending and economic optimism.

Frequently Asked Questions (FAQ)

Below are answers to some of the most common questions investors have about disinflation.

How Does Disinflation Impact the Stock Market?

During periods of rising inflation, investors tend to shy away from riskier securities like stocks and move their money toward more stable investment vehicles like bonds, so bear markets (falling stock prices) are common.

Disinflation, on the other hand, signals a slowdown in the increase of the rate of inflation, which instills optimism in investors. This typically lets buyers retake control, causing stock prices to increase.

How Does Disinflation Affect CPI?

The consumer price index is simply a measure of the average costs of goods and services, so CPI still goes up during periods of disinflation, it just does so at a slower pace than it has in recent months or years. Deflation, on the other hand, means an actual decrease in CPI.

How Does Disinflation Relate to Real Interest Rates?

A real interest rate is determined by subtracting the rate of inflation from a nominal interest rate (the actual interest rate specified by a bank). For instance, if someone earns 1% interest on their savings account, but the inflation rate is 3%, their real interest rate is -2%. In other words, they are losing purchasing power by keeping their money in a savings account at the current inflation rate.

Disinflation occurs when the inflation rate falls but is still positive. This causes real interest rates to rise. For instance, using the above example, let’s say inflation fell from 3% to 2%—the individual with the savings account would now have a real interest rate of -1%. They would still be losing purchasing power on their savings due to inflation, but not as quickly.