Kameleon007 via Getty Images Signature; Canva

What Is a Bond in Simple Terms?

A bond is a debt issued by a borrower, such as a corporation or the federal government, to raise money. A bond is known as a fixed-income security because it pays its holder a fixed sum on a regular schedule for a fixed term. At the end of the term, the borrower has paid back the principal of the debt, which is known as its face value, along with periodic interest payments.

Stocks may be the more glamorous financial assets, but believe it or not, the bond market is actually larger. According to the Securities Industry and Financial Markets Association (SIFMA), global equity markets were valued at $120 trillion in 2021, while global bond markets were valued at $123.5 trillion.

Because bonds are more stable and less volatile than stocks, owning bonds can be part of an investor’s balanced portfolio strategy. Another plus: Bonds provide income in the form of interest, also known as coupon payments.

One key thing to know about bonds is that their prices move inversely to interest rates. So when interest rates increase, bond prices fall. When interest rates decline, bond prices go up.

Most bonds mature in 30 years or fewer. Longer-term bonds typically have higher coupons to compensate the investor for the risk that interest rates might rise before the bond matures. This is known as interest-rate risk.

10 Bond Investing Terms You Need to Know

In order to understand how bonds work, we’ve put together a handy glossary of terms:

- Bond: A small loan, made by an individual, to a corporate or government entity.

- Bondholder: The individual who is loaning money to a corporate or government entity.

- Bond Duration: This measures the sensitivity of a bond’s value to a change in interest rates. High duration equals high sensitivity and high risk. Low duration equals low sensitivity and low risk.

- Bond Issuer: The corporate or government entity to whom the bondholder is loaning money.

- Bond Yield: The profit, or return, the bondholder receives annually on their bond. Yield on any bond will reflect the interest rates at the time the bond is issued.

- Coupon Rate: The annual income the bondholder will receive on their bond. The annual coupon rate is calculated by interest rates. The coupon rate is set in the bond agreement, but it can vary depending on current interest rates.

- Credit quality: This refers to the issuer's ability and willingness to pay interest and repay principal on schedule. Most bonds carry ratings (AAA is the highest) indicating their credit quality.

- Face Value/Par Value: This is the set value of the bond, and the amount the bondholder will be reimbursed at maturity. Oftentimes, with bonds, the face value is set to an easy-to-remember $100 or $1,000 value. The face value will never change. Try thinking of it as a bond’s wholesale price.

- Market Value: This is the price a bondholder actually pays for a bond when they purchase it. Why is this different from the face value of your bond? It’s different because the market value of the bond fluctuates. It will rise and fall in correlation to interest rates and other factors.

- Maturity Date: This is the date a bond matures and the bondholder gets paid back the principal bond amount (or original investment).

4 Common Types of Bonds

There are several classes of bonds: Treasury securities are issued by the federal government; municipal bonds are issued by states and local governments; and corporate bonds are issued by companies. Other types of bonds include high-yield bonds, agency securities, and asset-backed securities. Except for municipal bonds, all the other types are collectively referred to as spread product.

Agency bonds

Agency bonds are issued by government-sponsored enterprises (GSEs) or organizations affiliated with the federal government, such as the Federal Home Loan Mortgage (Freddie Mac), Federal National Mortgage Association (Fannie Mae), or Federal Home Loan Bank.

Corporate bonds

Corporate bonds are issued by companies seeking a lower interest rate and more favorable terms than are offered by traditional bank loans.

Government bonds

Government bonds are issued by government authorities and collectively known as "treasuries,” or “sovereign debt” if issued by the federal government.

Municipal bonds

Municipal bonds are issued by states and municipalities seeking the same.

Secured and Unsecured Bonds

A secured bond is typically a corporate or municipal bond that is backed by collateral, like property, equipment, or another asset. Some of the most well-known secured bonds are mortgage-backed securities, which are a collection of home loans that banks issue and investors can buy.

The only thing supporting an unsecured bond is a promise that they will be repaid on “full faith and credit.” There is nothing backing an unsecured bond, which adds to their risk level. Unsecured bonds, which are also known as debentures, usually pay higher coupon payments than secured bonds.

Fixed vs Variable Rates

Fixed-rate bonds pay a set, or fixed, coupon for the term of the bond. True to their name, variable-rate bonds pay a coupon that changes, so that when interest rates change, their coupon adjusts accordingly. A few examples will illustrate.

Bond Example 1: Fixed Interest Rate

Jessica bought a $1,000 bond with a maturity of 2 years, at a fixed coupon rate of 5%.

In 1 year, Jessica will receive a $50 coupon/bond yield.

In 2 years, when her bond matures, she will receive $1,050 back, which includes:

- Her par value of $1,000

- Her coupon/bond yield of $50 (calculated with the coupon rate of 5% interest)

So, in the end, her bond had a total coupon/bond yield of $100.

Jessica’s profit is directly proportional to the coupon rate she had on her bond. Since she chose the safest kind of bond, a fixed interest rate bond, she knew exactly what she was getting into and what she would receive at the end of the 2 years. She received her coupon/yield of $100—no more, no less.

Bond Example 2: Variable Interest Rate

Sam bought a $1,000 bond with a maturity of 2 years, at a variable interest rate of 5% (the current interest rate at the time of purchase).

If interest rates don’t change during that 1 year period, Sam will receive the same yield as Jessica: $50.

However, if interest rates drop to 3%, Sam’s yield will now change to $30. It’s unfortunate, but that’s the risk Sam took when he chose a variable interest rate bond.

However, instead of dropping, interest rates might rise to 7% during that year! If that’s the case, Sam’s yield has now changed to $70.

How do Bonds Pay Interest?

