What Are Business Inventories?

Business inventories are an economic indicator that focuses on the total of inventories at each of the three stages of production: manufacturing, wholesale, and retail. The report on business inventories also includes business sales, which are the total of sales at each of the three stages of production. Inventories include raw materials such as iron and wood, works in progress such as clothing pieces yet to be sewn, and finished products such as radios and cars.

Business inventories and sales are expressed in dollars for the reporting period, but investors and analysts tend to focus on the month-on-month percent change and the monthly year-on-year percent change.

The inventories-to-sales ratio is a metric that is also published with business inventories and sales, and that is calculated by dividing inventories by sales.

Why Are Business Inventories Important?

The data are widely followed by economists, investors, and analysts, and by organizations ranging from the Federal Reserve to institutional investment firms and banks in the analysis and forecasting of future economic conditions. Business inventories are viewed as a leading indicator in terms of measuring future commitments in the manufacturing sector and how consumers might be spending their money.

High inventory levels, for example, can be interpreted in two ways: that manufacturers are producing more and have enough goods to meet expected demand, or that consumer demand is weak and there are too many goods being left unsold. The latter could point to signs of recession.

Either way, much like retail sales, same-store sales, and auto sales, it’s a way to gauge the potential behavior of consumer spending.

When Are Business Inventories Released?

The Census Bureau of the U.S. Department of Commerce releases the data at the middle of the month, at 10 a.m. ET. The report’s official title is the Manufacturing and Trade Inventories and Sales Report. The report is based on the month two months prior to the release month because it takes about six weeks to compile the data.

Upcoming Release Dates in 2022

How Are Business Inventories Compiled?

The estimates for business inventories are based on data from three surveys: the Monthly Retail Trade Survey, the Monthly Wholesale Trade Survey, and the Manufacturers’ Shipments, Inventories, and Orders Survey. The manufacturers survey focuses on companies with $500 million or more in annual shipments, though the Census Bureau does get results from smaller companies.

The figures are adjusted for seasonal and trading day differences but not for price changes.

What Is the Inventories-to-Sales Ratio?

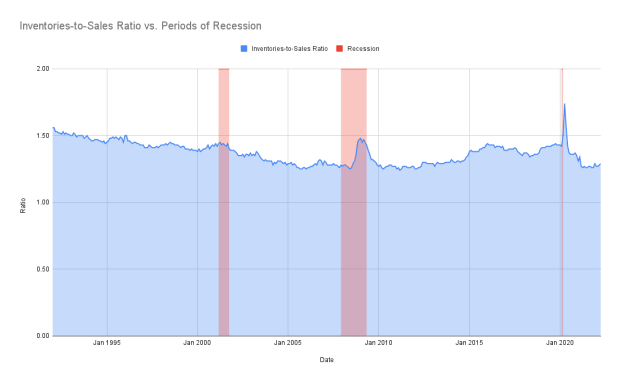

The ratio shows the relationship of the values of inventory to sales each month. A ratio of 1 indicates that there is enough merchandise available to cover one month of sales, while a ratio of 1.5 means one-and-a-half months, 2 for two months, and so on. The ratio may indicate whether the pace of inventories may either slow or accelerate over a period. A higher ratio, for example, might mean manufacturers will consider slowing down production to keep inventories at a minimum.

How to Interpret Business Inventories

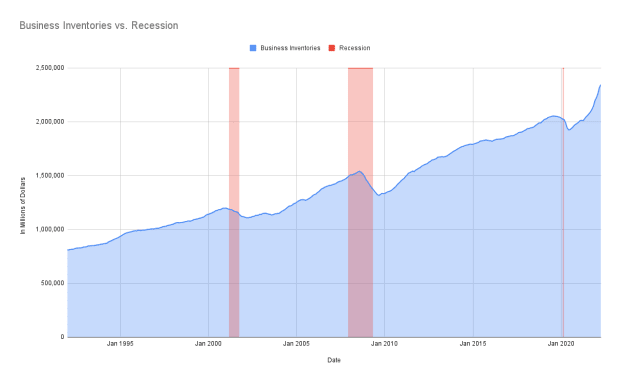

Below are graphs of business inventories and the inventories-to-sales ratio, with periods of recession.

Just as business inventories peaked in 2001, 2008 and 2020, the economy slipped into recession. On the other hand, the inventories-to-sales ratio rose in 2008 and 2020 at the tail end of each recession. The ratio spiked in 2020 as consumers withheld purchases at the start of the COVID-19 pandemic.

As inventories climb in early 2022, other indicators point to the economy slipping into recession.

How Do the Stock and Bond Markets React to Business Inventories?

High values in business inventories could mean that manufacturers are doing well to produce their goods. On the other hand, high inventory levels over a sustained period could indicate that consumer demand is weak and suggest that the economy could be heading into recession. In reaction to that scenario, stock prices, especially for businesses engaged in manufacturing, could decline. Bond prices could also fall if business inventories point to the potential of the economy contracting.