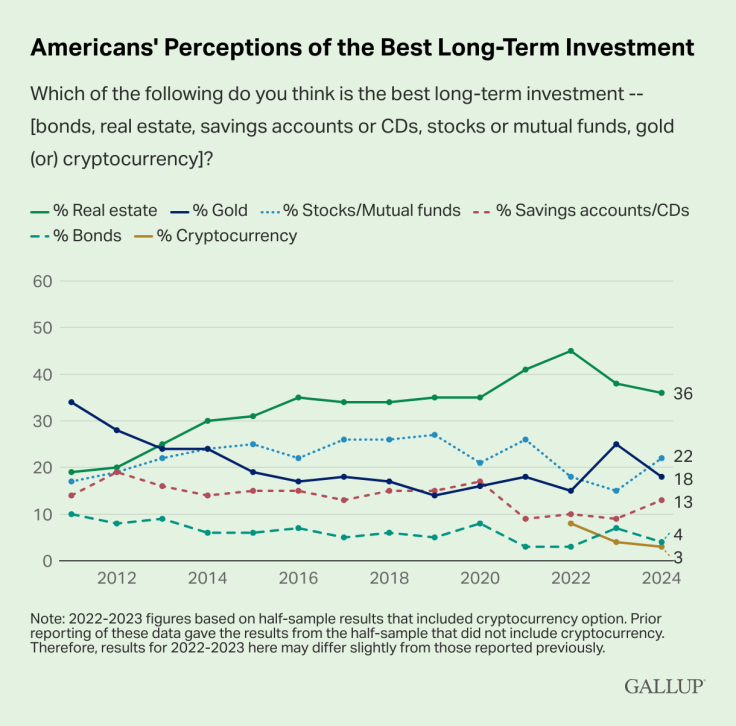

More than one in three Americans (36%) believe that real estate is the strongest long-term investment in the country, with the sector staying at the top of such assessment for the eleventh year in a row, according to a new Gallup survey.

Stocks and bonds followed in the list, jumping to the second spot with 22% of respondents and overtaking gold (18%). The top long-term investment in 2011 and 2012, gold has been decreasing in people's consideration as its price stagnated and other coverage alternatives arose during turbulent times.

Savings accounts, bonds and cryptocurrency complete the list, with the latter only being the top choice for 3% of Americans. The survey started offering it as an option in 2022 following a surge that saw bitcoin's price rise to $69,000 in late 2021. 8% of respondents chose it the first year, but its volatility contributed to make it less palatable for some, taking it to 4% in 2023 and 3% in the latest poll.

Another passage of the survey indicated that "Americans' historical tendency to choose real estate as the best long-term investment is consistent with their usual expectations of rising local home values."

The recent performances of both the real estate sector and the stock market help explain Americans' choices. The study notes that even though real estate values are down from their record high in late 2022, when "the median home sale price was $479,500," they remain "well above the average values from early 2021 and before."

The stock market has also reached historic highs, with the S&P 500 benchmark index topping 5,300 for the first time on Wednesday. Almost two in three Americans (62%) currently has money invested in the stock market, either through individual stocks, a mutual fund or a retirement savings account.

"The figure is essentially unchanged from last year but reflects a return to stock ownership levels not seen since the Great Recession in 2008," the survey said.

But while real estate is the best perceived investment for Americans across income levels, the second choice is not the same for all groups. "Whereas 31% of upper-income Americans say stocks are the best investment, 14% of lower-income Americans agree. Lower-income Americans are more likely to pick gold (23%) or savings accounts (20%) than stocks. Just 7% of upper-income Americans believe savings accounts are the best choice for investors," Gallup showed.

There is a correlation between stock ownership and income level, with the vast majority (87%) of those earning $100,000 a year or more owning stock, compared to 25% of those who earn less than $40,000 a year.

© 2024 Latin Times. All rights reserved. Do not reproduce without permission.