Key takeaways

- The IRS charges interest on unpaid taxes from the due date until the debt is fully paid. This interest is compounded daily.

- For the first three quarters of 2024, the IRS interest rate on underpayments for individuals is set at 8%. Since this is a comparatively high rate, it’s important to promptly pay any taxes or penalties you owe.

- If you’re getting a tax refund, the IRS might owe you interest if you don’t get your refund within 45 days. In most cases, the interest starts accruing from the tax filing deadline.

- If you owe interest because of an IRS error or delay, you can file Form 843 to request a reduction of the interest.

If you don’t pay your federal income taxes, or pay them late, the IRS is going to charge you interest on the unpaid balance. And unlike the IRS penalties for unpaid or late taxes, interest payments generally can’t be waived or reduced, even if you have a good reason for not paying (although there are a few exceptions).

Since interest on overdue taxes is compounded daily, the total interest due can add up quickly. Plus, interest rates are high right now, which is all the more reason to pay any federal tax or IRS penalties you owe as quickly as possible.

When you do make a payment, the IRS typically applies the payment to any taxes owed first. If there’s any money left over, it will then be applied to any outstanding penalties, and then finally to any interest you owe. (And, by the way, the IRS charges interest on unpaid penalties, too.)

When do IRS interest payments start and stop?

In most cases, the IRS starts charging interest as soon as the due date for the overdue taxes has passed. And since a tax extension typically doesn’t extend the time to pay any income taxes owed (it only extends the time for filing your return), you’ll still owe interest on any unpaid tax beginning right after the original tax filing deadline (typically April 15) even if you request an extension.

Interest continues to accrue until your balance is paid in full.

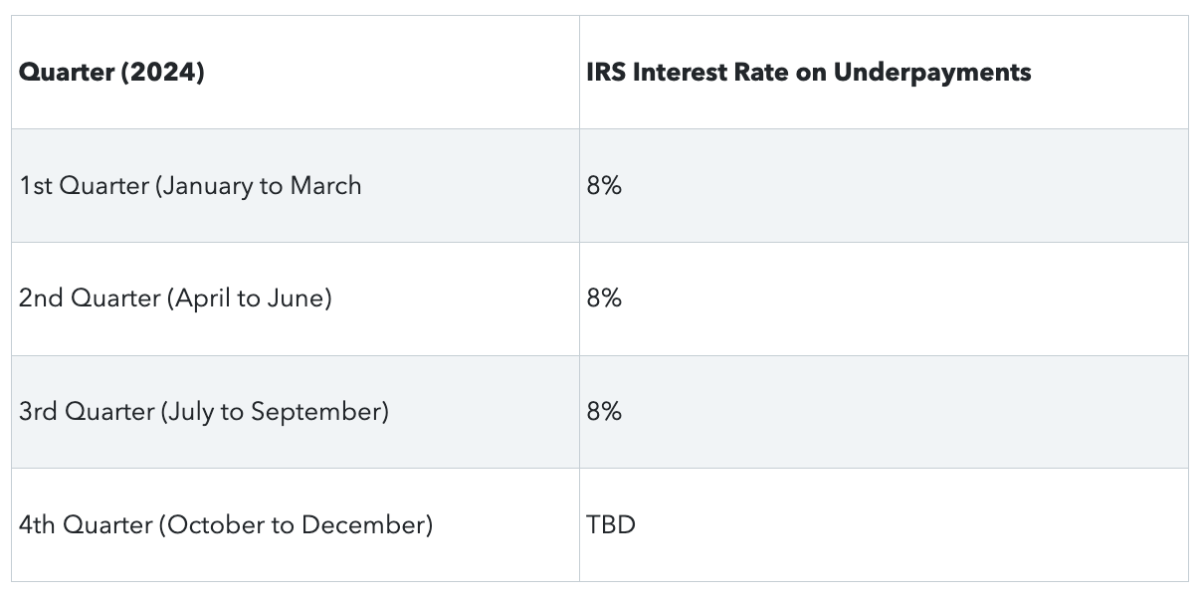

What are the IRS interest rates for 2024?

The IRS sets interest rates on the underpayment of taxes each quarter. The underpayment rate is equal to the federal short-term rate for the first month of the previous quarter (rounded to the nearest full percent), plus three percentage points.

For the first three quarters of 2024, the interest rate paid by individuals on unpaid taxes is 8%.

