Canva

Cost of goods sold are direct costs, including costs of material and labor associated with the production of goods.

What Is Cost of Goods Sold?

Cost of goods sold (COGS) is the expense tied to the sale of any finished product for delivery to customers. Expenses include the raw materials and labor associated with the production of any good. Even though the term itself mentions goods, cost also applies to services, depending on the revenue generated by a company.

Cost of goods sold is a line item found on a company’s income statement, and it is the first item of expense after revenue, which is typically the top line item in the income statement. For publicly traded companies, the income statement appears in the financial statement filed regularly on a quarterly or annual basis with the Securities and Exchange Commission. Some companies list this first-line expense item as cost of sales on their income statement. From a ledger’s point of view, it is listed conveniently below revenue for calculating the difference known as gross profit, which some companies list as a separate line item to make it easy for investors to spot immediately and avoid having them do the calculation themselves. In this article, cost of sales is used interchangeably with cost of goods sold.

It is separate from costs tied to what would be considered operating costs, including advertising, marketing, administration, and research and development. Those expenses appear below the cost of goods sold in the income as operating expenses.

Below is Apple’s cost of goods sold—listed as cost of sales—for its fiscal years 2019–2021, and the tech giant breaks it down for its products and services. The data show that as sales for Apple's products and services increased, the rate of expenses didn't exceed that of sales, except for products in 2020. It suggests that the company largely kept cost of sales in check.

How Is Cost of Goods Sold Calculated?

Cost of sales calculates the costs of all goods or services over a period. Under accounting methods targeting goods, this can be calculated in what is known as the periodic method of inventory.

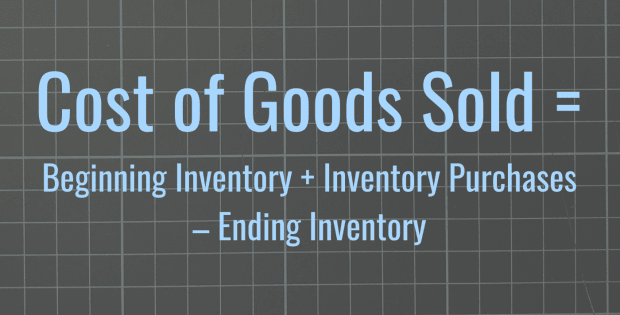

Below is a formula calculating cost of goods sold.

Cost of Goods Sold = Beginning Inventory + Inventory Purchases – Ending Inventory

For example, an electronics retailer is tabulating sales of a particular brand of laptops to customers during its first quarter. In the beginning of January, it had $10 million in laptops and purchased $5 million of units in February to further boost inventory. By the end of March, its inventory dropped to $8 million, indicating that—by using the above formula—its cost of goods sold amounted to $7 million. ($10,000,000 + $5,000,000 – $8,000,000 = $7,000,000.)

That would be a simplified version of calculating cost of goods sold. Selling and purchasing prices can change over time, which means using another way to calculate inventory valuation. There are three different popular methods used under accounting standards: first-in, first-out (FIFO); last-in, last-out (LIFO); and average cost. FIFO refers to calculating inventory by selling older items first, while LIFO goes for the sale of the newest items, and either’s use depends on the company’s business strategy.

In the case of the electronics retailer, FIFO can help determine whether older inventories sold first fetched a lower price, compared to LIFO, which might indicate higher prices because of unforeseen factors or conditions such as supply constraints that pushed up costs on purchasing laptops later in time. Average cost takes the average of the beginning inventory balance and purchases to calculate the average cost per unit. Specific valuations on inventory under the FIFO and LIFO methods can be derived by using inventories listed on the balance sheet.

How Is Cost of Goods Sold Used?

Cost of sales is used in calculating gross profit and in ratios such as gross profit margin. It helps to show whether executive management is efficient in sales practices or how profitable the company is. Generally, lower costs of sales relative to revenue indicate high gross profit.

Can Cost of Goods Sold Be Higher Than Revenue?

Cost of goods sold can be higher than revenue if the company is spending more than it takes in producing its goods or services. It would be rare for a company to experience costs far exceeding revenue, and events like a force majeure might lead to such a scenario.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about cost of goods sold.

What Is the Difference Between Cost of Goods Sold and Cost of Sales?

Both terms are the same in describing the cost associated with selling a good or service, and investors and analysts tend to use them interchangeably. Either term can appear as a line item below revenue in a company’s income statement.

Do Cost of Goods Sold Appear on the Balance Sheet?

Cost of goods sold appear in the income statement, but inventories—which are goods yet to be delivered and are associated with the cost of sales—appear on the balance sheet.

Is Cost of Goods Sold an Operating Expense?

Cost of goods sold refers to costs associated with the production of a good or service. Operating expenses, on the other hand, are tied to the company’s ordinary course of business operations, such as sales and marketing, building rental, and research and development.