What Is a Foreign Exchange Rate?

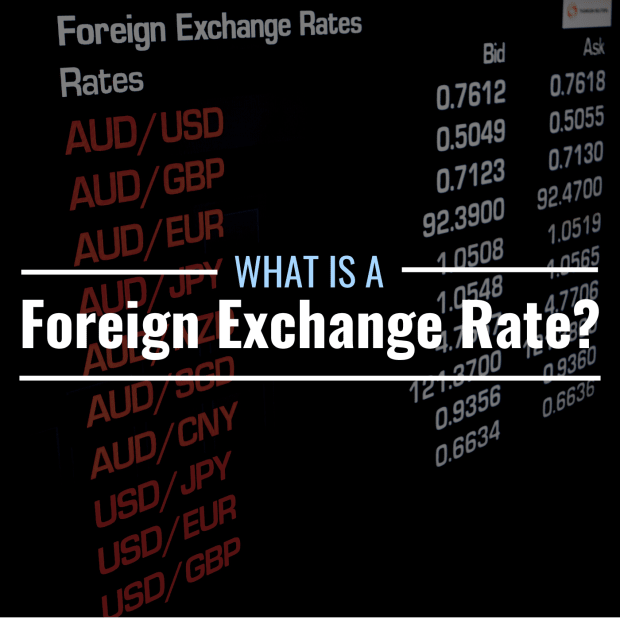

A foreign exchange rate is the rate at which a currency can be converted into another currency. Exchange rates always involve two currencies, and currencies are always traded in pairs on the foreign exchange market. The U.S. dollar is the most dominant in currency transactions, accounting for almost 90 percent of all trades in 2019, according to data from the Bank for International Settlements—a financial institution that operates as a bank to central banks worldwide.

Some of the more popular rates include U.S. dollar to euro, Japanese yen to U.S. dollar, and British pound to euro. Foreign exchange markets use a three-letter code to denote a country’s currency. For example, USD represents the U.S. dollar, EUR for euro, and JPY for Japanese yen. Traders typically assign names for some pairs of rates, such as dollar-yen for yen to U.S. dollar, and sterling for U.S. dollar to British pound.

Common Currency Trading Pairs

A Selection of 3-Letter Currency Codes

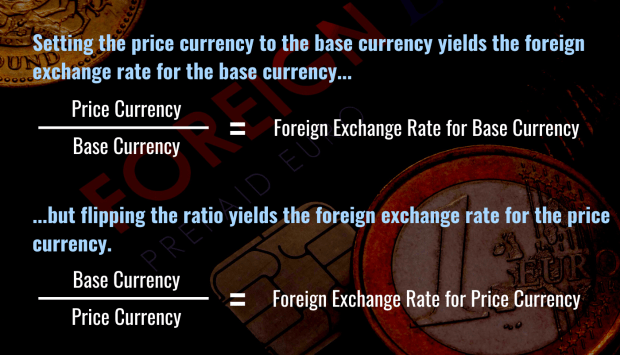

In determining a particular exchange rate, investors and traders use a base currency to determine how much that currency would fetch in another currency, known as a price currency. A change in a currency’s foreign exchange rate is known as depreciation or appreciation.

Let’s say you wanted to convert one U.S. dollar into Mexican pesos. How many Mexican pesos could you get in exchange for one U.S. dollar? Let’s say the Mexican peso to U.S. dollar rate is 20 to 1. This can be expressed mathematically as 20/1, where 20 (the numerator) represents the price currency and 1 (the denominator) represents the base currency.

The exchange rate in this case is 20 Mexican pesos to 1 U.S. dollar. Flipping the ratio to 1/20 allows us to find out how many dollars we could get for 1 peso. This means that 1 peso could fetch 0.05 of a U.S. dollar, or 5 U.S. cents.

Another example is the USD/EUR pair, in which the euro is the base currency and the U.S. dollar is the price currency. When investors want to know how many U.S. dollars each euro fetches, they’re seeking the rate at which the U.S. dollar can be exchanged into euros. If the ratio is 1.25, that means every euro is worth 1.25 U.S. dollars. A hundred euros would therefore fetch 125 U.S. dollars. On the flip side, each U.S. dollar would fetch only 80 (euro) cents.

Types of Foreign Exchange Rates

Exchange rate regimes refer to the different types of policies used by countries over their currencies. They are classified as floating, fixed, and intermediate.

Floating

A floating rate is a rate that changes depending on the supply and demand for a currency in the foreign exchange market.

There are nuances to a floating rate, such as a managed floating rate. Under a managed floating rate, a country’s currency is allowed to trade freely, but the central bank responds to fluctuations in the exchange rate—in particular, intervening when necessary to prop up the currency.

Examples of currencies with floating rates include the U.S. dollar, the euro, the yen, the British pound, the Mexican peso, the South Korean won, the Russian ruble, the Australian dollar, and the Indonesian rupiah.

Fixed

The value of a currency with a fixed rate is pegged to the value of another currency. Such a mechanism allows a country or territory with a smaller economy to be pegged to the fortunes of a bigger economy, and allows for lower transaction costs due to reduced uncertainty in the foreign exchange market.

However, a nation with a fixed exchange rate can be influenced by factors pertaining to the country to which its currency is pegged, such as following the direction of interest rates. For example, when the Federal Reserve raises interest rates to tame inflation in the U.S., other countries whose currencies are pegged to the dollar have to follow suit and increase their own rates to maintain the attractiveness of their currency. Failure to do so might lead to a mismatch in the currency strength and the abandonment of the peg.

Examples of currencies with fixed exchange rates include the Hong Kong dollar (pegged to the U.S. dollar), Danish krone (euro), and Saudi riyal (U.S. dollar). It is rare for currencies to trade on a one-to-one basis, but fixed exchange rates can come close.

Intermediate

Intermediate exchange rates, as the name implies, operate somewhere between floating and fixed rates—these are countries that have relatively rigid exchange rates but don’t peg to another currency.

What Risks Are Related to Foreign Exchange Rates?

Fluctuations in foreign exchange rates can wreak havoc on a company’s earnings and on a nation’s economy. Sharp depreciations in currencies can reduce the amount of money repatriated back home and make it more expensive to repay foreign currency-denominated debt. Interest rates, speculation, and global catastrophes are among the main risks of foreign exchange.

Can a Foreign Exchange Rate Be Negative?

No—a currency can depreciate in value compared to another currency, but an exchange rate cannot be negative.