Add two additional percentage points for corporations with unpaid taxes over $100,000.

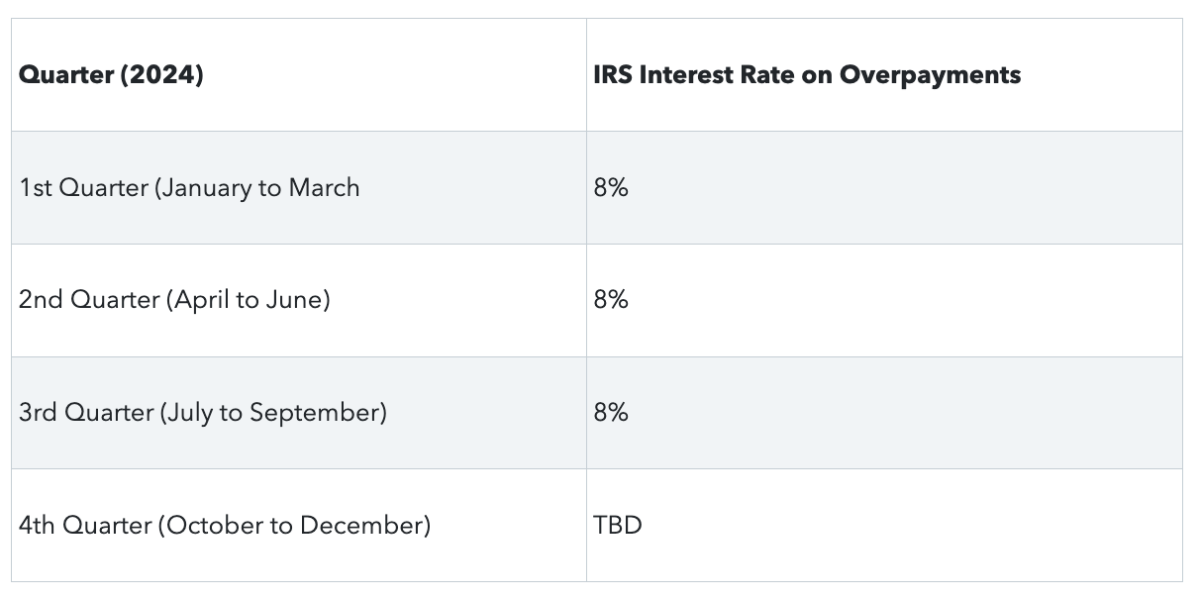

Does the IRS pay interest, too?

What if the IRS owes you money? Does the IRS have to pay interest until it pays you? Actually, yes – the IRS will generally pay you interest if you’re due a tax refund from the overpayment of taxes.

The IRS has 45 days to pay a tax refund before interest payments to you kick in. However, if the IRS doesn’t pay up within 45 days, it generally starts calculating interest on your overpayment from one of the following dates (whichever one is the latest):

TurboTax Tip: Any interest payment from the IRS is taxable income for the year you receive it. If the IRS pays you interest of at least $10, it will send you a Form 1099-INT reporting the interest in January of the following year.

- Deadline for filing your tax return,

- Date the IRS receives your late-filed tax return,

- When the IRS receives your return in a format it can process, or

- Date the overpayment was made.

The IRS stops paying interest when it refunds your money (plus interest already due) or applies the overpayment to other taxes you owe.

If the IRS owes you money, the current interest rate for overpayments is 8%.

The overpayment rate for corporate refunds is 7% for the first three quarters of 2024.

Net interest rate of zero. If you owe the IRS interest for unpaid taxes for the same time period the IRS owes you interest for an overpayment of taxes, the interest payments might balance each other out by asking for a net interest rate of 0%. You can request a 0% net interest rate by filing Form 843 and providing documents showing you’re entitled to interest on the overpayment.

Can interest you owe the IRS be reduced?

While rare, the amount of interest you owe the IRS can be reduced in certain situations. For example, it can be decreased or eliminated if you owe interest because of an IRS error or delay. If you qualify, file Form 843 to request a reduction of interest. However, if you contributed to the error or delay in a significant way, the interest you owe won’t be lowered.

If the IRS accidentally sends you a refund, any interest charged on the repayment of the refund will be wiped out if the mistaken refund is $50,000 or less and you didn’t cause the refund in any way. For mistaken refunds greater than $50,000, whether or not interest is eliminated will be decided on a case-by-case basis.

