It’s a bad day in the stock market on Monday, but far worse for AMC Entertainment (AMC). Shares are plunging this morning, down 36%.

At this morning’s low, shares were down just over 40%. That’s after the “movie theatre chain's largest rival, Cineworld, confirmed it's considering a Chapter 11 bankruptcy filing in the United States.”

The news is reverberating around the entertainment industry and is sending a punishing blow to AMC stock, which recently reported a larger-than-expected quarterly loss.

The company also announced a new preferred dividend when it reported earnings — APE shares — which began trading this morning under the ticker symbol “APE.” Given the volatility, it’s no surprise these have already been halted.

As one of the short-squeeze leaders, we’re seeing this group unwind quickly. AMC is being crushed on Monday, while Bed Bath & Beyond (BBBY) was decimated late last week after Ryan Cohen announced the sale of his long position in the stock.

As for AMC, shares are now trading near a key area.

Trading AMC Stock

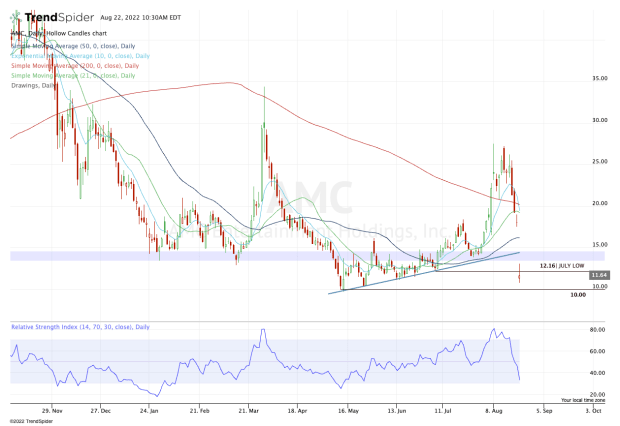

Chart courtesy of TrendSpider.com

AMC stock was riding a nice uptrend from the May low, before exploding higher in late July and early August.

The stock suffered a three-day, 27.5% decline to end last week. Bulls were hoping the downside would be limited from there. Instead, it was a forewarning to what was coming.

The stock tried to rally off this morning’s low, but so far, it’s struggling to reclaim the July low at $12.16. That leaves AMC stock in a monthly-down rotation.

If it can’t regain this level, it leaves AMC vulnerable to a drop down to the $10 level. This level was major support in mid-May. If we see a dip down to this area, it’s important that it holds.

If it does not hold, AMC bulls will see this stock drop into the single digits. That could put the $7.50 to $8 area in play, but there’s no guarantee it will drop that far. Instead, AMC stock simply dips into “no man’s land” if it loses $10 and the 2022 low of $9.70.

Above these marks and bulls can look for a move back above the July low, then today’s high at $13.05.

Above today’s high opens the door to the 50-day moving average and the $15 level in the short term.