Walmart (WMT) stock is mixed on Thursday, up less than 1% at last glance despite the retailer reporting a first-quarter-earnings beat this morning.

Earnings grew 13% and revenue jumped 7.6% year over year. Both figures topped analysts’ expectations. The company’s revenue figure of $152.3 billion topped estimates by more than $4 billion.

Same-store sales growth of 7.4% breezed past consensus estimates of 5.25%, while guidance was mixed.

Specifically, management’s second-quarter-earnings outlook was just a bit below consensus estimates. But it gave a slight boost to the retailer's full-year outlook, the midpoint of which is fairly close to analysts’ expectations.

Don't Miss: Can AI Power Nvidia Stock to All-Time Highs?

Broadly, Walmart’s results are a breath of fresh air, particularly when we consider some of the disappointing comments from Target (TGT) and Home Depot (HD) earlier this week.

Was the quarter good enough to justify sending Walmart stock to new 52-week highs, which it almost touched today?

Trading Walmart Stock on Earnings

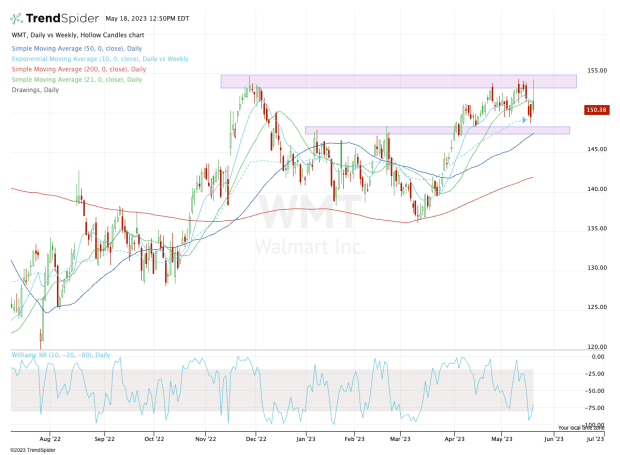

Chart courtesy of TrendSpider.com

Today’s action in Walmart stock is not helping traders very much. If the stock had been trading near or below $140 ahead of the print, it likely would have enjoyed a nice pop on the results.

But seeing as it’s stalling in the $154 to $155 zone, it’s hard to get too bullish without a breakout over this zone. The 52-week high sits up at $154.64, while this zone was resistance in both December and April.

In fact, if we zoom out to the weekly chart (as we did about a month ago), you’ll notice that this zone has been a key resistance point for quite some time.

So where to from here?

Don't Miss: Target Stock Has Slumped in '23. Does the Chart Signal a Turnaround?

The fundamentals matter but not so much when it comes to the chart. The market will decide if the results were good enough to trigger a move over $155 or if lower prices are in order.

If it’s the latter and Walmart stock dips, we’ll get a pretty good idea of whether buyers will want to support it or not.

The $147 to 148 area is key. This was prior resistance throughout the first quarter and then support last month. It’s also where the 10-week and 50-day moving averages come into play.

Below that and $145, then $142 become possible downside targets.

On the upside, a breakout over $155 could very well put the all-time high in play just over $160.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.