The IRS will also reduce or eliminate interest on penalties if the underlying penalties are decreased or wiped out.

And, of course, the best way to minimize the interest you owe is to pay any taxes owed as quickly as possible. That will stop the accumulation of interest payments right away. If it’s later determined that you didn’t owe the unpaid tax, the interest you paid on that balance will be refunded.

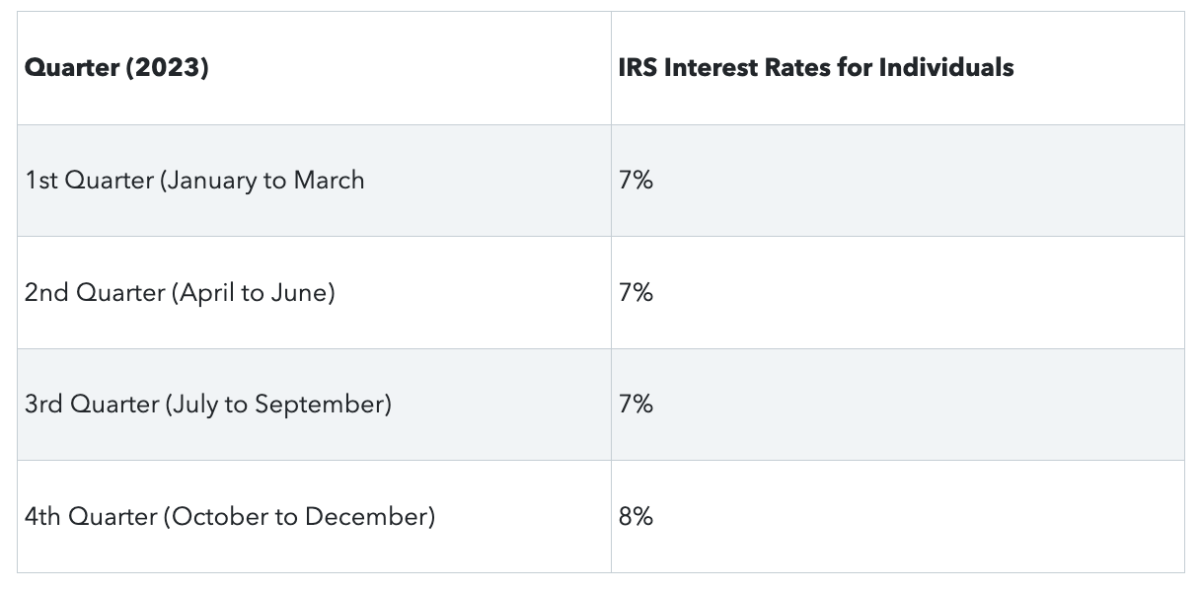

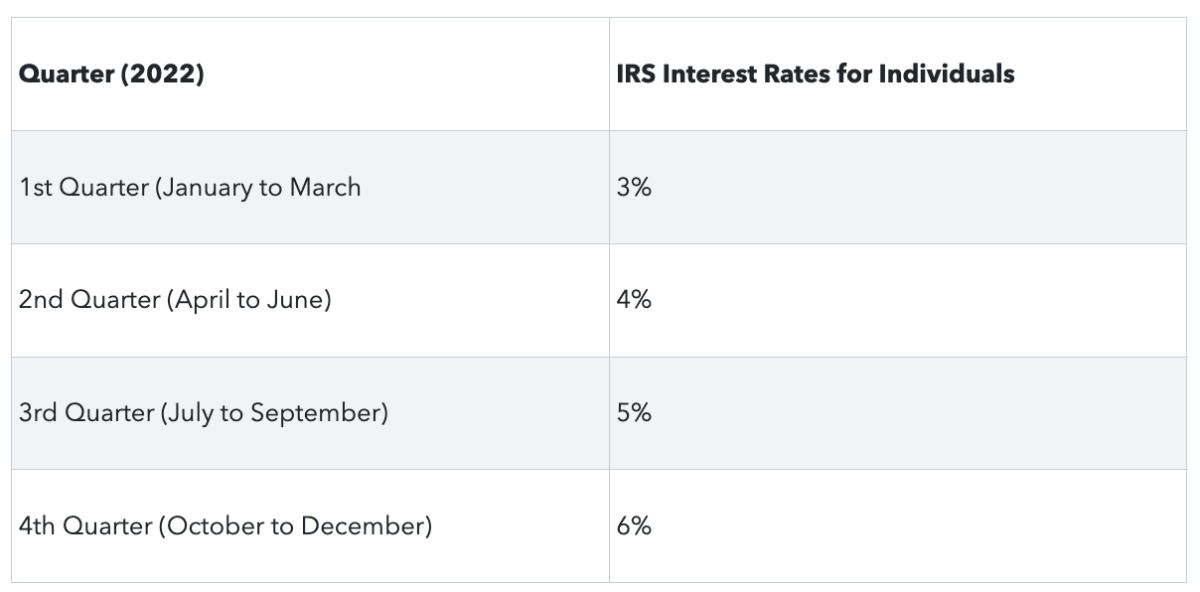

IRS interest rates for previous years

You might need to know the IRS interest rates for previous years if you have an underpayment or overpayment of tax from that year. Here are the interest rates for individuals from 2019 to 2023 (rates for underpayments and overpayments are the same).

