Last week, Wall Street began circulating their outlooks for the stock market in 2025.

For many folks, the key takeaway from these reports is the year-end price target.

As TKer subscribers know, I’m not crazy about taking these price targets too seriously. Sure, I keep an eye out for these targets (see here, here, and here). But I’m far more interested in the rigorous research behind these predictions. That’s because much of the underlying data and analysis that go into these calls is high quality and very insightful.

While it’s been the case their year-end price targets have been way off on the conservative side, strategists have actually nailed one important prediction: 2024 earnings.

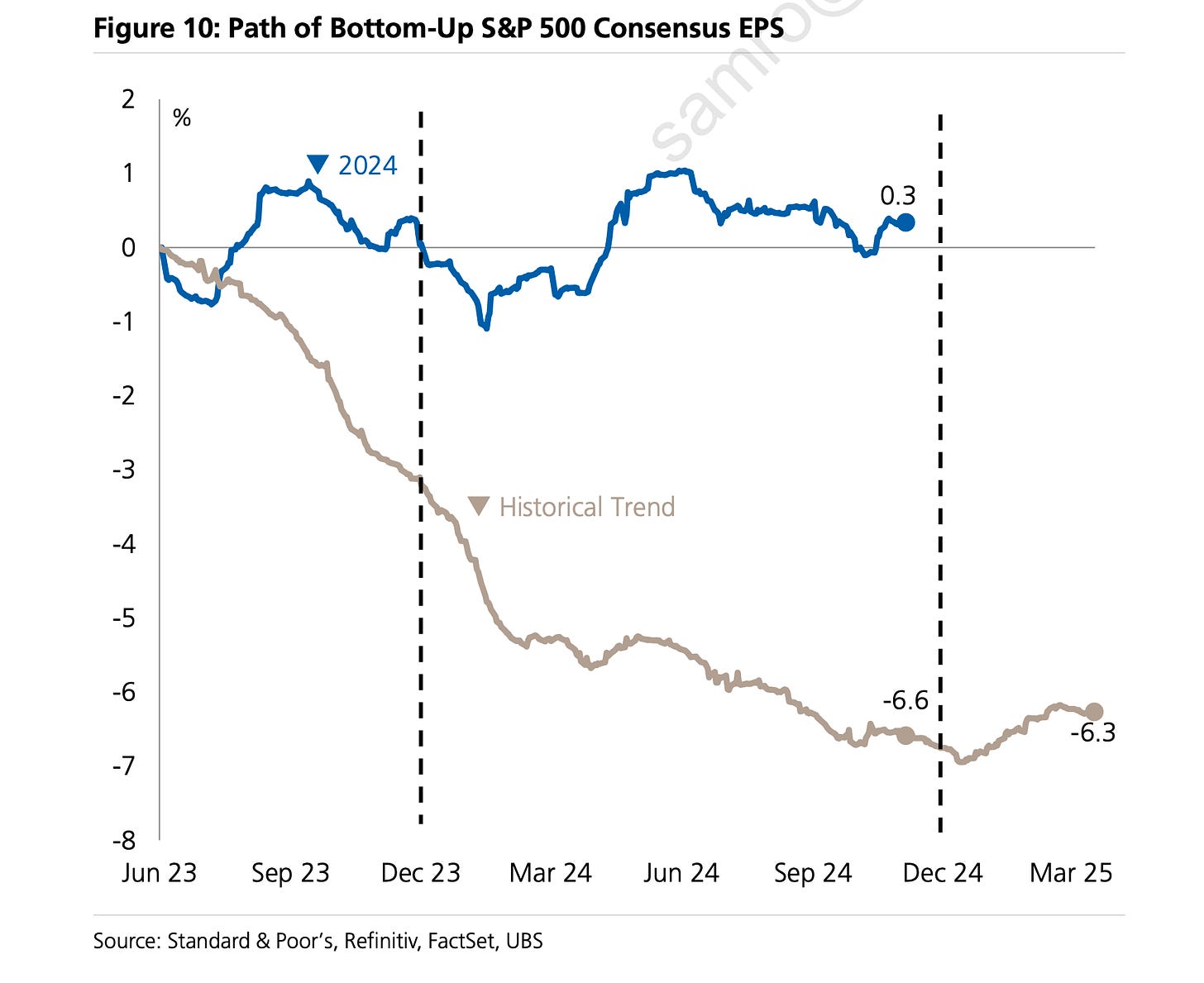

Historically, analysts’ annual S&P 500 EPS comes in significantly lower than initially forecast. Not in 2024. (Source: UBS)

