Despite reporting widening losses for the second quarter, QuantumScape Corporation (QS) saw its shares soared last month. Moreover, the company did not report any sales. This was largely due to investors being stirred by the company’s announcement that it was “working closely with a prospective launch customer” in the automotive market. Moreover, QS is ramping efforts to bring its first product to market soon.

However, QS took a drastic downturn this month, significantly dipping after the battery maker said it plans to offer $300 million worth of shares, which indicated further dilution.

Although QuantumScape continues to make considerable headway in solid-state battery technology, the stock could remain volatile and might not be the right investment now. In order to provide more context to this viewpoint, let’s assess some of its metrics.

Analyzing Financial Performance and Market Expectations for QS from 2020-2023

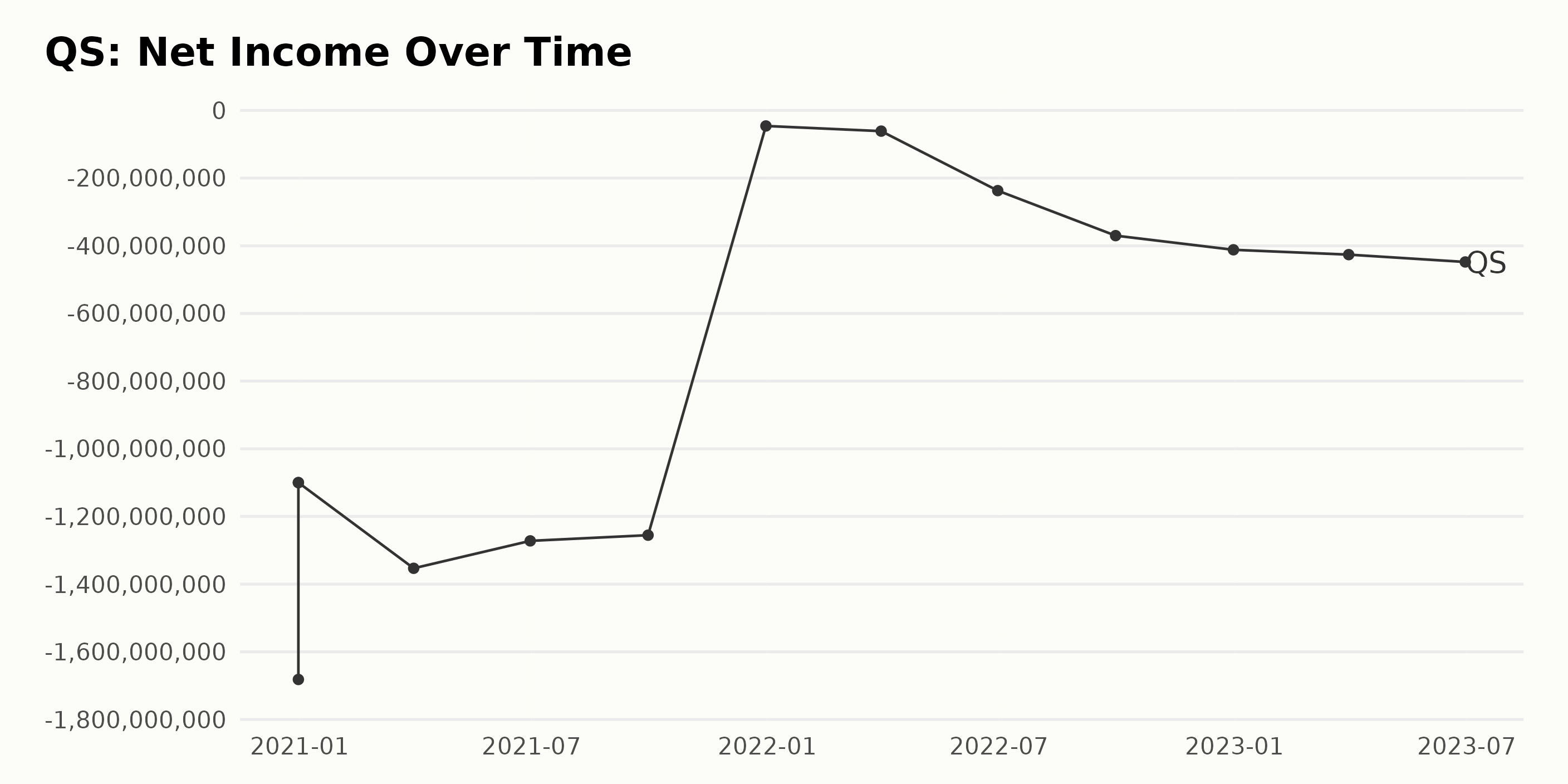

The trend and fluctuations of QS’ trailing-12-month net income from 2020 to 2023 reveal a consistent negative balance, which indicates a loss during these periods. Here is a summary:

- At the end of December 2020, the company reported losses.

- On March 31, 2021, the net income dropped further to -$1.35 billion; it continued to decline on June 30, 2021, with a net income of -$1.27 billion.

- Only a slight improvement was observed by the end of the third quarter of 2021, with a slightly less loss of -$1.26 billion.

- In the fourth quarter of 2021, QS significantly improved, limiting losses to just -$45.97 million.

- Unfortunately, the company’s net income remained in the red for the first quarter of 2022, with a recorded loss of approximately -$61.24 million.

- As we went further into 2022, the financial situation further deteriorated with a reported loss of -$237.06 million in the second quarter, -$370.07 million in the third quarter, and a year-end closing loss of -$411.91 million in the fourth quarter.

- The first half of 2023 exhibited an even worse performance, with reported losses of -$426.20 million and -$447.89 million in the first and second quarters, respectively.

From the beginning of 2020 till mid-2023, QS experienced consistent growth in its losses or negative net income. However, we note some fluctuation in the amount of loss, with larger losses in 2020 and 2021 and comparatively smaller but growing losses from late 2021 through mid-2023.

