Americans' long battle with weight has resulted in an endless stream of weight-loss strategies, including fad diets, that have proven ineffective long term. The result is an increasingly more significant number of people at risk of health complications resulting from obesity, including type 2 diabetes.

Three-quarters of the U.S. population is considered obese or overweight, 37 million have type-2 diabetes, and 96 million Americans have prediabetes.

The cost associated with obesity isn’t just deteriorating health. According to the Centers for Disease Control and Prevention, obesity costs the U.S. healthcare system over $173 billion annually.

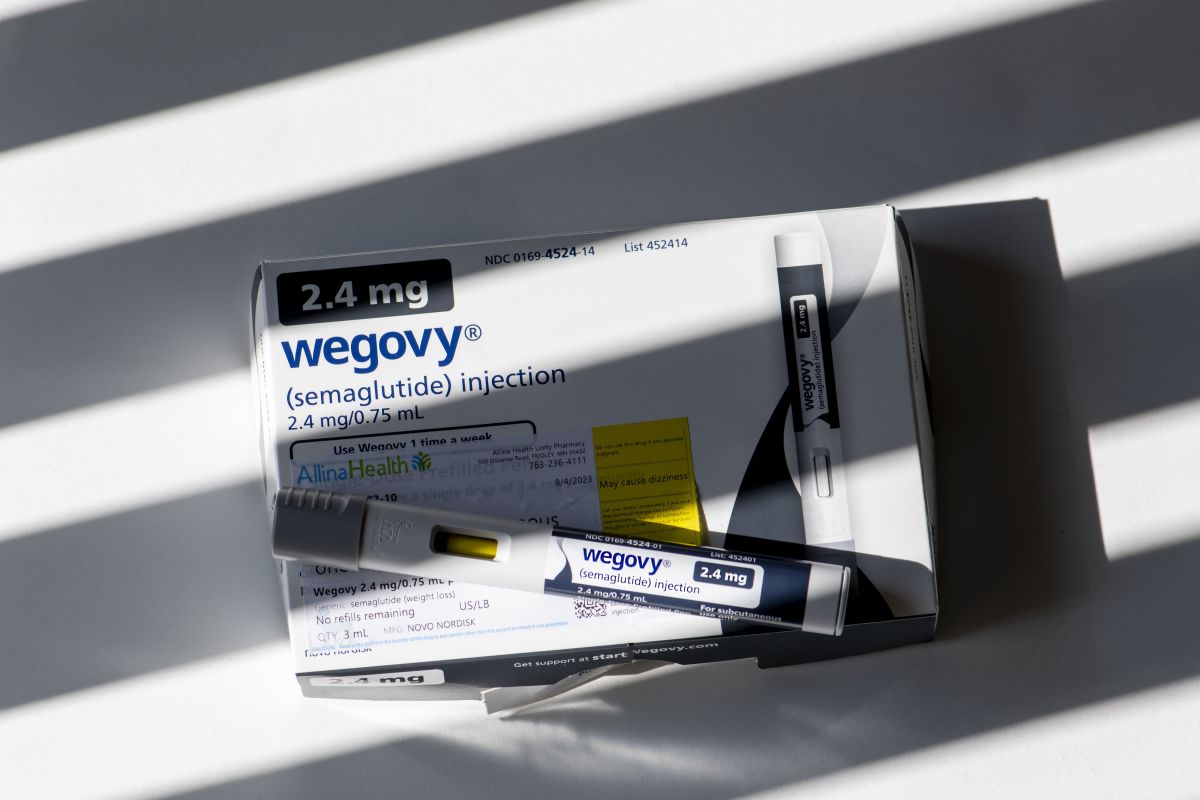

Fortunately, emerging weight loss medicines, including Novo Nordisk’s (NVO) -) Wegovy, which is also sold as the diabetes drug Ozempic, are providing a new weapon in the battle against obesity.

These drugs are so effective that there’s been a flurry of interest in them, but it’s not just drugmakers that will benefit from soaring sales. Another company with a long record of helping people manage their weight also stands to profit.

Obesity faces a new enemy

Doctors evaluate healthy weight using the body mass index (BMI), which measures body fat in adults by dividing weight by height.

Generally, a healthy weight is a BMI between 18.5 and 25. A BMI between 25 to 30 is considered overweight, while a person with a BMI above 30 is considered obese.

Studies have shown that higher BMIs are associated with a higher risk of adverse outcomes, including diabetes and cardiovascular disease.

Related: Viral Weight Loss Drugs Like Ozempic and Wegovy Sell For $10,000. Here's Why.

Excess weight also puts people at greater risk of severe COVID-19 complications.

The relationship between weight and health makes controlling weight important. However, it’s easier said than done for most people because weight programs can be complex or overly restrictive.

As a result, people often experience yo-yo dieting. They lose weight by adhering to diet plans, such as keto or paleo, blood type, or Atkins diets, only to regain weight after stopping.

Since diet programs fall short for many, doctors have relied on other long-term solutions, such as bariatric surgery, for those with health complications. These surgeries, which reshape the digestive system, are effective but costly and potentially risky.

Clearly, there’s a significant need for other weight loss alternatives.

The Food and Drug Administration approved Ozempic to lower blood sugar in type 2 diabetics in 2017, and it approved a higher dose formulation of Ozempic to be sold as Wegovy in 2021.

Eli Lilly’s (LLY) -) Mounjaro has a mechanism of action similar to Ozempic/Wegovy. It’s approved for use in type 2 patients, and a decision on its use to treat obesity is expected later this year.

The rapid adoption of these weight loss drugs is based on compelling efficacy and safety. For example, Wegovy reduced weight by 15% after 68 weeks, with manageable side effects in clinical trials. One in three patients lost over 20% of their weight on the drug in the trial.

Mid-stage trial results released earlier this year showed Mounjaro lowered weight by an average of 26% after 88 weeks.

With results like that, it’s easy to understand why sales of these drugs are surging.

Novo Nordisk reported Wegovy sales of $1.1 billion in the second quarter. Management said demand has been so strong that it is limiting the production of lower doses of the drug that are used when new patients begin treatment to ensure supply for existing patients.

Mounjaro sales were $980 million in the quarter, resulting in total sales of $1.5 billion through the first six months of the year, and that’s without the official FDA stamp of approval for use in obesity.

A surprising beneficiary of weight loss drugs emerges

One weight loss pioneer is going all in on the shift towards prescribing weight loss drugs like Wegovy.

Best known for assigning specific foods a certain number of points and recommending members stick to a maximum daily point allowance, Weight Watchers (WW) -) is repositioning itself as a weight loss healthcare provider.

To limit the risk that its core membership business may decline as more people turn to weight loss drugs, the company, which is now called WW International, acquired telehealth provider Sequence earlier this year for $106 million.

The move instantly propels Weight Watchers into the prescriber role, allowing it to counsel and recommend weight loss drugs to patients like a primary care provider.

The decision to embrace weight loss drugs marked a turn for at least one member of WW’s board.

Oprah Winfrey previously characterized weight loss drugs like Wegovy as “an easy way out.” Now, Winfrey says these drugs are an essential tool for weight loss.

It remains to be seen precisely how profitable prescribing weight loss drugs will be for WW, but Wall Street is optimistic.

Analysts expect revenue to increase to $984 million next year from $901 million this year, and earnings will grow to $0.46 per share from a loss of 14 cents per share in 2023.

Winfrey also appears impressed by the company’s prospects. She owns 1.1 million WW International shares, according to SEC filings.

Sign up to find out what stocks we're buying now (Weight Watchers isn't one of them!)