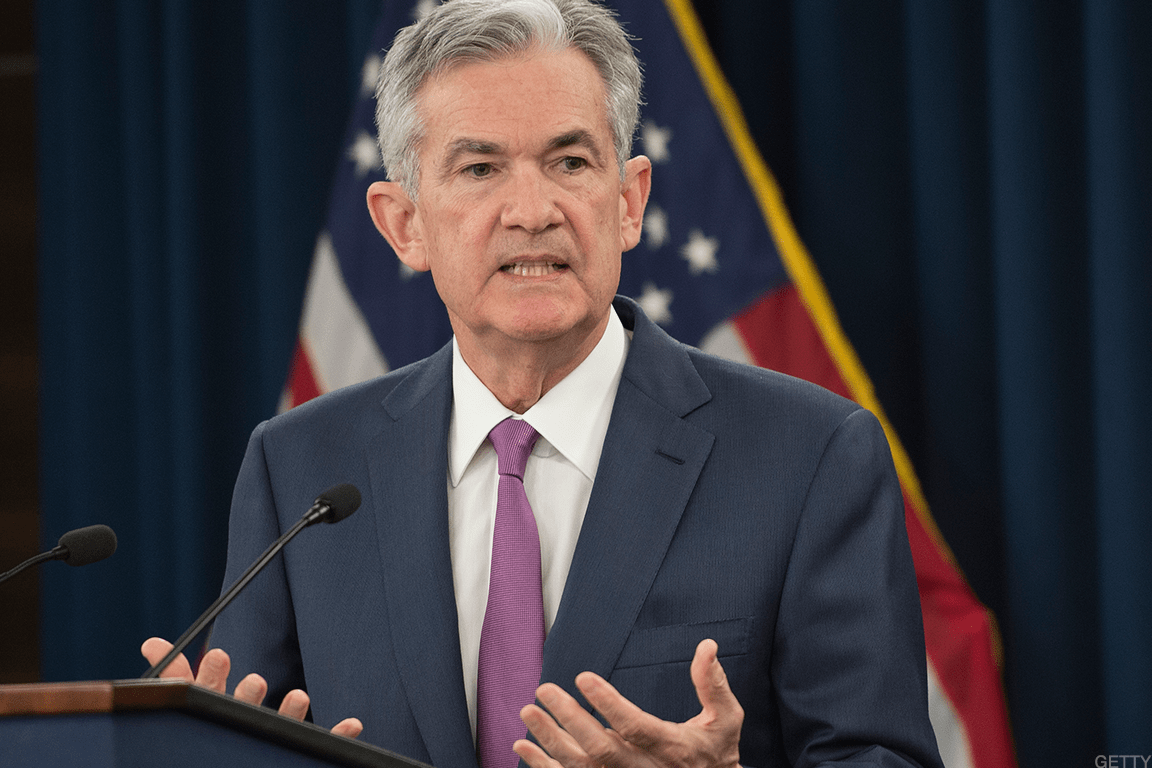

Federal Reserve policymakers are set to wrap up their meeting today, with an official interest rate decision due out at 2:00 PM ET, followed by a press conference from Fed Chair Jerome Powell. Catch everything Powell has to say in the video below.

Stick around after Powell as TheStreet's J.D. Durkin and CMT chief global strategist Jay Woods break down what it all means for your portfolio.

The Fed is widely expected to hit pause on its rate hike campaign, especially after the consumer price index came in as expected with headline inflation estimated to have risen 4% in the month of May.

If the central bank does hold rates steady, it would mark a major change for the Fed who has raised interest rates 10 times since last year in a concentrated effort to tame inflation. This is the fastest pace the Federal Reserve has tightened monetary policy since the early 1980s.

But what has been touted as a ‘pause’ by most major economists, may just be a skip. Rather than pausing their rate hiking campaign altogether, the Fed may continue to raise its benchmark rate – just not now. The extra time would give policymakers extra time to assess how higher borrowing rates are impacting the economy at large.

Minutes from the Federal Reserve’s May meeting show that officials are mostly split, with some noting that there is more work to do to rein in inflation, while others believe their work is done. The Federal Open Market Committee, who makes the rate decisions, also voted to remove a key phrase from its post-meeting statement that had indicated "additional policy firming may be appropriate."