Scammers pretending to work for online bank Monzo tricked a young professional into handing them her bank cards before stealing her life savings of more than £6,500.

Earlier this month, Linjing Peng, a 31-year-old designer who lives in Seven Sisters, north London, spent hours on the phone with a scammer posing as a member of Monzo’s fraud and security team claiming he wanted to help her evade a “group of hackers”.

The fraudster warned Linjing they had detected unauthorised payments on her account, which proved to be true and in turn helped gain her trust.

He proceeded to explain she needed to act quickly as her phone had been compromised and hackers would be able to access all of personal information including photos and social media accounts.

“Terrified”, Linjing followed his instructions, even handing over bank cards to a courier which arrived by car to her workplace under the pretext that they were required as evidence to arrest the hackers.

After being bombarded with alleged “security questions”, she was tricked into taking out an overdraft and revealing her Pin before the scammer hung up the phone and cleared her account.

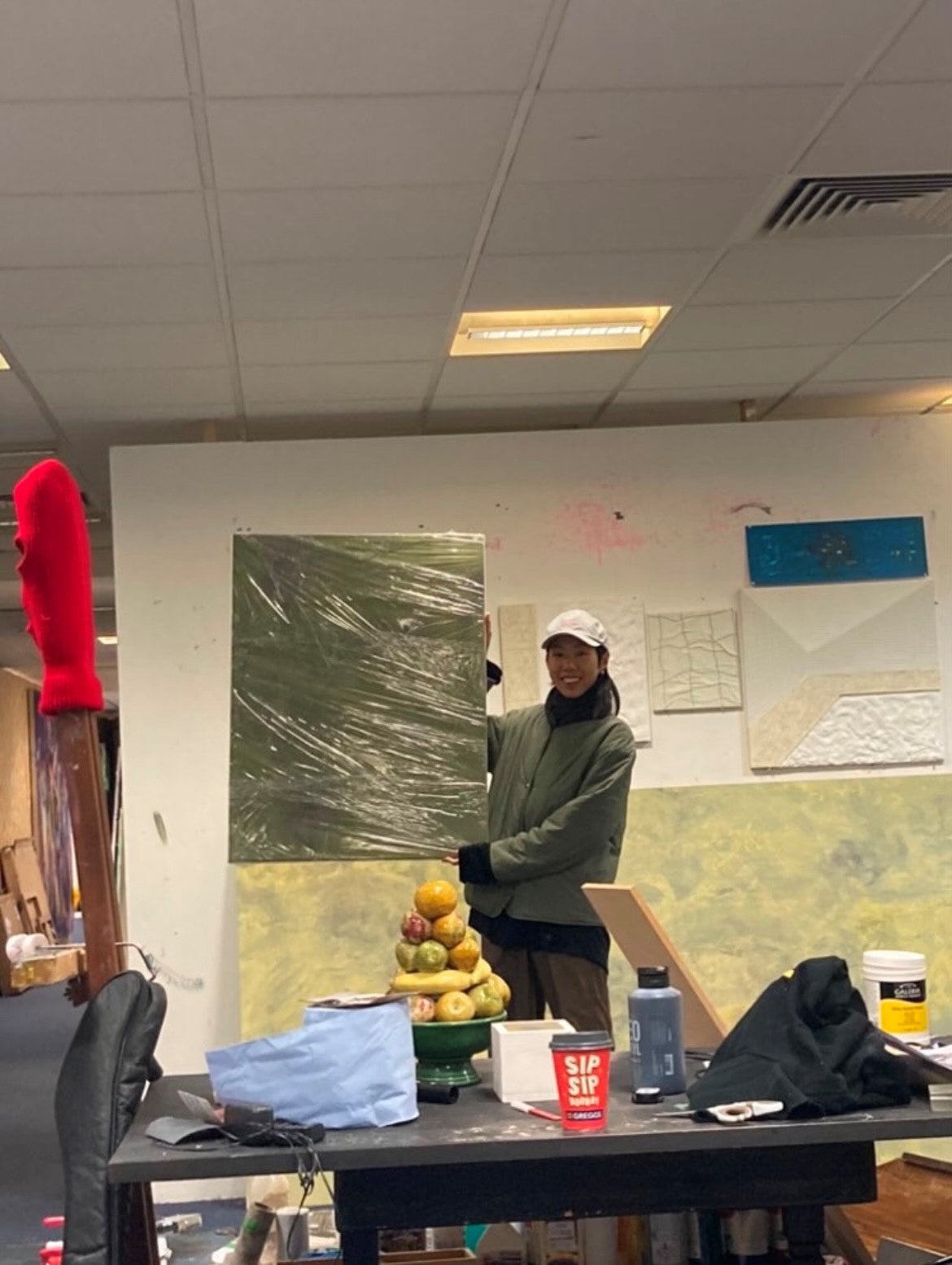

Linjing, who has lived in the UK for more than 12 years, has reported the incident to police and launched a GoFundMe to recoup some of her £6,530 loss – but she remains traumatised by the elaborate digital heist.

