The Tax Cuts and Jobs Act appeared to eliminate the so-called marriage tax penalty by making the tax brackets exactly double for taxpayers in all brackets except for the highest. However, there are areas of the tax code where the marriage penalty still exists, especially when there is a large disparity in income.

Assuming a committed relationship, a case can be made for remaining unmarried while still partaking in many things often thought to be reserved for married people such as buying a home together and starting a family. Of course, both partners must be comfortable with the risk of the relationship ending without the legal protection of divorce proceedings.

TurboTax Live experts look out for you. Expert help your way: get help as you go, or hand your taxes off. You can talk live to tax experts online for unlimited answers and advice OR, have a dedicated tax expert do your taxes for you, so you can be confident in your tax return. Enjoy up to an additional $20 off when you get started with TurboTax Live.

Here are four ways that skipping the altar in favor of a committed cohabiting partnership may save money on taxes as a couple:

- Roth IRA contributions: The income limits for Roth IRA contributions still reflect a marriage penalty – the limit for married filing joint taxpayers is substantially lowered compared to doubling the limit for single taxpayers. Many couples actively funding Roth IRAs are surprised to learn that they no longer qualify at tax time the year after getting married, resulting in possible penalties.

- SALT deduction: For taxpayers who itemize, the $10,000 limit on state and local taxes is the same whether married or single. For unmarried couples with a joint mortgage, filing as two single taxpayers essentially doubles the SALT limit, which allows for a higher deduction assuming both partners itemize.

- Student loan interest deduction: Sometimes getting married gives a higher earner the ability to deduct student loan interest when they’d otherwise lose it due to income limits, but if a lower earner with loans would lose their deduction due to the other partner’s income taking them over the combined limit, it can make sense to postpone the wedding until the loans are paid off or the deduction is no longer material.

- Child tax credits: For unmarried couples with children, child and dependent care credits could be higher assuming one of the parents would qualify for the full amount due to a lower income when a combined income would lower or eliminate the credit. This requires the lower-income parent to pay the costs of care and claim the child as their dependent but could net a lower overall tax bill.

It bears mentioning that forgoing marriage eliminates other tax and legal benefits such as the ability to transfer unlimited assets to a spouse as well as spousal Social Security benefits, but no one says you can’t make it legal later in life (although watch out for Social Security taxation limits!).

Once the kids are grown, student loans are paid off, retirement savings are intact and perhaps the house is paid off, it can make sense to get married at that point to ensure your partner benefits from a higher Social Security check and the ability to do some asset transfers for estate planning purposes.

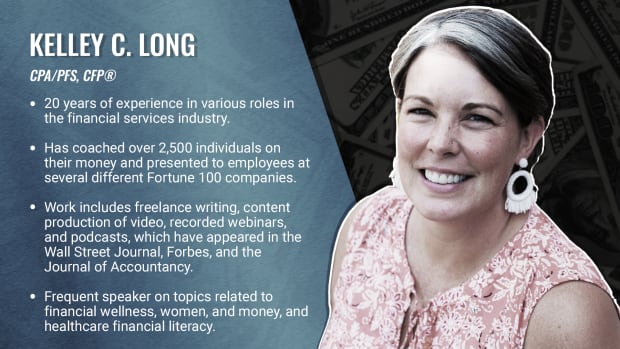

Panelist Bio| More About Our Tax Expert, Kelley C. Long

Read more from our partners at TurboTax:

- Should You and Your Spouse File Taxes Jointly or Separately?

- When Married Filing Separately Will Save You Taxes

- How Changes in Your Life Can Save You Money

- 7 Tax Advantages of Getting Married

Editor’s Note: Reviewed for tax accuracy by a TurboTax CPA expert.