Walmart (WMT) shares are down about 8% in Tuesday's session after the latest disappointing announcement from the retail giant.

After the close on Monday, Walmart said it cut its second-quarter and full-year guidance, explaining that “increasing levels of food and fuel inflation are affecting how customers spend.” Further, currency headwinds are hurting profit.

The news clearly took investors off guard; Walmart wasn’t expected to report earnings until mid-August.

Investors are viewing the update as a shock, especially after the stock’s performance last quarter.

In mid-May, Walmart stock fell almost 20% in a three-day span following a worse-than-expected earnings report. It didn’t help that Target (TGT) also reported concerning results as well.

Despite the Q2 and full-year reduction in profit expectations, though, it’s interesting that the stock isn’t making new lows. Is it possible that it’s carving out a low?

Trading Walmart Stock

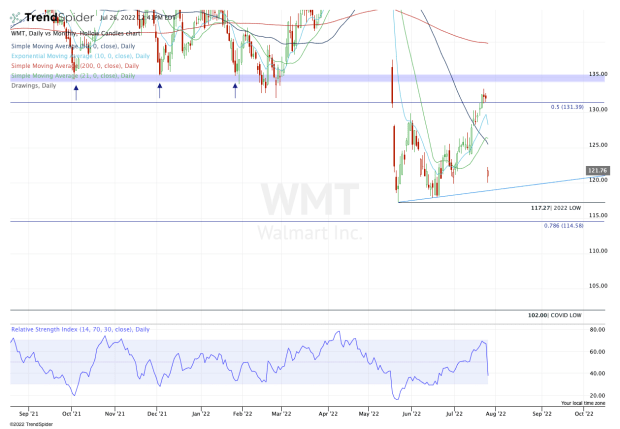

Chart courtesy of TrendSpider.com

Walmart stock traded down to about $120 this morning and is now bouncing. With the news, today’s gap-down below all its major daily moving averages comes as little surprise.

But if Walmart can hold uptrend support (blue line) and avoid making new 2022 lows below $117.27, then the bulls may have something to work with.

That’s especially true if the shares can reclaim $125 to $127 and, in doing so, reclaim the 21-day and 50-day moving averages.

Even if that takes some time, I think that if Walmart can avoid taking out the lows — either the June low at $117.90 or the 2022 low — it’s very constructive action for the bulls.

If the stock does break the June low and then the 2022 low, that opens the door to the 78.6% retracement from the all-time high down to the March 2020 low. That comes into play near $114.50.

Below that and it’s possible that the covid-19 lows could eventually be in play at $102 -- although it would likely take continued market weakness to get there.

On the upside, a move back above the 21-day and 50-day moving averages puts $130 in play, then the gap-fill near $131.50.

Notably, WMT shares earlier this month topped out just under prior long-term support. That’s bearish price action and Monday evening’s news accelerated that rejection.