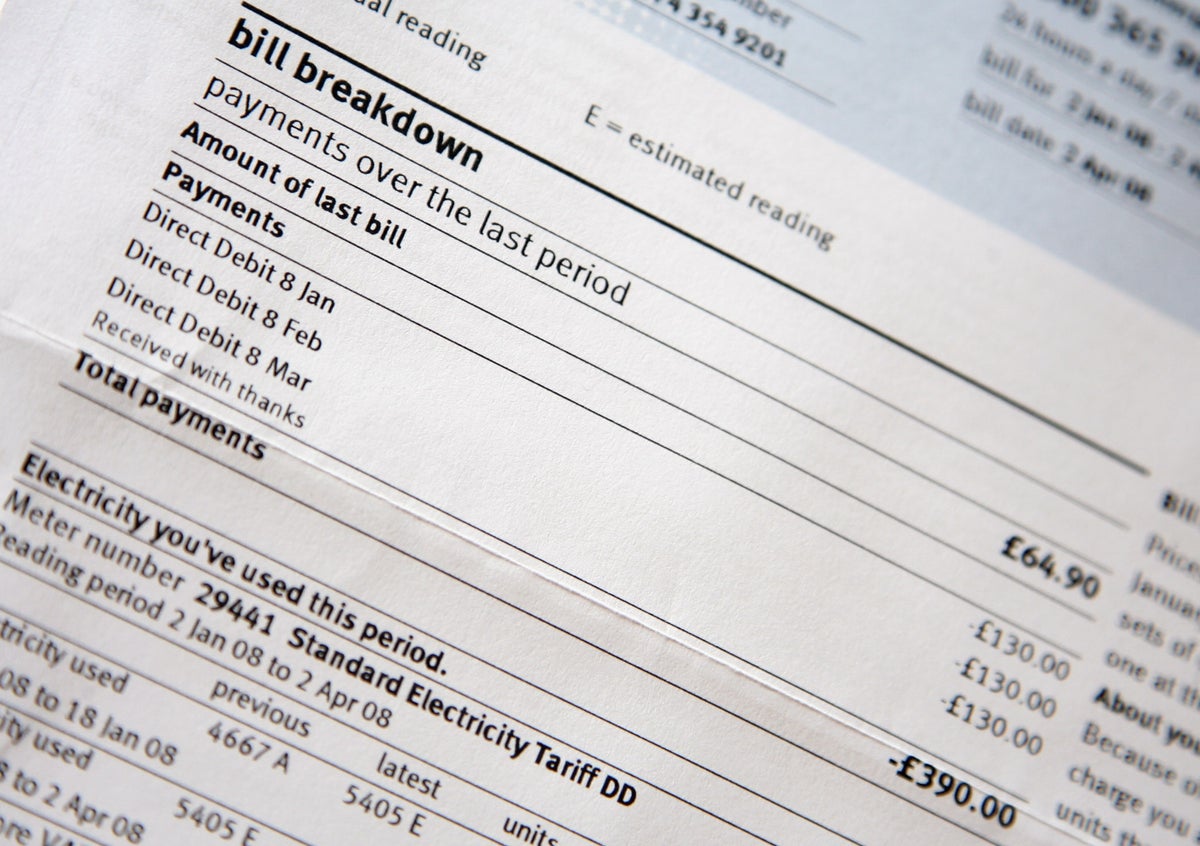

The energy price cap is the maximum amount a utility company can charge an average customer in the UK per year for the amount of electricity and gas they use, preventing businesses from simply passing on cost increases to the consumer.

But the cap, set by the regulator Ofgem and first introduced in January 2019, only applies to customers who are on a standard variable tariff, typically a provider’s default and most expensive option.

It does not safeguard consumers against global market fluctuations and does not limit an individual’s overall bill – if you use more than the “average user”, you still pay more.

The rate is reviewed every six months and the latest cap, announced on 26 August 2022, ushered in a rise of 80 per cent, meaning a steep increase in household bills this spring.

As of 1 October 2022, the cap was due to rise to from £1,971 to £3,549 for a household on average usage, having begun the year at £1,277, with prepayment meter customers facing an even steeper rise.

What’s more, the cap was forecast by analysts at Cornwall Insights to rise even further in future quarters, perhaps pushing beyond the £6,000-mark by April 2023, all of which follows a rise in inflation to 9.9 per cent and interest rates to 2,25 per cent as a cost of living crisis drives up the price of consumer goods.