“I think it actually gave me PTSD because I had nightmares for three days in a row, every night,” Linjing, who is originally from China, told PA Real Life.

“It’s starting to get better, but the first week was really tough.

“He had a very well-educated, British accent – like someone you hear on the news.

“He was very gentle and polite, saying things like ‘I appreciate your concern, we are here to help’.”

On November 9, Linjing was heading to her studio in Bethnal Green when she received a phone call from someone claiming to be Monzo’s fraud and security team, who warned her they had detected suspicious activity on her account.

Linjing checked her Monzo account and indeed she saw £112 worth of unauthorised charges.

“From that moment on, I believed that person was legitimately calling from my bank,” she said.

“They said we have reason to believe your account details have been stolen.”

The scammer proceeded to explain they had identified a group of hackers operating around Liverpool and were working with police to stop them.

He warned Linjing the hackers had almost certainly cloned her phone, therefore it was important she change all of her passwords as soon as possible.

“He said they have access to my iCloud, Gmail, social media accounts… all my photos and contacts and could target my family and friends,” explained Linjing.

“Hearing that, I was terrified, because I have so much private stuff on my phone.

“At that moment, I stopped suspecting anything and really believed that person was trying to help me.”

Next, the swindler explained he needed to ask Linjing a few security questions, including whether she had any other banking apps on her phone.

“It might be that one of your other accounts has been jeopardised he told me,” said Linjing who revealed she also had a Lloyds banking app.

“They asked me to confirm my balance in my current and savings accounts.”

Linjing had around £300 in her Monzo accounts and £3,500 in her Lloyds savings account.

After reaching her studio, the scammer stayed on the phone while Linjing proceeded to change all of her passwords.

“At the same time he was asking me all these questions about my cards,” she said.

“This went on for a very long time.”

He then asked whether she wished to press charges and was willing to provide evidence. Linjing readily agreed.

“He said you will need to submit all your cards as evidence – that’s the physical evidence we need to prosecute them,” explained Linjing.

After pretending to speak with his supervisor, the scammer explained they would pay for a courier to collect the cards.

A car pulled up outside the studio a few minutes later and Linjing handed over her bank cards.

“Just talking about it, I realise how silly it sounds… but he sounded very trusting,” she said.

“I now suspect they just ordered an Uber, because the driver was using his phone.”

The scammer then encouraged Linjing to transfer any savings to her Monzo account, claiming it was “safer” being in an “internet bank”.

“He said this will keep your money safe until we are able to secure your phone,” continued Linjing.

He then created a sense of urgency, warning Linjing the hackers were attempting to take out a £20,000 loan.

The only way to stop them, the scammer said, was for Linjing to cancel the application herself.

“I don’t really know how the banking system works. I thought it made sense, so I followed,” she said through tears.

“They were telling what buttons to click and I followed their steps.”

The scammer managed to trick Linjing into actually applying for a £20,000 loan and £500 overdraft.

Fortunately, the former was refused, but this has now damaged Linjing’s credit score.

The final blow was convincing Linjing to share her Pin.

“He explained they needed my pin number in order to secure my account, otherwise they wouldn’t be able to help me,” she said.

“I even received a text message with a verification number that looked exactly like the ones I normally get from Monzo.”

He then asked Linjing to delete and re-install the Monzo app which he claimed had been updated.

By the time she logged back in, her accounts had been cleared and her overdraft maxed out.

“I tried calling back but there was no answer,” she said.

In total Linjing lost £6,530, money which she needed to pay rent on her flat and studio.

She later learned her funds had been withdrawn or spent at Westfield in Stratford, east London, including £3,000 at an Apple store.

A few days later she received another phone call from someone claiming to be part of Monzo’s fraud and security team.

But this time she did not fall for it and started “shouting down the phone”.

Linjing has since reported the scam to police, as well as Monzo and Lloyds Bank.

She also launched a fundraiser on GoFundMe to help recoup her loses, which has so far received £850 in donations.

To support Linjing visit: https://www.gofundme.com/f/help-lj-recover-from-a-devastating-phone-scam

Last year, Monzo launched a “call status” tool that lets customers verify whether Monzo is phoning them or if fraudsters are trying to scam them.

If the customer’s call status shows that Monzo is not on the phone, they are told to hang up straight away.

A Lloyds spokesperson said: “We have a great deal of sympathy for Ms Peng as the victim of an impersonation scam.

“As no money was lost directly to fraudsters from her Lloyds account, we have advised she will need to contact Monzo to raise the scam claim.

“It’s important to remember that your bank, the police nor any genuine organisation or company will ever ask you to move money to keep it safe.

“If you’re ever in doubt, hang up and call back on a number you trust.”

A Monzo spokesperson said: “We’re sorry that this happened to our customer and can imagine how distressing it must have been.

“We are currently speaking to them to get the details here so we can investigate this case thoroughly.

“We are committed to fighting fraud at the source and have invested heavily in cutting-edge technology such as our call status tool which lets customers know in the app if they’re really talking to Monzo.

“We urge all customers to remain vigilant and end the conversation if something doesn’t feel right.”