Throughout the last three months, 9 analysts have evaluated Cracker Barrel Old (NASDAQ:CBRL), offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 6 | 2 | 0 |

| Last 30D | 0 | 0 | 2 | 0 | 0 |

| 1M Ago | 1 | 0 | 2 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 2 | 1 | 0 |

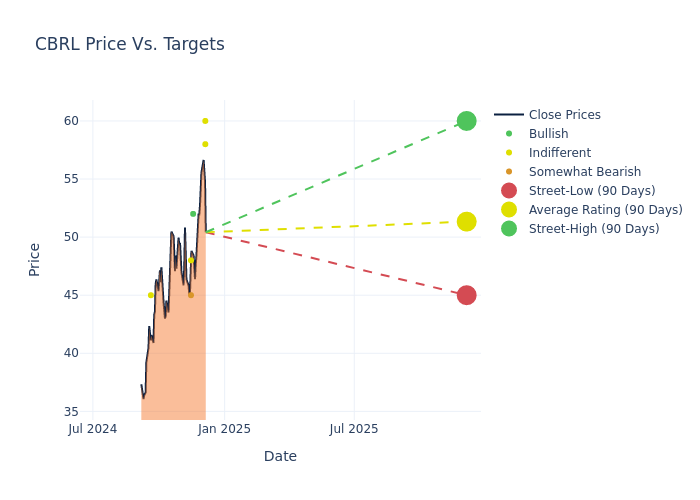

The 12-month price targets, analyzed by analysts, offer insights with an average target of $48.89, a high estimate of $60.00, and a low estimate of $42.00. This current average reflects an increase of 11.75% from the previous average price target of $43.75.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Cracker Barrel Old by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dennis Geiger | UBS | Raises | Neutral | $60.00 | $42.00 |

| Brian Mullan | Piper Sandler | Raises | Neutral | $58.00 | $46.00 |

| Brian Mullan | Piper Sandler | Raises | Neutral | $46.00 | $44.00 |

| Jim Kelleher | Argus Research | Announces | Buy | $52.00 | - |

| Sara Senatore | B of A Securities | Raises | Underperform | $45.00 | $42.00 |

| Jake Bartlett | Truist Securities | Raises | Hold | $48.00 | $44.00 |

| Sara Senatore | B of A Securities | Raises | Underperform | $42.00 | $40.00 |

| Jake Bartlett | Truist Securities | Raises | Hold | $44.00 | $42.00 |

| Alton Stump | Loop Capital | Lowers | Hold | $45.00 | $50.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Cracker Barrel Old. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Cracker Barrel Old compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Cracker Barrel Old's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Cracker Barrel Old's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Cracker Barrel Old analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Cracker Barrel Old's Background

Cracker Barrel Old Country Store Inc operates hundreds of full-service restaurants throughout the United States. The restaurants of the company are open for breakfast, lunch, and dinner, with menus that offer home-style country food. The company generates maximum revenue from the Restaurants.

Understanding the Numbers: Cracker Barrel Old's Finances

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Cracker Barrel Old's remarkable performance in 3 months is evident. As of 31 July, 2024, the company achieved an impressive revenue growth rate of 6.89%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Cracker Barrel Old's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 2.03%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Cracker Barrel Old's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 4.19%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Cracker Barrel Old's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.84%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Cracker Barrel Old's debt-to-equity ratio is below the industry average at 2.73, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.