/Lilly(Eli)%20%26%20Co%20logo%20on%20building-by%20Michael%20Vi%20via%20Shutterstock.jpg)

With a market cap of $799.5 billion, Indianapolis, Indiana-based Eli Lilly and Company (LLY) is a leading global pharmaceutical firm renowned for its innovative contributions to healthcare. The company has developed notable medications such as Prozac for depression, Humalog for diabetes, and Mounjaro for type 2 diabetes.

Shares of the drugmaker have outperformed the broader market over the past 52 weeks. LLY has increased 24.6% over this time frame, while the broader S&P 500 Index ($SPX) has gained 22.6%. In addition, LLY stock has risen 13.8% on a YTD basis, compared to SPX's 3.3% YTD gain.

Looking closer, Eli Lilly and Company has also outpaced the Health Care Select Sector SPDR Fund's (XLV) 2.8% rise over the past 52 weeks.

Eli Lilly's stock rose 3.3% on Feb. 6 after a strong Q4 earnings report. The company reported a 45% year-over-year increase in revenue, reaching $13.5 billion, driven by significant sales of its diabetes and obesity treatments, Mounjaro and Zepbound. Adjusted EPS more than doubled to $5.32, surpassing analysts' expectations. Additionally, Eli Lilly provided an optimistic 2025 forecast, projecting sales between $58 billion and $61 billion, further boosting investor confidence.

For fiscal 2024, which ended in December, LLY reported adjusted EPS of 12.99. The company's earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

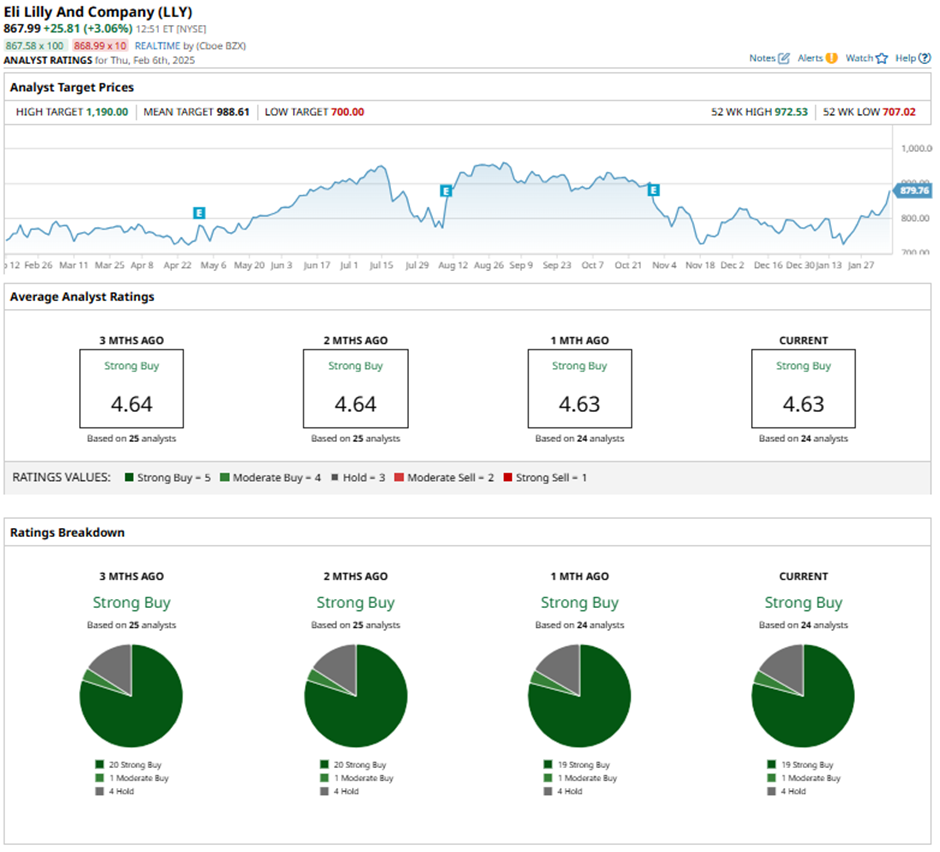

Among the 24 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

This configuration is slightly less bullish than three months ago, with 20 “Strong Buy” ratings on the stock.

On Feb. 6, Bernstein reiterated its “Outperform" rating on Eli Lilly with a price target of $1,100, expressing optimism about the company's prospective weight loss treatment, CagriSema.

As of writing, LLY is trading below the mean price target of $988.61. The Street-high price target of $1,190 implies a modest potential upside of 37.1% from the current price levels.