KEY POINTS

- Many HODL memes are on X as the well-used crypto term becomes a hot topic in the crypto space

- Long-time holders believe the crypto crash is an opportunity to stack up more coins

- Spot Bitcoin ETFs have bled over $600 million Thursday amid the downtrend

It's that time of the year when the cryptocurrency community sees a flood of memes across social media, especially X (formerly Twitter), as crypto prices plunge or struggle to leave the red line.

"HODL," a term used by crypto users to describe the act of holding on to crypto assets regardless of market action, was a top trend on X overnight following Bitcoin's plunge below $100,000 that apparently shook the market to its core and crumbled the faith of new crypto owners.

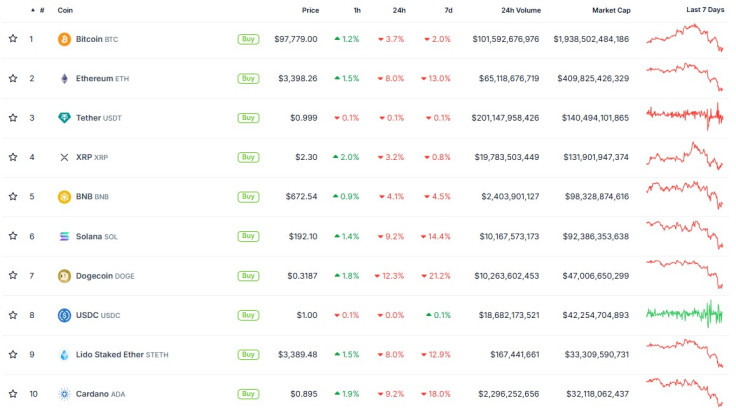

As of early Friday, all tokens on CoinGecko's Top 10 largest crypto assets by market value are in the red in the last 24 hours, including Bitcoin (3.7%) and Ethereum (8%).

A Rough Ride for New Entrants

New holders of Bitcoin or altcoins and memecoins are in for a rude awakening about the true nature of crypto: volatility. Well-followed @CarlBMenger, who describes himself as "stoic Bitcoin chief hodler," specifically welcomed newbies into the BTC world as top cryptocurrencies are in the red.

Welcome to #Bitcoin Newbies. pic.twitter.com/1a7Q8DYhFn

— Carl ₿ MENGER ⚡️🇸🇻 (@CarlBMenger) December 19, 2024

One user posted a GIF of legendary wrestler Ric Flair with his trademark "Whooooh!" The same user said the volatility of crypto makes him "feel alive."

A Time to Buy the Dip

For many long-time crypto owners, the market's plunge is actually a buying opportunity while prices are low, and it might not be a bad idea to just hold on to their coins and wait for the next surge.

Others also believe that the sudden market crash "can be a prelude to gain."

"Bitcoin's journey is full of ups and downs, but its long-term potential is what keeps us holding strong," said another user.

El Salvador, often dubbed as Bitcoin country, was among the "diamond hand" holders that bought the dip. The country, just after bending its BTC views to secure a multi-billion-dollar funding package from the International Monetary Fund (IMF).

El Salvador 🇸🇻 has been buying 1 Bitcoin each day for its Strategic National Bitcoin Reserve.

— HODL15Capital 🇺🇸 (@HODL15Capital) December 20, 2024

Today, they added 10 extra BTC 🟢👇 @nayibbukele ✅ pic.twitter.com/ZS502c6q6L

Japanese company Metaplanet looks to buy the dip too, announcing a plan to issue 5 billion yen (approximately $31.9 million) in ordinary bonds "to accelerate Bitcoin purchases."

$BTC ETFs Feel the Heat

Meanwhile, it appears that even spot Bitcoin exchange-traded funds (ETFs) listed in the U.S. were hit hard by the crypto market's downtrend, bleeding a total of $671.9 million, led by Fidelity's FBTC ($208.5 million). BTC ETF King IBIT did not see any outflows, as per data from Farside Investors.

Bitcoin is down significantly from its all-time high of $108,000 which was achieved earlier this week. As of early Friday, the world's first digital cryptocurrency is trading at around $95,000.