What Is Capital Stock?

Capital stock represents the total number of shares issued by a company. For a publicly traded company, that is the number of common stock and preferred stock shares issued. Capital stock is referred to as paid-in capital when investors put their money into a company and receive shares in return.

The number of common and preferred shares can be found in the shareholders’ equity section of a company’s balance sheet. For listed companies, the balance sheet is part of the quarterly or annual report filed with the Securities and Exchange Commission. Some companies, though, only have common shares. Still, each company has its own method of recording capital stock and its own usage of terms.

How Does Capital Stock Differ From Authorized Stock?

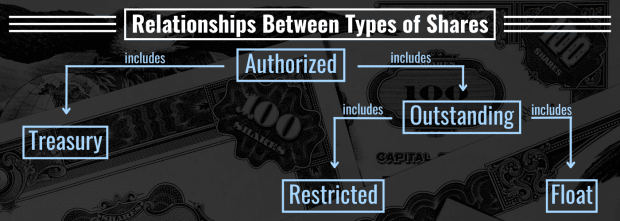

While capital stock is stock that a company sells, authorized stock, as the name implies, is the number of shares legally authorized by a company. When a corporation is legally incorporated or a company sets its charter in a state, it outlines the total number of shares its executive management has authorized it to issue. So, capital stock cannot exceed authorized stock, which is the broadest category of shares.

How Is Capital Stock Valued?

The value of capital stock is typically a combination of its paid-in capital based on par value and its additional paid-in capital.

A company typically sets its common stock’s par value at a minimum, typically well below the offering price at the time they go public, for accounting purposes. The par value is a nominal figure, to show that the shares are accounted for in shareholders’ equity, and also to meet a state government’s requirement that shares cannot be sold at below their par value. The par value for preferred stock, on the other hand, can be different from that for common stock because dividends paid to preferred shareholders are calculated based on the par value. Still, for some companies, the par value for common and preferred stock are the same. In other cases preferred shares have no par value.

Additional paid-in capital is the difference between what is paid by investors for a company’s stock at market value and its par value at the time of its initial public offering, or what’s known as paid-in capital in excess of par value. Additional paid-in capital is typically used to offset the stock at par value. Some companies, though, only list stock at par value and do not list additional paid-in capital because they haven’t issued new shares or repurchased stock. Some companies have separate entries for contributed capital (paid-in capital) and additional paid-in capital, while some might combine the two into one.

When a company decides to sell new shares (via a follow-on offering or secondary offering) or repurchase stock, the amount of capital stock changes and is recorded for that period.

Note: Whenever a company sells new shares to raise capital, that dilutes the value and voting rights of shares held by existing common shareholders.

Common shares that are bought back can be set aside by the company as treasury shares, which can be listed as a separate, negative line item because it is considered a contra equity account (against paid-in stock) within shareholders’ equity.

Is Treasury Stock Included in Capital Stock?

Treasury stock is stock that was issued by a company and subsequently repurchased. That stock is no longer part of shares outstanding, and a company can use it for employee compensation (stock options, grants, etc.). Treasury stock remains part of issued shares but carries restrictions such as lack of voting rights and no entitlement to dividend payments. When a company repurchases shares from the open market, treasury shares are registered as a contra equity account in shareholders’ equity section of the balance sheet.

Capital Stock Examples: Apple (NASDAQ: AAPL) and Netflix (NASDAQ: NFLX)

Below is Apple’s recording of its common stock and additional paid-in capital as a single item on its balance sheet. The par value for its common stock is set at 1/1000 of a cent, which means that legally, Apple’s listed stock price cannot go below that par value. An expanded entry shows beginning and ending balances for its share capital to reflect shares that were awarded to employees as compensation.

Below is Netflix's shareholders’ equity, in which it combines its common stock capital and additional paid-in capital. Preferred stock is a separate line item, but is left blank because while there were shares authorized, none were issued. The paid-in capital and additional paid-in capital are listed in a single line. Meanwhile, Netflix has a separate entry for treasury stock, which is a contra equity account to show that shares were repurchased and entered as treasury for 2021.

Apple and Netflix have their own approach to recording capital stock on their balance sheets, and other companies are likely to follow their own formats, whether they combine share capital and additional paid-in capital into one entry or creating separate ones.

Frequently Asked Questions (FAQ)

The following are answers to some of the most common questions investors ask about capital stock.

What’s the Difference Between Paid-In Capital and Capital Stock?

Capital shares are referred to as paid-in capital when investors buy a company’s shares.

How Does Additional Paid-in Capital Differ From Capital Stock?

Additional paid-in capital, or share premium, is the amount paid for stock above the par value for stock issued at the time of a company’s offering.

Does a Stock’s Current Market Price Affect Its Paid-In Capital?

No, shares that trade in the open market don’t affect a company’s paid-in capital, since paid-in capital is recorded at the time of a company’s IPO.

Are Issued Shares Also Outstanding?

That depends on the company issuing the shares. A company may have more shares issued than outstanding, and the difference may be held as treasury stock.

Can Capital Stock Be Negative?

Common and preferred stock have a par value that is the nominal value of the shares. A stock’s price technically can go to zero in the open market, depending on the state’s rules where it was incorporated, but cannot be negative.

Can Capital Stock Increase?

Yes, when a company issues new common or preferred stock, usually to raise capital, after its initial public offering the number of issued shares increases.