Bonds make periodic interest payments, which is known as their coupon rate. Most coupon bonds make payments semiannually, or twice a year. However, there are some bonds, like Zero-coupon bonds, that do not pay any interest at all.

Zero-coupon bonds

Zero-coupon bonds are perhaps the simplest of bonds. A zero-coupon bond does not pay a coupon rate; instead, income is generated by issuing the bond at a discounted price compared to its face value. This in turn provides a profit to the bondholder at maturity, when the full face value is reimbursed. An example of a zero-coupon bond is a dollar bill issued by the U.S. Treasury.

Convertible bonds

Convertible bonds can be converted into stock depending on the conditions of the contract. This is attractive to some bond issuers, as it allows them to sell at a lower coupon rate/higher maturity with the lure to the bondholder being that they can potentially convert that bond into stock when the stock price rises.

Callable bonds

Callable bonds are considered a riskier option for bondholders. This type of bond allows the bond issuer to “call” the bond before the maturity date, which often occurs when that bond is rising in value.

Puttable bonds

Puttable bonds are the reverse of callable bonds: this type of bond allows a bondholder to “put” or sell the bond back to the bond issuer before it has matured.

How Are Bonds Rated?

Credit Quality: To help investors understand the creditworthiness of a bond, private rating agencies, such as Standard & Poor’s, Moody’s and Fitch Ratings, conduct an assessment of the bond issuer at the time they issue a bond. Their findings are published in an easy-to-understand ratings system, with AAA being the highest. An AAA rating means the issuer is extremely capable of meeting its financial commitments.

Investment-grade bonds are anything above BB status, while D-rated bonds indicate that the company is in default. This chart provides a handy illustration of the different ratings.

Investment-grade bonds typically have lower coupon yields than non-investment-grade bonds, which offer investors higher yields as a way to offset their increased risk. Junk bonds are bonds with high coupons but also have ratings lower than BB. Companies usually issue junk bonds when they need to quickly raise cash.

Junk bonds are bonds with high coupons but also have ratings lower than BB. Companies usually issue junk bonds when they need to quickly raise cash.

How Are Bonds Priced?

Remember our definition of par value, (also known as face value)? Par value is the bond’s set price. It is also the amount the investor will receive at maturity. Bonds can trade at par, at a discount, which is below their face value, or at a premium, which is higher than their face value.

Bond performance is measured by benchmarks. These benchmarks are the highest-rated government Treasuries, which are considered to be free of default risk. The 10-year Treasury, for example, is used as a benchmark for 10-year bonds.

Bond prices are also influenced by their creditworthiness as well as how old they are, which is their maturity. The closer a bond is to its maturity, the more likely it will trade at par value, because it is simply closer to returning the full investment to a bondholder.

How to Calculate Yield to Maturity

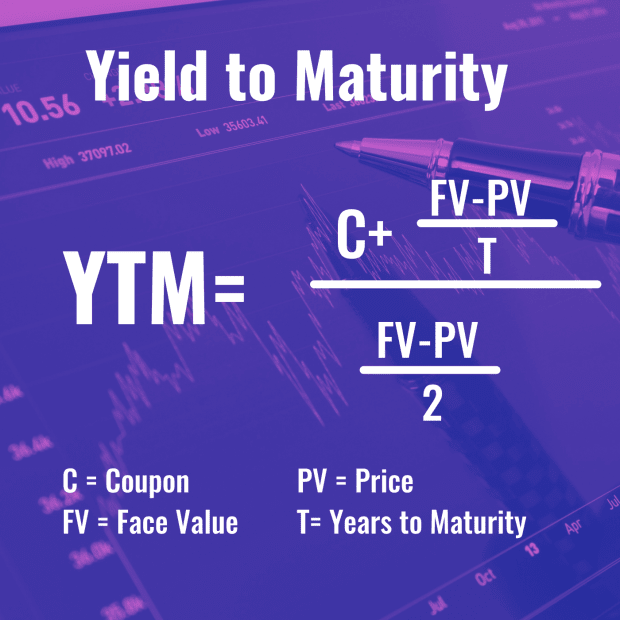

The formula used to calculate yield to maturity is below:

KellyISP via Getty Images; Canva

The Yield to Maturity formula is the sum of the coupon plus the calculation of face value minus bond price divided by the number of years to maturity. All of this gets divided by another calculation, which is the face value subtracted by the bond price and divided in half.

Remember, bonds that have longer terms to maturity are usually priced lower and offer higher yields.

Should I Invest in Bonds?

A diversified portfolio has the “right mix” of equities and income investments. For a long time, investors relied on an allocation strategy known as the 60/40 Rule, with 60% of their portfolio allocated to stocks and 40% to bonds and other fixed-income investments so that they could enjoy long-term upside potential while limiting their volatility.

But the times they are a-changin', and the 60/40 Rule is not as ironclad as it once was. Warren Buffett, known as the most famous investor of all time, believes that because of the current market environment of minuscule bond yields, “today’s bond portfolios are wasting assets.” It all depends on what your financial goals are, and how much risk you are willing to take.

Where Can I Buy Bonds?

Investors can purchase Treasury bonds issued in $100 increments through Treasury Direct, the government’s website. Banks, bond traders, and brokerages also offer bonds for sale, with face values of $1,000 or $5,000 being typical. Bonds are also packaged into mutual funds and as exchange-traded funds (ETFs) with varying minimum investments.

Fun Bond Facts

- Bonds are securitized as tradable assets.

- Bonds are an important instrument for governments to raise money for infrastructure and also during times of war when a government may need to raise money quickly.

- The credit quality of a bond issuer and the bond’s time to maturity are two major factors in determining coupon rate.

- Some municipal bonds offer tax-free coupon income for investors.

- A bond's price may change on a daily basis based on interest rates in the current economy, similar to all publicly traded securities, where supply and demand determine price.