When volatility picks up, some trading desks do quite well. J.P. Morgan (JPM) and Goldman Sachs (GS) tend to be pretty good at it. But the banking side isn’t quite so easy.

Banks like Wells Fargo (WFC) have a lot to balance when volatility in the system persists. That’s in regard everything from interest rates (and thus savings rates, mortgage rates, etc.) to currency fluctuations and margin pressure.

Now throw in the very real threat of a recession and Wells Fargo — along with all banks — faces a growing set of risks related to businesses and consumers.

Wells Fargo itself also has today's report to contend with: The bank was fined nearly $4 billion for its role in mismanaging consumer loans for more than 16 million customers, TheStreet's Martin Baccardax reports.

When we look at the bank stocks, the charts reflect those worries from investors. Those concerns can also be seen in Wells Fargo stock, as the shares cling to support by a thread.

Trading Wells Fargo Stock

Chart courtesy of TrendSpider.com

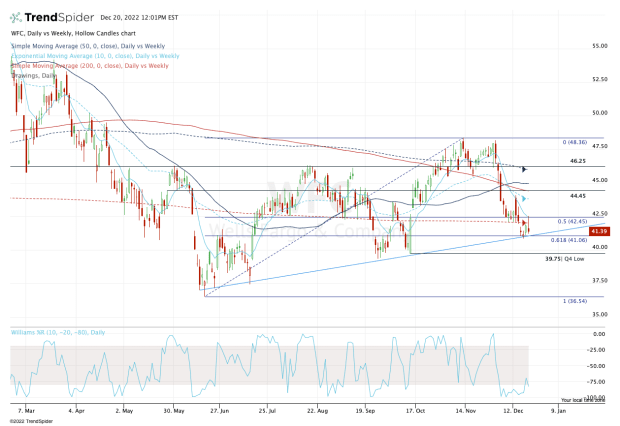

The chart above looks insanely busy — and it is — but that's by design. It’s a daily chart with a weekly overlay, highlighting various levels and measures to keep an eye on across different time frames.

That helps illustrate where Wells Fargo stock is relative to all these key measures and moving averages. Note that the stock is below all of them.

The shares are hanging by a thread as the stock clings to the 61.8% retracement and uptrend support (blue line). Just today, Wells Fargo stock was rejected by the 10-day and 200-week moving averages, as well as the 50% retracement.

If the shares close below last week’s low of $40.85, that opens the door down to the fourth-quarter low of $39.75.

The $39 area was a double-bottom in September and October, but if it fails as support this time around, that opens the door back down to the $36.50 to $37.50 area, where the 52-week low comes into play.

On the upside, the bulls need to see this stock clear $42.50 to enjoy a more sustainable rally.

Wells Fargo stock can bounce from this area, but the gains will not be meaningful unless the stock can clear the $42.50 area, opening the door to the $44 to $45 area and perhaps higher.