What Are Fiscal Quarters & Why Are They Important in Finance?

Fiscal quarters, usually referred to simply as quarters, are three-month portions of the fiscal year. Each year includes 4 quarters over 12 months.

Quarters are a convenient way for businesses and governments to break the fiscal year up into manageable chunks for things like reporting. All publicly traded companies use the same four-quarter system to organize their operations and report on their performance.

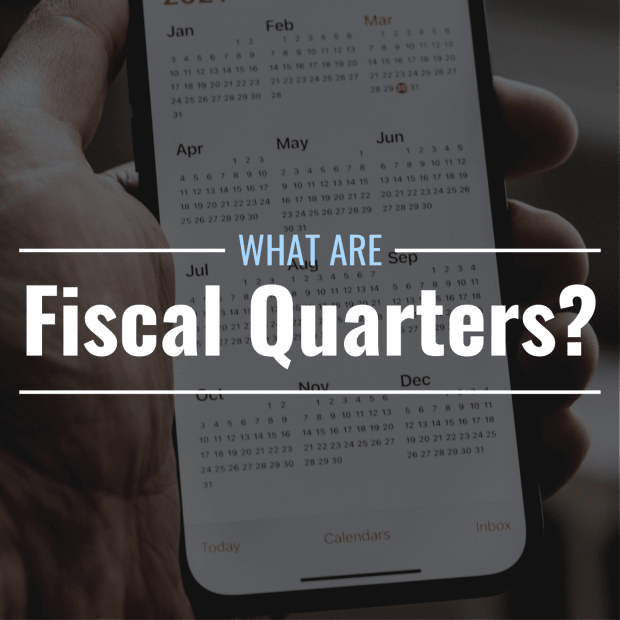

The four fiscal quarters—often abbreviated as Q1, Q2, Q3, and Q4—are typically laid out as follows.

The 4 Fiscal Quarters

- Q1: January 1st–March 31st

- Q2: April 1st–June 30th

- Q3: July 1st–September 30th

- Q4: October 1st–December 31st

At the end of each quarter, publicly traded companies publish reports on their financial performance and may disburse dividends to investors. By looking at a business’ financial results on a quarterly instead of annual basis, investors can identify trends, get a clearer picture of how a business is doing in the shorter term, and determine whether certain aspects of a business’ performance are seasonal.

What Do Publicly Traded Companies Report on a Quarterly Basis?

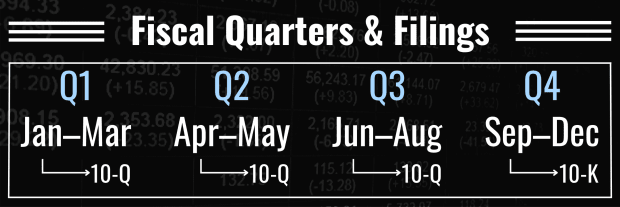

After the end of each of the first three quarters of the year (Q1, Q2, and Q3), public companies release quarterly reports about their financial performance for that quarter. These reports, known as 10-Q statements, must be filed with the Securities and Exchange Commission so that a company’s revenue, expenses and earnings are available for public scrutiny. Additionally, these reports include discussions of market risk, any legal proceedings that took place over the quarter, and other information that might be pertinent to investors and regulatory bodies.

While quarterly 10-Q reports are not audited, annual 10-K reports—which are similar but cover an entire fiscal year and are filed after the 4th quarter—are audited for accuracy by independent accountants to ensure that companies are adhering to established reporting and accounting practices.

The 10-Q and 10-K reporting requirements were established with the passage of the Securities and Exchange Act of 1934 in an effort to provide more transparency between public companies and their existing and prospective investors.

Investors and analysts eagerly await the release of quarterly financials, and many tune into public earnings calls hosted by the companies they are interested in. During these calls, company executives explain the numbers in their quarterly reports, providing crucial context about why certain metrics may have been above or below expectations due to economic or industry-specific events and conditions. Additionally, these calls provide a forum for companies to issue guidance about their projected future financial performance.

Those with an ear to the equity market, from amateur retail investors to professional hedge fund managers, use the information from these earnings reports (along with company projections about future quarters) to make informed decisions about whether to invest in, divest from, or continue to hold various companies’ stocks in their portfolios.

What Other Important Financial Events Happen Quarterly?

The financial reports of publicly traded companies aren’t the only quarterly phenomena investors and analysts pay close attention to—the quarterly release of certain economic data and the expiration of derivative contracts also tend to pique the interest of the market and its constituents.

Dividend Payments

Not all companies pay dividends, but those that do often pay them quarterly. When a quarterly dividend is announced, the issuing company’s stock often goes up slightly in value as a result. Similarly, once a company’s ex-dividend date (the date after which new stockholders are no longer eligible to receive the most recently announced dividend) passes, its stock price usually drops by an amount similar to the per-share dividend payout.

GDP and GNP

While GDP (gross domestic product) statistics come out on a monthly basis, the detailed estimates released by the Bureau of Economic Analysis come out once per quarter, and these can cause quite a stir. Because GDP is considered the most holistic economic indicator, its growth (or lack thereof) can drastically alter the mood of the markets, causing stocks to rise or fall across the board as investors move into or out of riskier asset classes.

Triple Witching

Triple witching refers to the simultaneous expiry of three types of derivative securities—options contracts, index options, and index futures—a phenomenon known to stir up volatility not just in the derivatives market but in the equities market in general. This phenomenon happens once per quarter, and when it does, investors often see their stock portfolios move more than usual.