The Finance Minister, Nirmala Sitaraman, said recently that India’s long-term growth prospects are embedded in public capital expenditure programmes. She added that an increase in public investment would crowd in (or pull in) private investment, thus reviving the economy. The Minister was speaking at the third G20 Finance Ministers and Central Bank Governors (FMCBG) meeting hosted by Indonesia in Bali.

Lag in investment

Public investment-led economic growth has a respectable academic pedigree, and forms a credible strand of explanation for India’s post-Independence economic growth. Here is an illustration. When it was faced with a slow-down after the Asian financial crisis of 1997, the Atal Bihari Vajpayee led-National Democratic Alliance government initiated public road building projects. In the form of the Golden Quadrilateral (to link metro cities using a high-quality road network) and the Pradhan Mantri Gram Sadak Yojana (to ‘provide good all-weather road connectivity to unconnected habitations’), these initiatives sowed the seeds of economic revival, culminating in an investment and export-led boom in the 2000s; GDP grew at 8%-9% annually.

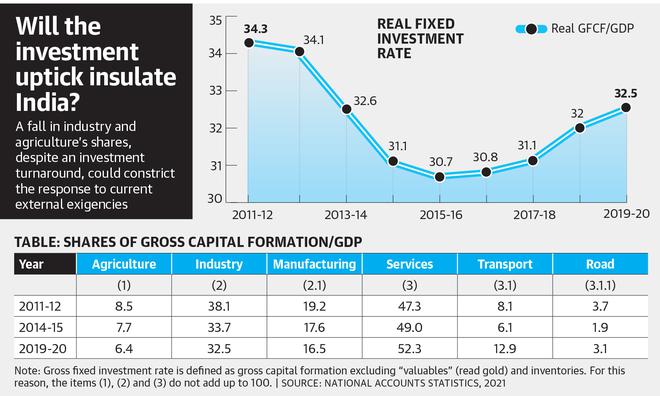

In comparison, the investment record during the 2010s has been dismal. However, a recent uptick is evident in the real gross fixed capital formation (GFCF) rate — the fixed investment to GDP ratio (net of inflation). The ratio recovered to 32.5% in 2019-20 from a low of 30.7% in 2015-16 (figure).

Ms. Sitaraman has claimed that the Government sustained the investment tempo even during the novel coronavirus pandemic (2020-21 and 2021-22). As in the June edition of the Ministry of Finance’s Monthly Economic Review, the fixed investment to GDP ratio was 32% in 2021-22. However, there is need for caution in reading the most recent data, as they are subject to revision. Moreover, the budgetary definition of investment refers to financial investments (which include purchase of existing financial assets, or loans offered to States) and not just capital formation representing an expansion of the productive potential.

On gross capital formation

The National Accounts Statistics provides disaggregation of gross capital formation (GCF) by sectors, type of assets and modes of financing; over 90% of GCF consists of fixed investments. The upturn in the investment rate is welcome, though its productive potential depends on its composition. Contrary to Ms. Sitaraman’s contention, the investment distribution has hardly changed over the last decade, with the public sector’s share remaining 20%.

The table shows the distribution of GCF by agriculture, industry and services (columns 1 to 3); within services transport (column 3.1) and within transport, roads (the single largest expenditure item; column 3.1.1).

Between 2014-15 and 2019-20, the shares of agriculture and industry in fixed capital formation/GDP fell from 7.7% and 33.7% to 6.4% and 32.5%, respectively. Services’ share rose to 52.3% in 2019-20 compared to 49% in 2014-15. The rise in the services sector is almost entirely on transport and communications. The share of transport has doubled from 6.1% to 12.9% during the same period. Within transportation, it is mostly roads.

As roads and communications are classic public goods, investment in them is welcome. But over-emphasising it may be lop-sided. For healthy domestic output growth, there is a need for balance between “directly productive investments” (in farms and factories) and infrastructure investments. And this balance was missed. Moreover, the share of agriculture and industry shrank even as the economy’s gross capital formation rate trended downwards (see figure).

Import dependence grew

The case of manufacturing is distressing. Its share in the investment ratio (column 2.1) fell from 19.2% in 2011-12 to 16.5% in 2019-20. It is not surprising that ‘Make in India’ failed to take off, import dependence went up, and India became deindustrialised. Import dependence on China is alarming for critical materials such as fertilizers, bulk drugs (active pharmaceutical ingredients or APIs) and capital goods. This became acute during the COVID-19 pandemic, as China imposed export restrictions — prompting the Prime Minister to announce the ‘Atmanirbhar Bharat’ campaign.

Instead of boosting investment and domestic technological capabilities, the ‘Make in India’ campaign frittered away time and resources to raise India’s rank in the World Bank’s (questionable and contested) Ease of Doing Business Index. India’s position did go up, from 142 in 2014 to 63 in 2019, but it failed to boost industrial investment, let alone foreign investment.

The contribution of foreign capital to financing GCF fell to 2.5% in 2019-20 from 3.8% in 2014-15 (or 11.1% in 2011-12). With declining investment share, industrial output growth rate fell from 13.1% in 2015-16 to a negative 2.4% in 2019-20, as per the National Accounts Statistics.

Public investment

The Finance Minister has claimed that public investment is the pivot of the ongoing investment-led economic revival. The recent upturn in the aggregate fixed capital formation to GDP ratio is positive, though the rate is still lower than its mark in the early 2010s. The claim that the investment revival is public sector driven is not borne out by facts. The jury may still be out on the suggested rise in public investment during the COVID-19 pandemic. The budgetary figures refer to financial investment, not estimates of capital formation, indicating expansion of the economy’s productive capacity.

During the 2010s, the investment shares of agriculture and industry fell but rose sharply in services. The percentage share for roads has doubled. The expansion of roads and communications is surely welcome. Considering such a skewed investment priority, the ‘Make in India’ strategy failed to take off, accentuating India’s import dependence, especially on China, leading to deindustrialisation.

The lack of domestic capacity for essential raw industrial materials and capital goods could prove costly. It will likely test India’s ability to withstand external economic challenges. With a depreciating currency and rising (imported) inflation, prospects of sustaining investment recovery are likely to get harder. The deficit on balance of payment is already well above policy makers’ comfort level of 2.5% of GDP.

R. Nagaraj is with the Centre for Development Studies, Thiruvananthapuram. The views expressed are personal