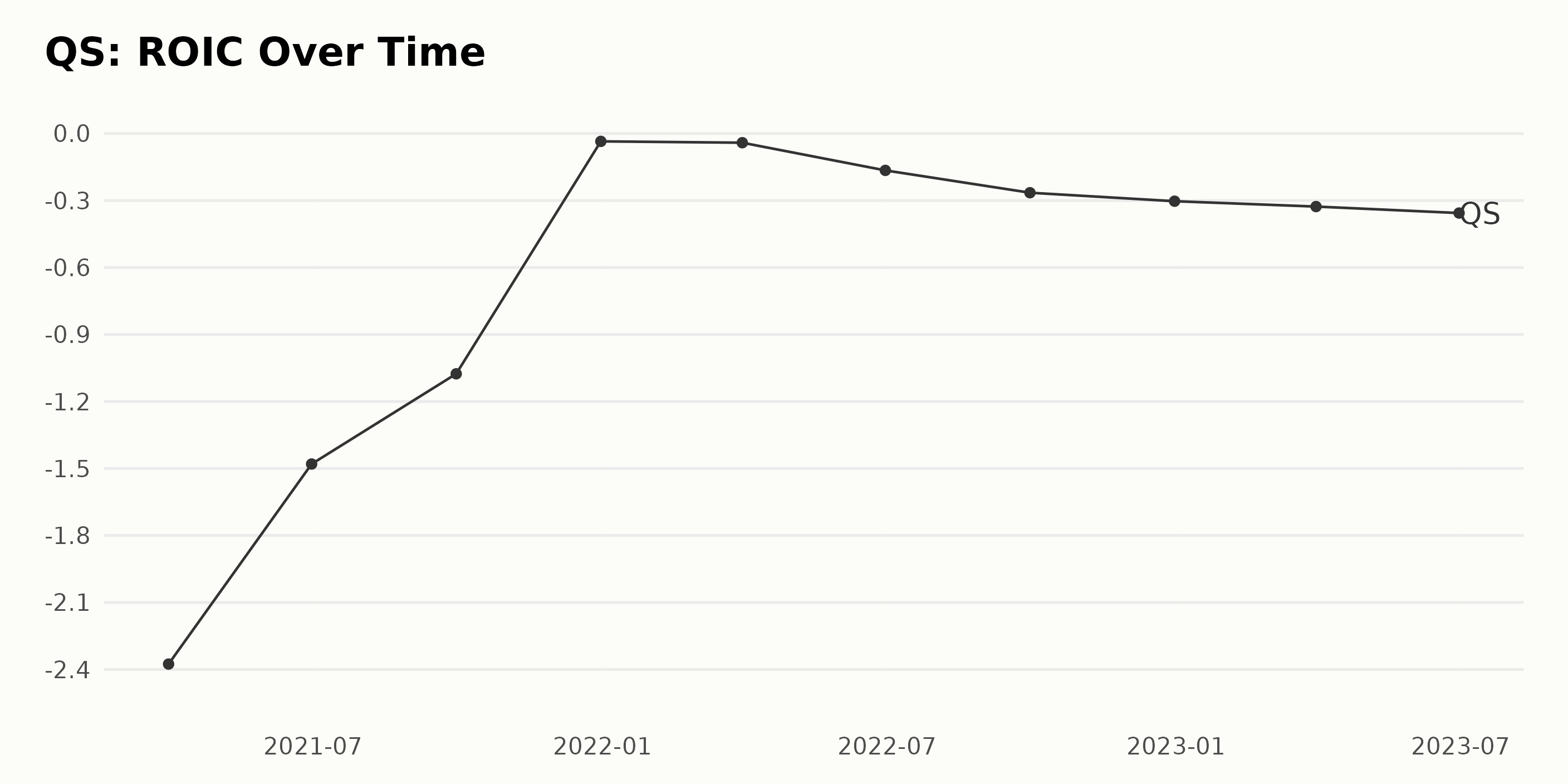

The reported ROIC of QS shows a decreasing trend over the period from March 2021 to June 2023. The ROIC has consistently been negative during this period, indicating an unfavorable return on invested capital.

- A substantial improvement was noted from March 31, 2021, when the ROIC was -2.38, to December 31, 2021, when it almost reached equilibrium at -0.035.

- The ROIC then saw a slight dip to -0.041 by the end of March 2022 but experienced a further decline in the subsequent months.

- By June 30, 2022, the ROIC fell to -0.165 and continued its downward trend until the end of 2022, reaching -0.303 on December 31, 2022.

- As of the more recent data from 2023, there is evidence of consistent yet marginal deterioration in the ROIC. It went down to -0.327 in March and -0.356 in June.

Our greater emphasis on recent data indicates that there is persistent fluctuation, highlighting a negative trajectory for the QS’s ROIC, which investors should take into account.

Overview of Current Ratio Trends for QS:

- On September 30, 2020, QS reported a Current Ratio of 7.67.

- The Current Ratio peaked dramatically at 81.71 by December 31, 2020. This peak persisted until the end of the year with no marked fluctuations.

- From this peak, there was a gradual downward trend across 2021, starting from a Current Ratio of 72.21 on March 31, falling to 42.78 by the end of September.

- There were minor increments in the Current Ratio to the end of 2021 at 47.81 and into the start of 2022, finishing March at 48.57. However, these were followed by a definite downward trajectory again.

- For the remaining period through to June 30, 2023, QS experienced a steady decline in the Current Ratio from 32.11 to 19.25.

This shows an overall downward trend in terms of the Current Ratio across the time series. While specific reasons for the variability are not provided, factors influencing Current Ratio can include changes in the company’s current assets and liabilities, company management strategies, and industry circumstances. However, without further financial details, it is difficult to make assertions about the company’s liquidity health.

Over time, the Analyst Price Target of QS has shown significant fluctuation and a downward trend. Using the last value from the first value to calculate the growth rate, we can observe the primary findings:

- The series starts with an Analyst Price Target of $35 on November 12, 2021.

- The highest target is $38 from December 10, 2021, maintained until February 4, 2022.