Former chancellor Rishi Sunak had unveiled a package of support measures in the spring aimed at providing additional support to low-income families, pensioners and those on means-tested benefits, but it was widely dismissed as insufficient.

Then, after a summer of apocalyptic economic news, dire warnings and public anxiety while the Conservative government did nothing, waiting for the conclusion to its drawn-out leadership contest to find a successor to Boris Johnson, new prime minister Liz Truss was finally ushered into Downing Street and acted quickly.

Cost of living: How to get help

The cost of living crisis has touched every corner of the UK, pushing families to the brink with rising food and fuel prices.

- The Independent has asked experts to explain small ways you can stretch your money, including managing debt and obtaining items for free.

- If you need to access a food bank, find your local council’s website using gov.uk and then use the local authority’s site to locate your nearest centre. The Trussell Trust, which runs many food banks, has a similar tool.

- Citizens Advice provides free help to people in need. The organisation can help you find grants or benefits, or advise on rent, debt and budgeting.

- If you are experiencing feelings of distress and isolation, or are struggling to cope, The Samaritans offers support; you can speak to someone for free over the phone, in confidence, on 116 123 (UK and ROI), email jo@samaritans.org, or visit the Samaritans website to find details of your nearest branch.

Despite stating her opposition to “handouts” during a campaign interview with The Financial Times, Ms Truss duly unveiled a plan in the House of Commons to freeze Ofgem’s cap at £2,500 for two years, saying it was “a moment to be bold”.

She claimed this would help households save £1,000 a year and come in addition to the £400 direct payment promised by Mr Sunak earlier this year, which she said would still go ahead.

Ms Truss said there would also be a six-month scheme offering “focused support” for vulnerable businesses but insisted there would be no windfall tax on profit-making energy companies, as advocated by Labour, claiming such a measure would “undermine the national interest”.

Ms Truss was attacked by Liberal Democrat leader Sir Ed Davey for settling on a cap still £500 north of the current rate and by Labour’s Sir Keir Starmer for her refusal to tackle energy companies’ sky-rocketing excess profits while the public pick up the bill over the long term and for the Tory failure to encourage home insulation.

Chancellor Kwasi Kwarteng was due to announce the precise cost of the scheme in his “mini-Budget” on 23 September, a package that turned out to consist of uncosted tax-slashing initiatives based around a heavy borrowing programme that was deemed so radical and ill-considered it spooked the global financial markets for several weeks, forcing the Bank of England to launch a rescue effort to bail out Britain’s pensions by buying up government debt to the tune of £65bn.

Mr Kwarteng subsequently suffered an embarrassing summons back from an IMF meeting in Washington, DC, on 14 October to be sacked and replaced by Jeremy Hunt in a bid to save Ms Truss’s already-ailing premiership.

Mr Hunt also moved quickly, announcing another U-turn among many when he said that the government could only guarantee its cap on the unit price of energy for another six months, not two years as promised.

The new man said the Treasury review would aim to come up with support plan that will “cost the taxpayer significantly less” beyond April in a move aimed at reassuring markets that the government can balance the books.

The Resolution Foundation subsequently estimated that the volte face could save the Treasury up to £40bn in 2023/24 – but would allow the annual energy price cap to rise again to £4,000 from April.

“The price of shielding the public finances from wholesale gas markets next year is more pressure on households, with the energy price cap now on course to hit £4,000 next April – almost double its effective level today,” said chief executive Torsten Bell.

The End Fuel Poverty Coalition, an umbrella body for 60 charities and campaign groups, likewise called for clarity, saying the financial cliff edge faced by millions “has now become even steeper”.

Coordinator Simon Francis told The Independent: “We thought everyone could rely on some support, but that’s been taken away. We need clarity on support for the most vulnerable as soon as possible.”

Labour again called on the government to consider a new windfall tax on the fossil fuel giants, agreeing that the country still had “no clarity” of the impact of the disastrous Truss-Kwarteng mini-Budget.

“The humiliating climbdown on their energy plan begs the question yet again – why won’t they bring in a windfall tax on energy producers to help foot the bill?” said shadow chancellor Rachel Reeves.

Consumer champion Martin Lewis urged Mr Hunt to consider ways to help those not on benefits. “The post-April support will still need [to] reach a decent way up the net and support middle earners – energy rates are still huge.”