Oracle (NYSE:ORCL) has been analyzed by 31 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 14 | 9 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 7 | 12 | 8 | 0 | 0 |

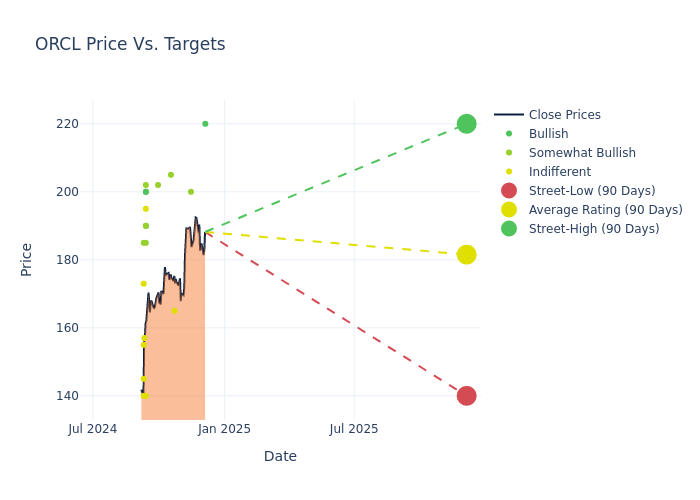

Insights from analysts' 12-month price targets are revealed, presenting an average target of $179.87, a high estimate of $220.00, and a low estimate of $140.00. Surpassing the previous average price target of $163.21, the current average has increased by 10.21%.

Decoding Analyst Ratings: A Detailed Look

In examining recent analyst actions, we gain insights into how financial experts perceive Oracle. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brent Thill | Jefferies | Raises | Buy | $220.00 | $190.00 |

| Jason Ader | Keybanc | Raises | Overweight | $200.00 | $190.00 |

| Alex Zukin | RBC Capital | Announces | Sector Perform | $165.00 | - |

| Patrick Walravens | JMP Securities | Raises | Market Outperform | $205.00 | $175.00 |

| Mark Moerdler | Bernstein | Raises | Outperform | $202.00 | $201.00 |

| Brent Thill | Jefferies | Raises | Buy | $190.00 | $170.00 |

| Mark Murphy | JP Morgan | Raises | Neutral | $140.00 | $120.00 |

| Karl Keirstead | UBS | Raises | Buy | $200.00 | $175.00 |

| Jason Ader | Keybanc | Raises | Overweight | $190.00 | $175.00 |

| Brad Sills | B of A Securities | Raises | Neutral | $195.00 | $175.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $202.00 | $172.00 |

| Derrick Wood | TD Cowen | Raises | Buy | $190.00 | $180.00 |

| Patrick Walravens | JMP Securities | Maintains | Market Outperform | $175.00 | $175.00 |

| Kirk Materne | Evercore ISI Group | Raises | Outperform | $190.00 | $175.00 |

| John Difucci | Guggenheim | Raises | Buy | $200.00 | $185.00 |

| Brent Bracelin | Piper Sandler | Raises | Overweight | $185.00 | $175.00 |

| Tyler Radke | Citigroup | Raises | Neutral | $157.00 | $140.00 |

| Patrick Walravens | JMP Securities | Announces | Market Outperform | $175.00 | - |

| Brent Thill | Jefferies | Raises | Buy | $170.00 | $150.00 |

| Keith Bachman | BMO Capital | Raises | Market Perform | $173.00 | $160.00 |

| Brad Reback | Stifel | Raises | Hold | $155.00 | $135.00 |

| Jason Ader | Keybanc | Raises | Overweight | $175.00 | $165.00 |

| Raimo Lenschow | Barclays | Raises | Overweight | $172.00 | $160.00 |

| Gil Luria | DA Davidson | Raises | Neutral | $140.00 | $105.00 |

| Siti Panigrahi | Mizuho | Raises | Outperform | $185.00 | $170.00 |

| Karl Keirstead | UBS | Raises | Buy | $175.00 | $160.00 |

| Kirk Materne | Evercore ISI Group | Raises | Outperform | $175.00 | $160.00 |

| Derrick Wood | TD Cowen | Raises | Buy | $180.00 | $165.00 |

| Keith Weiss | Morgan Stanley | Raises | Equal-Weight | $145.00 | $125.00 |

| Brad Sills | B of A Securities | Raises | Neutral | $175.00 | $155.00 |

| Brent Bracelin | Piper Sandler | Raises | Overweight | $175.00 | $150.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Oracle. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Oracle compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Oracle's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Oracle's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Oracle analyst ratings.

Discovering Oracle: A Closer Look

Oracle provides database technology and enterprise resource planning, or ERP, software to enterprises around the world. Founded in 1977, Oracle pioneered the first commercial SQL-based relational database management system. Today, Oracle has more than 400,000 customers in 175 countries.

Oracle: Financial Performance Dissected

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Positive Revenue Trend: Examining Oracle's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 6.86% as of 31 August, 2024, showcasing a substantial increase in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Oracle's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 22.01% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Oracle's ROE stands out, surpassing industry averages. With an impressive ROE of 30.01%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Oracle's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.05% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 7.81, caution is advised due to increased financial risk.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.