- The target started to see a consistent drop after February 11, 2022, with a 10% decrease to $34.5 by the following week.

- The most substantial decrease occurred between March 4, 2022, and August 5, 2022, when the price target dropped from $28 to a low of $13.5 - nearly a 52% drop.

- The target reached its lowest point of $4 on June 16, 2023.

- Subsequently, QS saw a short burst of optimism as the Analyst Price Target increased slightly towards the end of the series, reaching $7 on August 11, 2023.

In summary, the reported Analyst Price Target for QS has been mostly on a declining trajectory, falling from $35 to $7 over the course of the data series. This represents a decrease of approximately 80%, reflecting a less favorable outlook from analysts for QS over time. The most recent data, however, indicates a slight rebound in expectations.

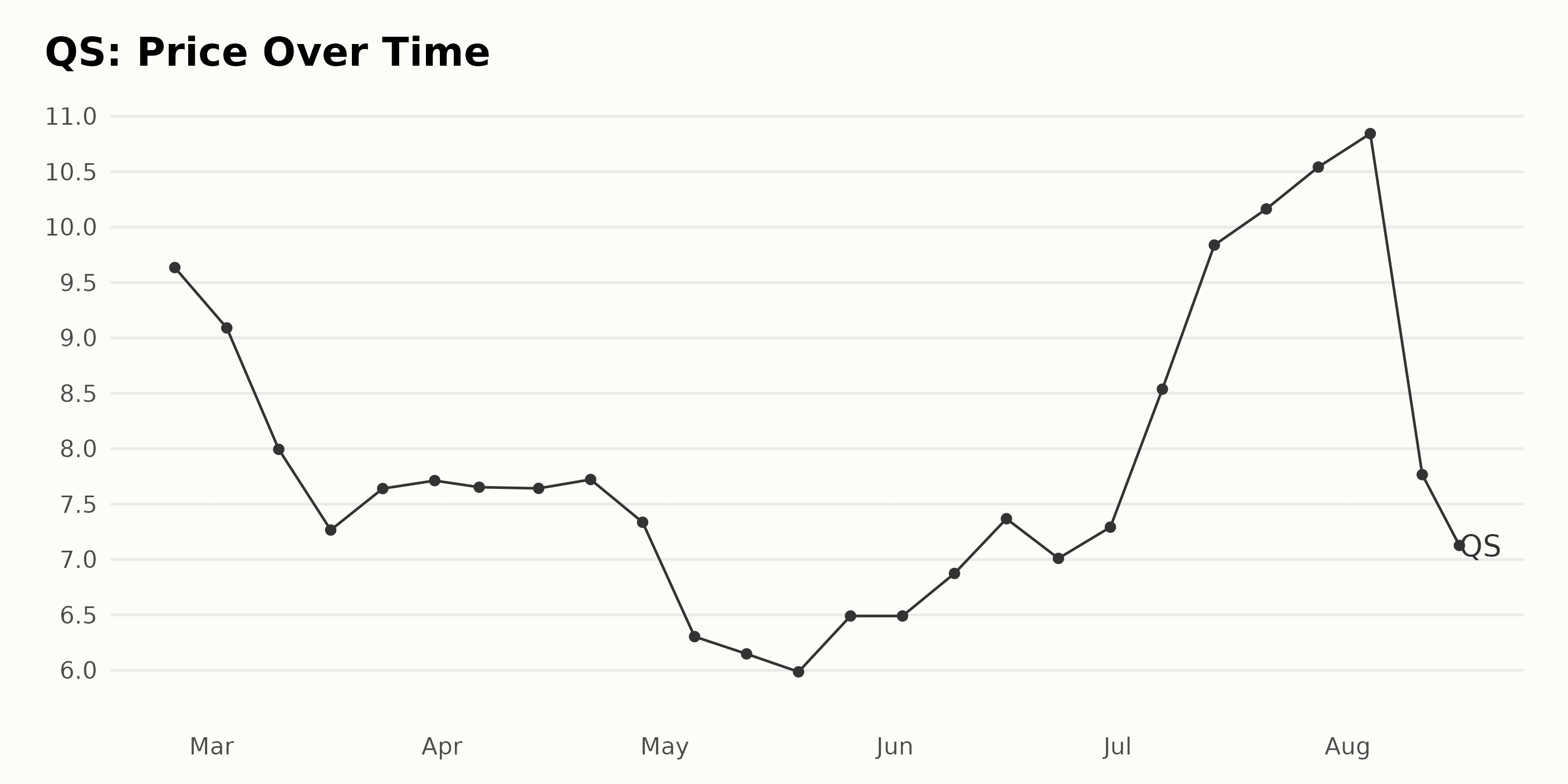

QS Share Price: Analyzing the Unpredictable Six-Month Trend from February to August 2023

Upon inspection, the share price of QS demonstrates a volatile trend over the monitored period from February to August 2023. A general overview reveals three distinctive phases:

Decreasing Phase (February to May): -

- On February 24, 2023, the share price started at $9.64. Price decreased steadily over time, dropping to $7.27 by March 17, 2023.

- Minor fluctuations occurred towards the end of March but did not interrupt the overall downward trend.

- The downtrend continued into April, despite minor upward bumps. By April 28, 2023, the share price had gone down to $7.34.

- In May, the sharpest decrease was observed, finally bottoming out at $5.99 on May 19, 2023.

Flat Phase (Late May to Early July):

- From May 26 to June 16, 2023, the share price displayed a fairly flat trend, fluctuating around an average of approximately $6.50.

- There was a slight improvement in the last two weeks of June, with the price increasing to $7.37 by June 16, 2023, but the general flat trend persisted.

Rising Phase (July to August):

- In July, the QS share prices showed a remarkable improvement. It ascended from $8.54 on July 7, 2023, to $10.54 on July 28, 2023, marking the highest point in the dataset.

- At the start of August, the company’s stock price briefly touched $10.84 on August 4, 2023, which is around a 14% increase from early July.

- However, the later part of August demonstrated a significant fall again, with the price dropping to $7.13 as of August 16, 2023.

Thus, there is a clear decelerating trend from February through May, followed by a period of stability from late May up to early July, then an accelerating trend from July to early August, and another sharp deceleration by mid-August. This shows that the QS share price can be quite unpredictable. Here is a chart of QS’s price over the past 180 days.

