What Is an Inflection Point in Finance?

In finance and business, the term “inflection point” refers to a change in direction of a trend or pattern in a market or indicator, typically in response to an event or action. An inflection point can also represent a change in a market, industry, sector, or a company’s business that could lead to a positive or negative outcome. The term is borrowed from mathematics, in which it refers to the point where a curve changes direction (e.g., upward or downward).

How Is an Inflection Point Determined?

An inflection point typically represents a significant change, rather than small changes or steadiness, over a period. On a graph, an inflection point usually appears as a sudden change in direction, either up or down. Still, it may be challenging to recognize inflection points in real time, or as they occur, as opposed to spotting them in hindsight.

In business, inflection points also may not always be easy to recognize. For example, impending regulation on solar energy such as a government mandate that all new homes be outfitted with solar panels could result in an industry-wide shift, but it might take some time for companies and consumers to react. While this new law could open opportunities for solar-related companies, it could also raise concerns about the rising costs of home construction and ownership.

A law to curb smoking, in another example, could affect revenue and profit for tobacco makers as consumers habits shift, but this legislation could also provide opportunities for companies investing in smoking alternatives such as vaping.

Examples of Inflection Points in Economics & Business

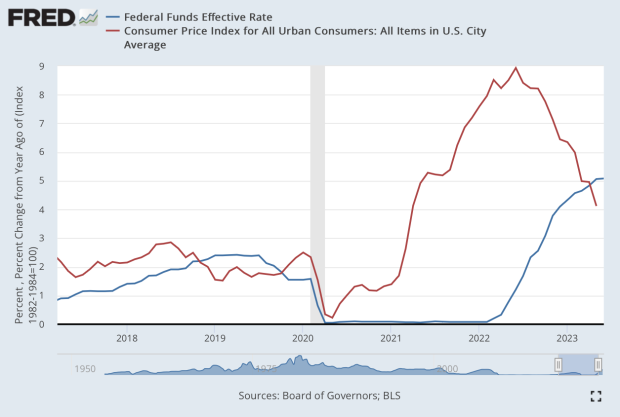

Say that the inflation rate steadies and then begins to decline after a long period of going up. That would be an indication of an inflection point, which would have implications on the broader economy—in particular, a potential change in monetary policy and the direction of interest rates. The same would apply to an acceleration in inflation.

In the graph below, consumer prices, reflected in the consumer price index (CPI), started to accelerate in 2020, but inflation’s inflection point was in early 2021, when it took off. Despite the rapid rise in the CPI, the Federal Reserve was slow to react to the increase in prices, waiting until a year later in early 2022 to begin a tightening in monetary policy by raising its key interest rate, the federal funds rate.

Another example would be the growth of the internet and the start of online commerce in the 1990s. Companies like Amazon (Nasdaq: AMZN) would change how consumers shop, and brick-and-mortar retailers such as bookseller Barnes & Noble and JCPenney would find it challenging to keep up with online commerce.

In the corporate world, it’s important to be able to adapt to the changing business environment and be open to pivoting in strategy to explore the next big opportunity. This entails being vigilant for possible inflection points and reacting to them before the competition.

What Is a Strategic Inflection Point?

Andrew Grove, a former chief executive of semiconductor maker Intel Corp. (Nasdaq: INTC), popularized the term strategic inflection point as early as the 1990s to refer to a change in a business’s fundamentals that could lead to opportunities. It could mean a major change in a business’s competitive environment, which might arise from a variety of factors including changes in technology, regulation, and customers’ habits.

There are many examples of strategic inflection points for companies, particularly significant changes in business models. Eastman Kodak (NYSE: KODK), a pioneer in the development of digital cameras, continued to rely on making film products instead of making the switch to digital photography in the 21st century. Nokia was the biggest market of mobile phones in the 2000s, but the company failed to keep up with Apple’s iPhone, which paved the way for the smartphone industry.

What is one company’s loss is another’s opportunity, and vice versa.