Formerly known as WeightWatchers, WW International (WW) has been in the spotlight over the past few days.

That’s mostly as the shares rallied 79% in Tuesday’s trading session.

That rally came despite the volatility and selling pressure in the overall market due to worries about the Fed increasing interest rates faster than expected.

Don't Miss: Meta Has Been the Best FAANG Performer in '23; Where From Here?

The rally also followed the company's report of its fourth-quarter results, which missed earnings and revenue expectations. Sales fell more than 18% year over year. First-quarter guidance also came in light.

The company did beat analysts’ expectations for subscribers (coming in at 3.5 million vs. estimates for 3.4 million).

None of this, of course, was the driver for the stock’s rally.

Instead, it was WW International’s acquisition of Sequence, “a subscription telehealth platform offering access to health-care providers specializing in chronic weight management.”

Trading WW International Stock

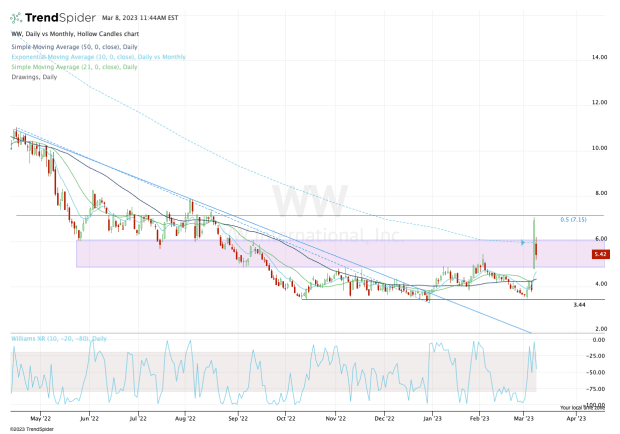

Chart courtesy of TrendSpider.com

If we look at the daily chart above, traders will notice that WW International stock is at a key area. While the $5 to $6 range is wide, it's also critical.

This zone was support in the second and third quarters of 2022, but resistance in the fourth quarter, as well as resistance so far in the first quarter.

After the stock’s strong close on Tuesday, WW International stock looked as if it was going to break out and clear this zone. It also hurdled the 10-month and 50-week moving averages in the process.

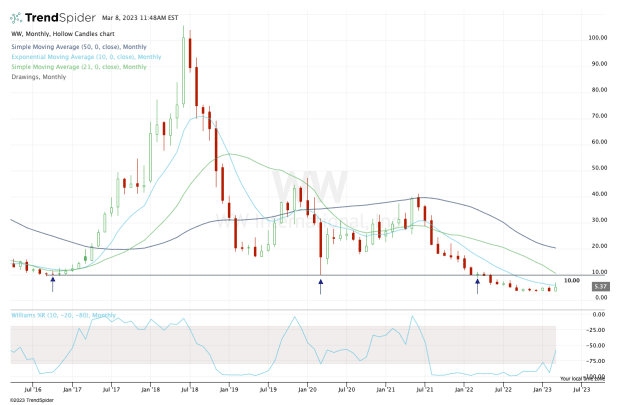

That would have set the stage for a potential return back to the $10 area, which, as you can see on the monthly chart below, has been a critical level over the years.

Chart courtesy of TrendSpider.com

The shares are pulling back on Wednesday, down about 24% at last check. The move has WW International stock failing at the $6 level and being rejected by the 10-month moving average.

Ideally, the bulls will see the stock hold the $5 level and the 10-day moving average. On a true breakdown, $3.50 is ultimately support.

If it can hold up over $5, though, $6-plus stays in play. If the shares can clear that area, then the recent high and 50% retracement are in play near $7 to $7.20.

A close above $7.25 would technically open the door up toward $10, but it will take some serious momentum to get WW International stock there.