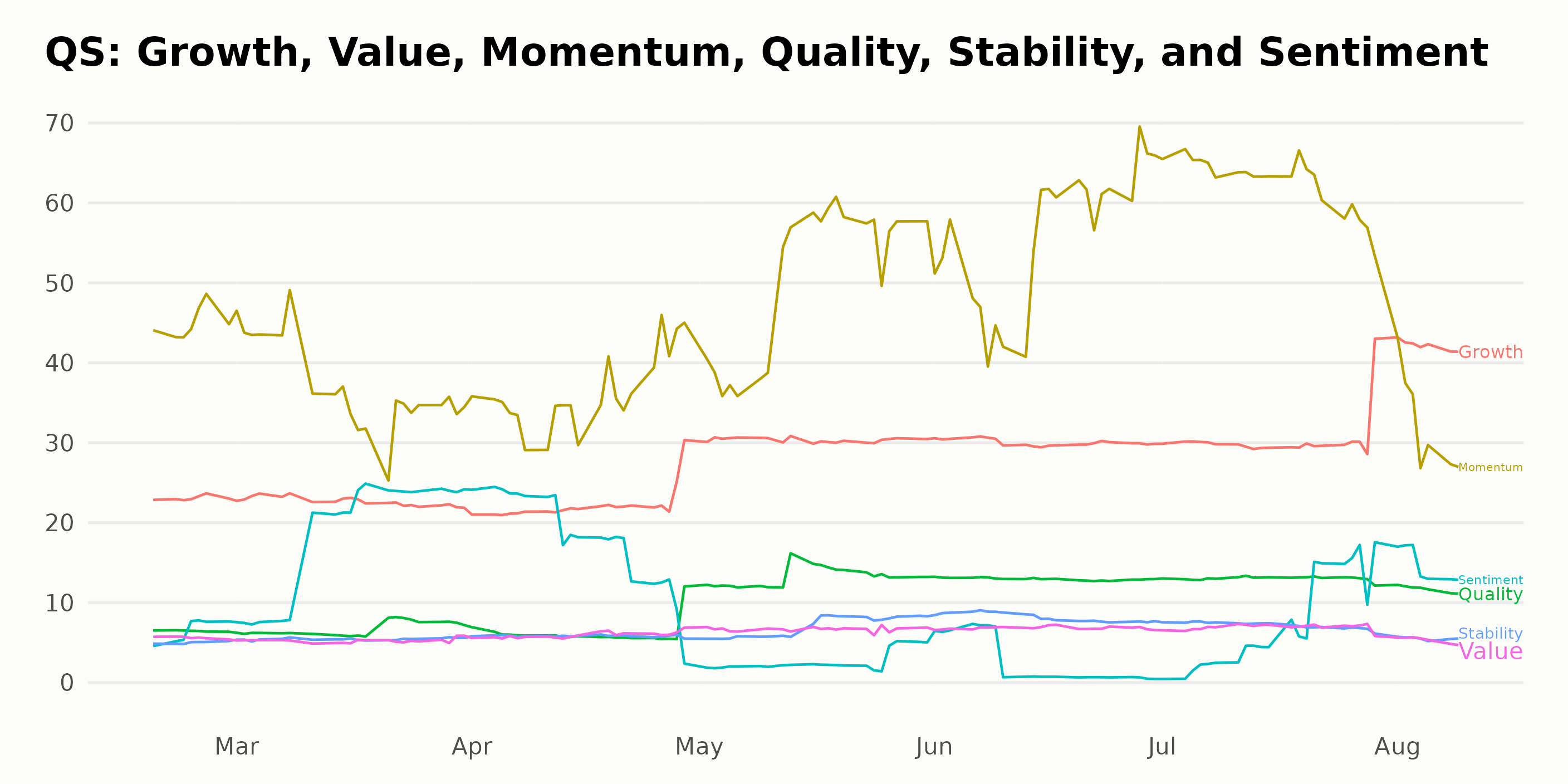

Examining QS’ Noteworthy POWR Ratings: Momentum, Growth, and Quality (February - August 2023)

QS has an overall F rating, translating to a Strong Sell in our POWR Ratings system. It is ranked #59 out of the 60 stocks in the Auto Parts category.

The three most noteworthy POWR Ratings dimensions for QS during the period between February and August 2023 are Momentum, Growth, and Quality. Here is a brief explanation of each dimension’s performance:

- Momentum: From February to July, QS showed significant growth in the Momentum rating, rising from 45 in February to an impressive 63 in July 2023. However, there was a noticeable decline in August, bringing the Momentum value down to 33. It was the highest-rated dimension overall, showing notable fluctuations but generally trending upwards for most of the period.

- Growth: The Growth POWR Rating also demonstrated an encouraging uptrend for QS, rising steadily from 23 in February 2023 to 42 in August. Thus, it indicates sustained growth over the observed period.

- Quality: Although the Quality rating had the lowest numbers among these three dimensions, a clear upward trend was observed from February to June - going up from 6 to 13. This increased Quality rating suggests improvements in the intrinsic worthiness of QS over the period.

Stocks to Consider Instead of QuantumScape Corporation (QS)

Other stocks in the Auto Parts sector that may be worth considering are Commercial Vehicle Group, Inc. (CVGI), Garrett Motion Inc. (GTX), and Allison Transmission Holdings, Inc. (ALSN) -- they have better POWR Ratings.

What To Do Next?

Get your hands on this special report with 3 low priced companies with tremendous upside potential even in today’s volatile markets:

3 Stocks to DOUBLE This Year >

QS shares rose $0.03 (+0.43%) in premarket trading Thursday. Year-to-date, QS has gained 24.16%, versus a 16.19% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

What Do Investors Think About QuantumScape (QS)? StockNews.com