Across the recent three months, 11 analysts have shared their insights on PNC Finl Servs Gr (NYSE:PNC), expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 3 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 1 | 2 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

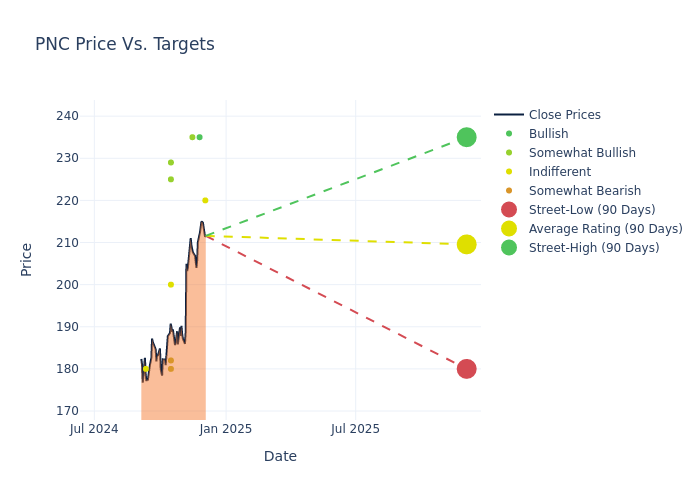

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $210.27, a high estimate of $235.00, and a low estimate of $180.00. Observing a 6.39% increase, the current average has risen from the previous average price target of $197.64.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of PNC Finl Servs Gr among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Scott Siefers | Piper Sandler | Raises | Neutral | $220.00 | $200.00 |

| Keith Horowitz | Citigroup | Raises | Buy | $235.00 | $200.00 |

| Whit Mayo | Wells Fargo | Raises | Overweight | $235.00 | $215.00 |

| Jason Goldberg | Barclays | Raises | Overweight | $229.00 | $209.00 |

| Whit Mayo | Wells Fargo | Raises | Overweight | $215.00 | $204.00 |

| Terry McEvoy | Stephens & Co. | Raises | Equal-Weight | $200.00 | $185.00 |

| John Pancari | Evercore ISI Group | Raises | Outperform | $225.00 | $212.00 |

| David Konrad | Keefe, Bruyette & Woods | Raises | Underperform | $182.00 | $180.00 |

| Betsy Graseck | Morgan Stanley | Raises | Underweight | $180.00 | $177.00 |

| John Pancari | Evercore ISI Group | Raises | Outperform | $212.00 | $203.00 |

| Richard Ramsden | Goldman Sachs | Lowers | Neutral | $180.00 | $189.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to PNC Finl Servs Gr. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of PNC Finl Servs Gr compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of PNC Finl Servs Gr's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of PNC Finl Servs Gr's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on PNC Finl Servs Gr analyst ratings.

All You Need to Know About PNC Finl Servs Gr

PNC Financial Services Group is a diversified financial services company offering retail banking, corporate and institutional banking, asset management, and residential mortgage banking across the United States.

PNC Finl Servs Gr's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, PNC Finl Servs Gr showcased positive performance, achieving a revenue growth rate of 3.78% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: PNC Finl Servs Gr's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 25.7%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): PNC Finl Servs Gr's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.58%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): PNC Finl Servs Gr's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.25%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 1.22, PNC Finl Servs Gr adopts a prudent financial strategy, indicating a balanced approach to debt management.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.