What Is Consumer Credit?

Consumer credit is debt taken on by a consumer, typically to be repaid with interest in the future. As an economic indicator, consumer credit is used to gauge the indebtedness of Americans.

Consumer credit comes in two forms, revolving (or open-ended) and nonrevolving (or on an installment basis until the last payment is made), and either may be secured with collateral or without. Examples of consumer credit include credit cards, automobile loans, personal loans, and student loans. Mortgages wouldn’t be included because housing is viewed as an investment.

Why Is Consumer Credit Important?

Consumer credit data is used by investors and analysts to determine the degree to which people are taking on credit to pay for goods and services. Investors and analysts tend to pair consumer credit with other types of data such as household credit and the personal savings rate to provide a bigger picture on how much American households owe and how much they are saving. Historically, credit has outpaced savings, and debt overall continues to climb.

When Is Consumer Credit Released?

The Federal Reserve releases its report on consumer credit on the fifth business day of every month, based on data collected from depository institutions from the two prior months. For example, July data would be released on the fifth business day in September. Investors and analysts tend to focus on the annual rate of the total outstanding balance and the year-on-year percent change for the reporting month.

Upcoming Release Dates for Consumer Credit Data

Is Consumer Credit a Leading or Lagging Economic Indicator?

Consumer credit is based on the prior two months from its release date and is considered a lagging indicator. It shows the spending habits of Americans and serves as a confirmation of how their spending is affected by other lagging indicators, including inflation.

When inflation is accelerating and real wages show that people’s pay isn’t keeping up with the cost of living, they may turn to their credit cards for purchases.

Too much debt may mean more money from a worker’s pay going toward servicing principal and interest and less toward savings or buying goods that help to spur economic activity. Less spending, particularly among the middle class, might translate into weak results in auto sales, retail sales, and home sales. And too much credit puts borrowers at the risk of delinquent payments—one late payment could force a lender to charge more interest and lead to a lower credit score.

Even though interest rates on mortgages and consumer loans usually go down during a loosening in monetary policy, the rates on credit cards aren’t likely to go down as much.

High consumer debt combined with a recession would be bad for an economy with a high inflation rate. With no money pumped into the financial system, such as via quantitative easing, demand for money would be high, and interest rates would likely rise. Credit tends to tighten during a tight monetary policy, and sustained high inflation might push credit balances higher.

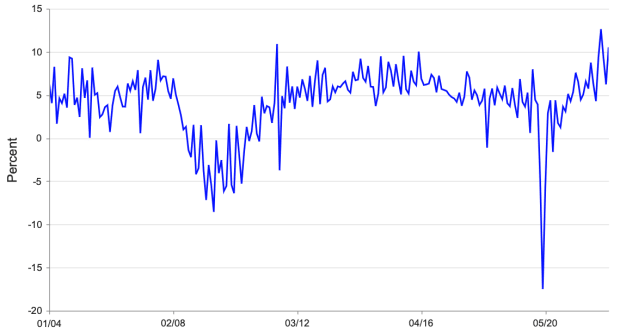

Below is a graph on consumer credit balances from 2004 to mid-2022, showing the percent change of total consumer credit, seasonally adjusted at an annual rate.

How Do Financial Markets React to Consumer Credit Data?

Stock and bond markets often react negatively to a pick-up in consumer credit, especially when it is a short-term increase. On the other hand, investors might react positively to a decline in consumer credit—in the absence of a recession—which could be a signal that consumers are taking on less debt and be a positive sign for the economy.

Michael Burry, an investor famous for betting against the mortgage market during the 2007–2008 financial crisis, used consumer credit data to determine whether the economy would face a downturn. Burry claimed that rising consumer credit and low savings combined with high inflation could spell a serious threat to the economy. In mid-2022, inflation had reached levels not seen since the 1980s, and consumer debt was rising.

Are Buy Now, Pay Later (BNPL) Loans Included in Consumer Credit Data?

Whether this type of loan—in which payments are made on a monthly basis after the time of purchase—is included in consumer credit depends on the lending institution. According to the Fed, banks should include them as part of their credit data, but many of the major BNPL lenders are newly established non-bank lenders, which means there is limited coverage. As such, the volume of transactions isn’t meaningful enough to warrant separate categorization.