Shares of Walmart (WMT) started out under pressure, off about 3%, on Tuesday, the first session of a holiday-shortened trading week.

The move followed disappointing guidance and some worrisome comments from management.

At last check, however, the giant retailer's shares were up about 0.6% as the bulls bought the dip. The stock’s been outperforming; the overall market is under notable selling pressure.

The retailer delivered a top- and bottom-line beat for its most recent quarter, but its earnings outlook for the current quarter was a bit below consensus expectations, as was its full-year revenue outlook.

Further, management’s comments on higher-than-expected food inflation didn't help sentiment.

Trading Walmart Stock on Earnings

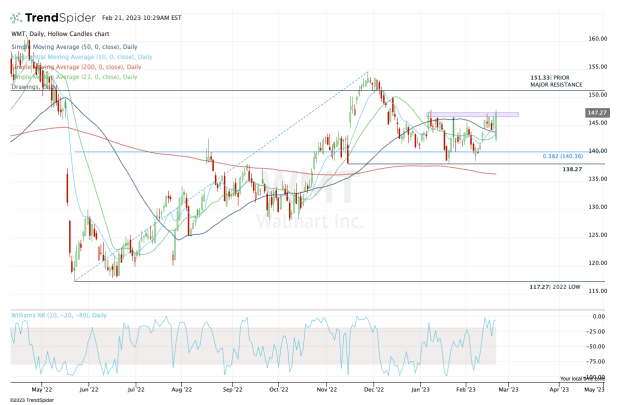

Chart courtesy of TrendSpider.com

Recent support has come into play from the $138 to $140 area, where the 38.2% retracement also sits. The shares appeared to be heading into this area early on.

This morning’s open put Walmart stock below the 10-day, 21-day and 50-day moving averages. But the ensuing rally has put the stock back above all three measures, while it also remains over the 200-day moving average.

The shares are currently trying to clear the $147 to $148 resistance area, which has kept Walmart stock in check all year long.

If it can break above this level, the $150 to $151 area is in play, followed by the fourth-quarter high near $155.

In that sense, the upside roadmap is straightforward. The downside layout is a little bumpier.

The post-earnings low of $142.15 is key. If Walmart breaks below this level, it opens the stock to a test of the aforementioned $138 to $140 support zone.

Below that puts the 200-day moving average in play, followed by the 61.8% retracement near $131.50, then the $128 to $129 area, which was key support in September and October.

Walmart is a high-grade retail stock, and while its guidance was not stellar, the price action has been solid given the selling in the overall market.

That said, traders should not be complacent if it fails to hold support.