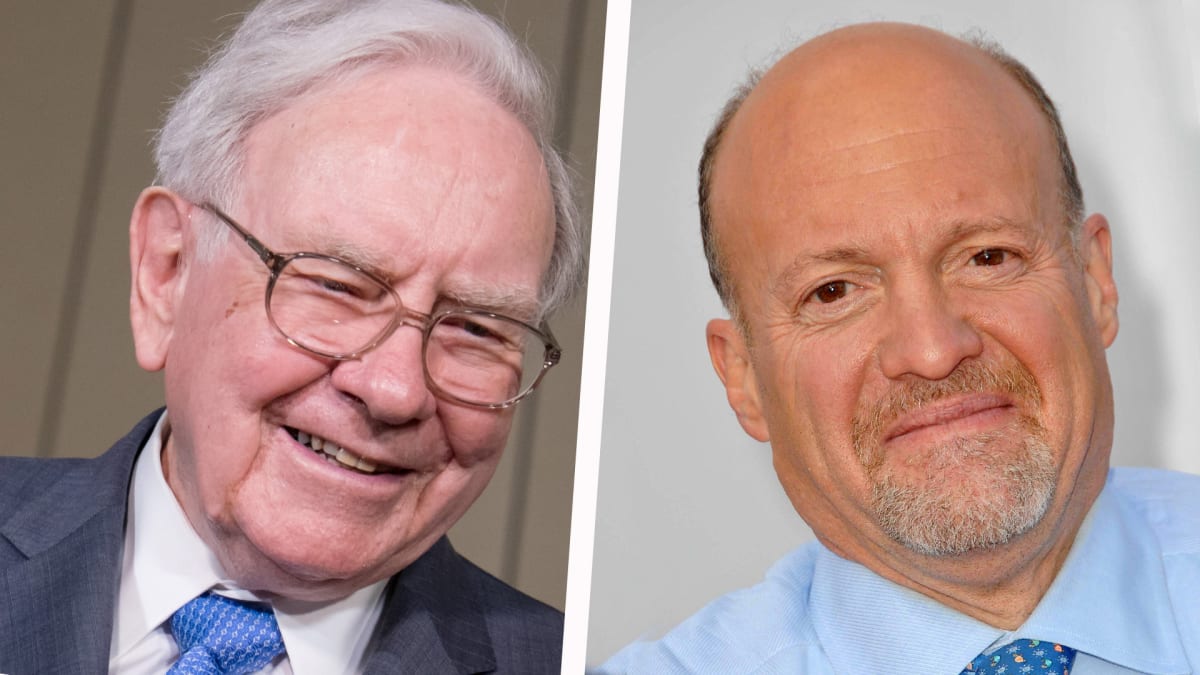

Don't trust Jim Cramer's investment advice? Well, maybe you'd rather listen to Warren Buffett.

Cramer's stock picking acumen has been severely called into question in recent months as multiple banks he was previously bullish on have succumbed to a regional banking crisis.

DON'T MISS: Warren Buffett's Warnings, Actions Send Shockwaves Through Financial Markets

But now Cramer is getting backup on one of his banking picks from one of Wall Street's most trusted investors.

Capital One (COF) has been a Cramer approved stock pick, but now Warren Buffett and Berkshire Hathaway (BRK.B) have made it legitimate.

The bank, which is mostly focused on credit cards, closed Monday's session up more than 3% and was up another 6.5% in premarket trading Tuesday after Berkshire disclosed a 9.92 million share stake in the company.

The estimated $954 million stake in Capital One came at the expense of two other Berkshire bank holdings, Bank of New York Mellon (BK) and U.S. Bancorp (USB).

Berkshire sold $1.4 billion of its remaining holdings in the two banks, according to regulatory filings.

The purchase may be a signal that Buffett and the team at Berkshire are bullish on the American consumer and their use of credit cards at a time of high inflation and economic uncertainty.

Capital One says it is the third largest issuer of Visa and Mastercard credit cards in the U.S.

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.