Across the recent three months, 7 analysts have shared their insights on Nucor (NYSE:NUE), expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 5 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 1 | 0 | 0 |

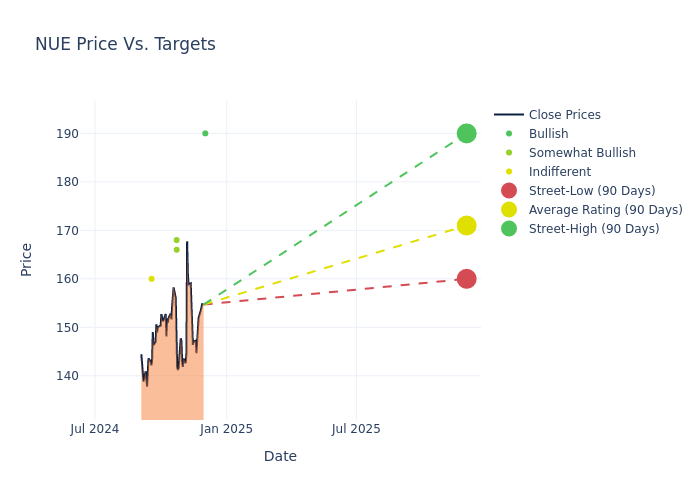

Analysts have set 12-month price targets for Nucor, revealing an average target of $171.14, a high estimate of $190.00, and a low estimate of $160.00. A 0.79% drop is evident in the current average compared to the previous average price target of $172.50.

Interpreting Analyst Ratings: A Closer Look

In examining recent analyst actions, we gain insights into how financial experts perceive Nucor. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mike Harris | Goldman Sachs | Announces | Buy | $190.00 | - |

| Bill Peterson | JP Morgan | Lowers | Overweight | $168.00 | $170.00 |

| Carlos De Alba | Morgan Stanley | Lowers | Overweight | $166.00 | $170.00 |

| Bill Peterson | JP Morgan | Lowers | Overweight | $170.00 | $174.00 |

| Katja Jancic | BMO Capital | Lowers | Market Perform | $160.00 | $175.00 |

| Carlos De Alba | Morgan Stanley | Lowers | Overweight | $170.00 | $176.00 |

| Bill Peterson | JP Morgan | Raises | Overweight | $174.00 | $170.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Nucor. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Nucor compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Nucor's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Nucor's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Nucor analyst ratings.

All You Need to Know About Nucor

Nucor Corp manufactures steel and steel products. The company also produces direct reduced iron for use in its steel mills. The operations include international trading and sales companies that buy and sell steel and steel products manufactured by the company and others. The operating business segments are: steel mills, steel products, and raw materials, the steel mills segment derives maximum revenue. The steel mills segment includes carbon and alloy steel in sheet, bars, structural and plate; steel trading businesses; rebar distribution businesses; and Nucor's equity method investments in NuMit and NJSM.

Unraveling the Financial Story of Nucor

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Decline in Revenue: Over the 3 months period, Nucor faced challenges, resulting in a decline of approximately -15.17% in revenue growth as of 30 September, 2024. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Materials sector.

Net Margin: Nucor's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 3.34%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Nucor's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.21%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Nucor's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.73%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Nucor's debt-to-equity ratio is below the industry average at 0.34, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.