IRS interest rates for 2023

IRS interest rates for 2022

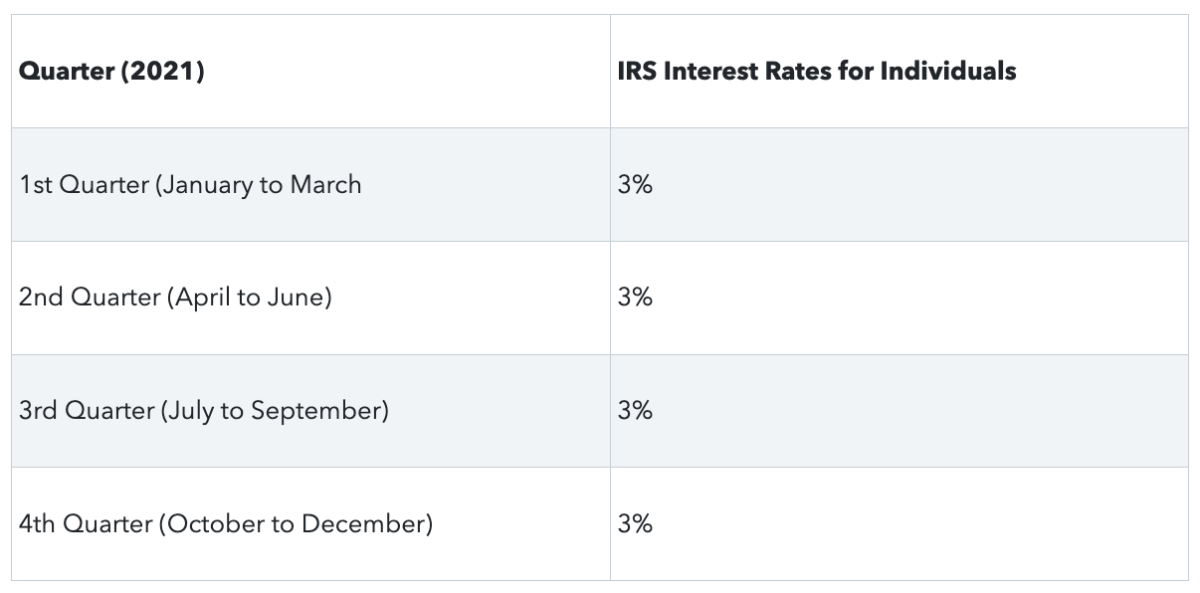

IRS interest rates for 2021

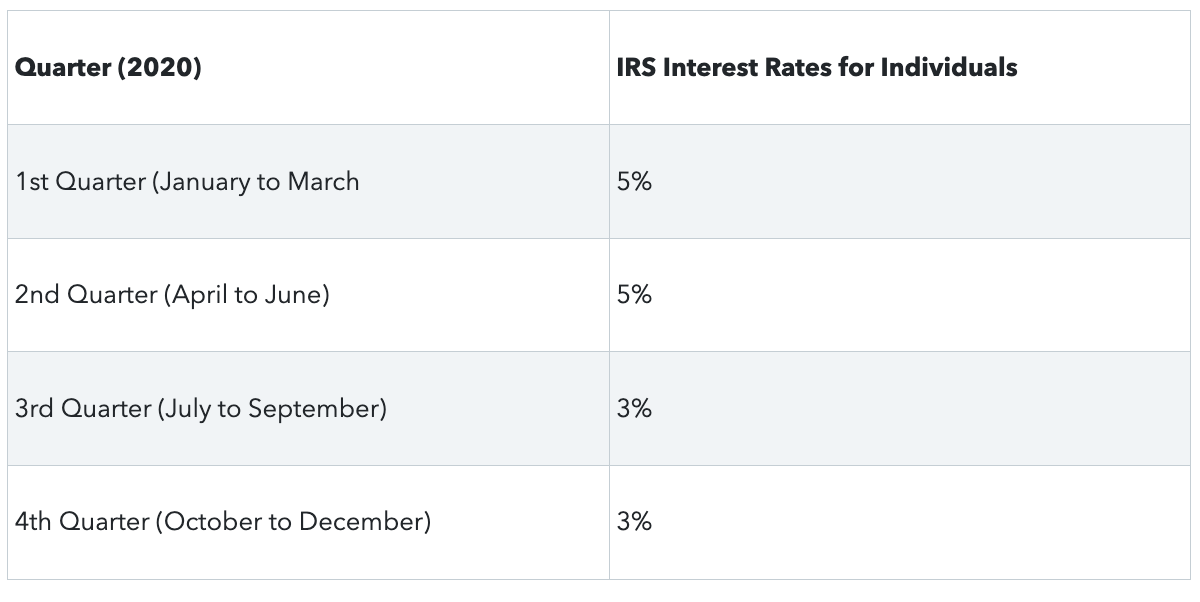

IRS interest rates for 2020

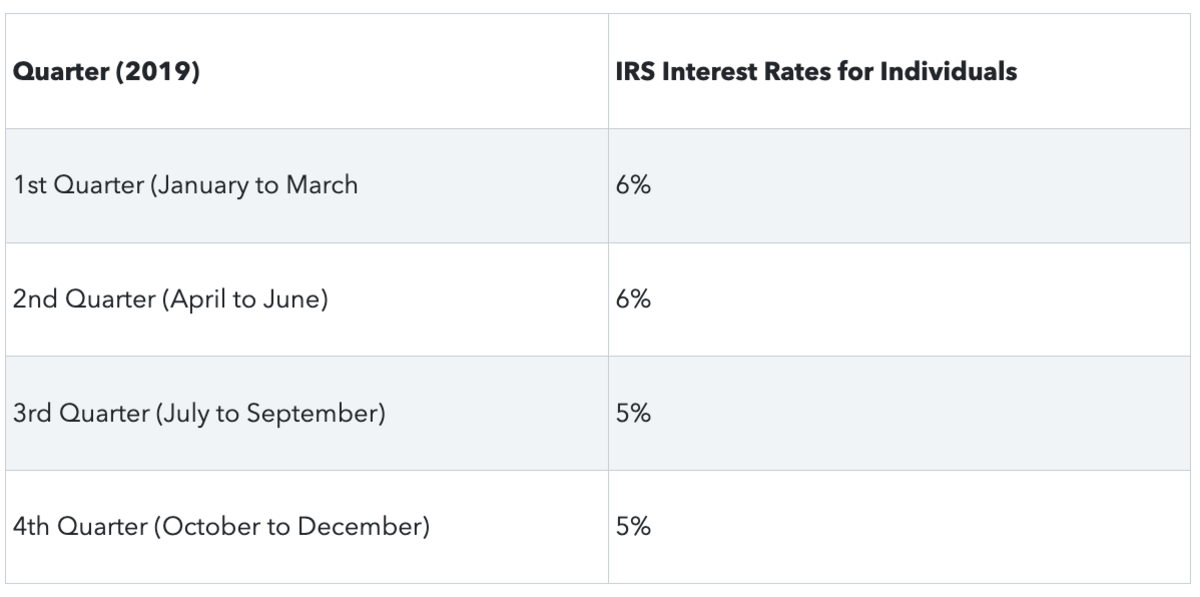

IRS interest rates for 2019

With TurboTax Live Full Service, a local expert matched to your unique situation will do your taxes for you start to finish. Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted.

And if you want to file your own taxes, you can still feel confident you'll do them right with TurboTax as we guide you step by step. No matter which way you file, we guarantee 100% accuracy and your maximum refund.