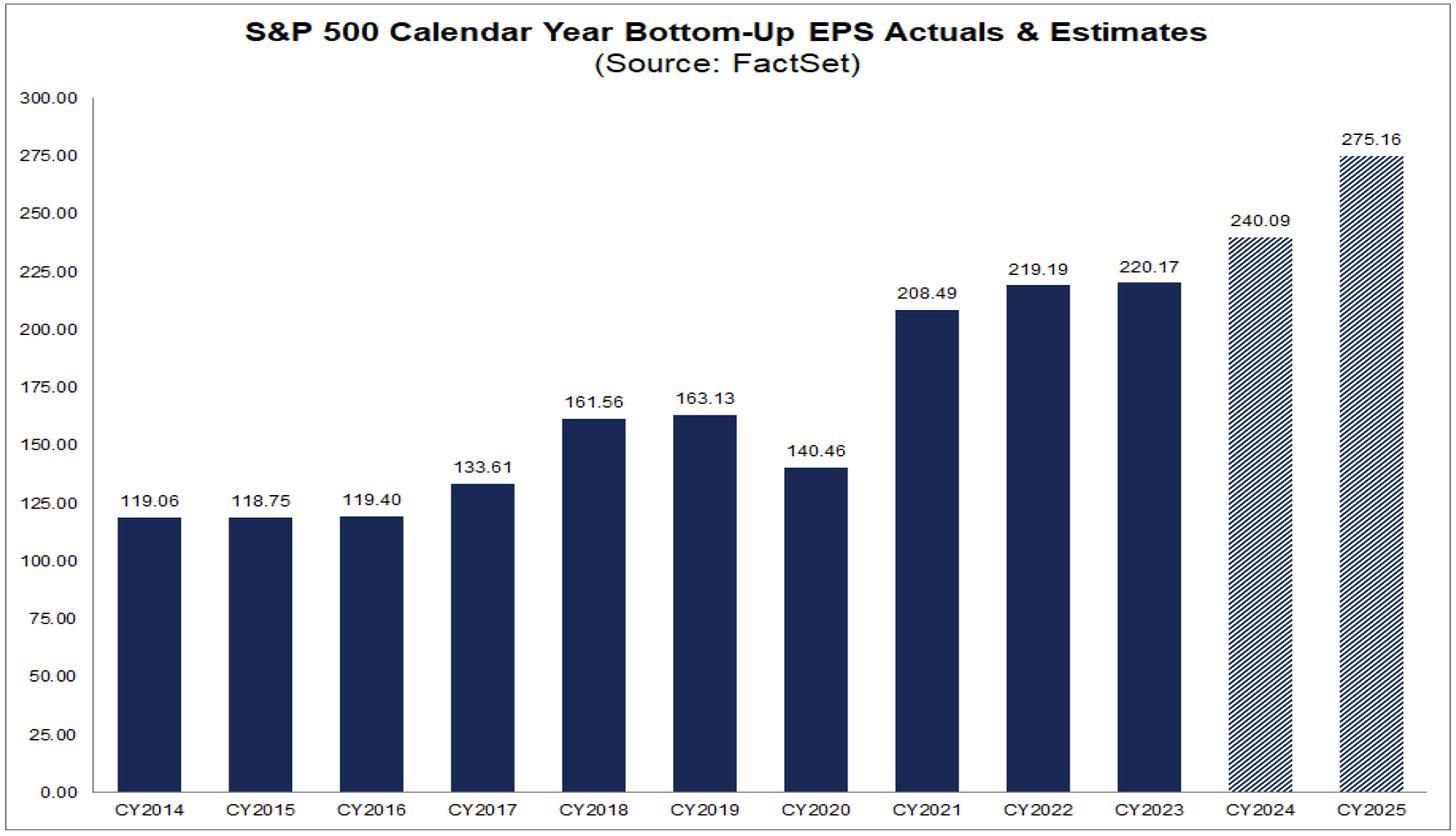

At the beginning of the year, strategists’ estimates for 2024 S&P 500 earnings per share (EPS) ranged from $225 to $250.

According to FactSet, after three quarters worth of reported earnings, 2024 EPS is on track to be $240. That is to say, the consensus midpoint EPS estimate has been off by what amounts to a rounding error.

“Wall Street analysts have been reasonably good at predicting forward year earnings over the last few years,” wrote Nicholas Colas, co-founder of DataTrek Research.

S&P 500 EPS is expected to have risen to $240 in 2024. (Source: FactSet)

How we’re getting these earnings might not be exactly how the strategists may have laid out a year ago. But they were right about major themes driving earnings growth like persistently high profit margins and looser Fed monetary policy.

If the earnings have been coming through, then why have strategists been so off with their price targets?

As we discussed in the May 24 TKer, assumptions about valuation multiples are where Wall Street’s calculations often go wrong.

At the beginning of the year, forward price/earnings (P/E) multiple was 19x. Many strategists believed that was high and there was little room for it to go higher. Some even expected it to come down.

Today, the forward P/E is about 22x. At first glance, the difference between 19x and 22x might not seem like much. But when you actually apply it to an EPS estimate, the range of S&P price scenarios can be wide. For example, here’s what the price scenarios look like assuming $275 EPS (which is what the consensus is expecting for 2025):

-

19x $275 EPS = 5,225

-

20x $275 EPS = 5,500

-

21x $275 EPS = 5,775

-

22x $275 EPS = 6,050

Differing assumptions about valuations are often why price target calculations vary, and inaccurate assumptions about valuations are why those targets almost always go wrong.

The Big Picture

For long-term investors in the stock market, I don’t think it’s a good use of energy to obsess over exactly where the stock market might be exactly one year from now — especially since no one has figured out how to do that accurately and consistently.

It is, however, much more helpful to be aware of the fundamentals driving earnings because earnings are the most important long-term driver of stock prices.

If the prospects for earnings growth are attractive, then it’s probably not crazy to think stock prices will head in that direction.

Indeed, it’s usually the case that EPS have grown, and it is also the case that the S&P 500 has moved higher.

Similarly, strategists’ annual forecasts tend to predict the direction of earnings is up and the direction of prices is also up.

Maybe strategists rarely nail their price targets. But directionally, they tend to get things right.

A version of this post was originally published on Tker.co.