Investors with a lot of money to spend have taken a bearish stance on Vistra (NYSE:VST).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with VST, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 16 options trades for Vistra.

This isn't normal.

The overall sentiment of these big-money traders is split between 25% bullish and 62%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $100,000, and 15, calls, for a total amount of $982,633.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $195.0 for Vistra over the last 3 months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Vistra options trades today is 609.2 with a total volume of 1,888.00.

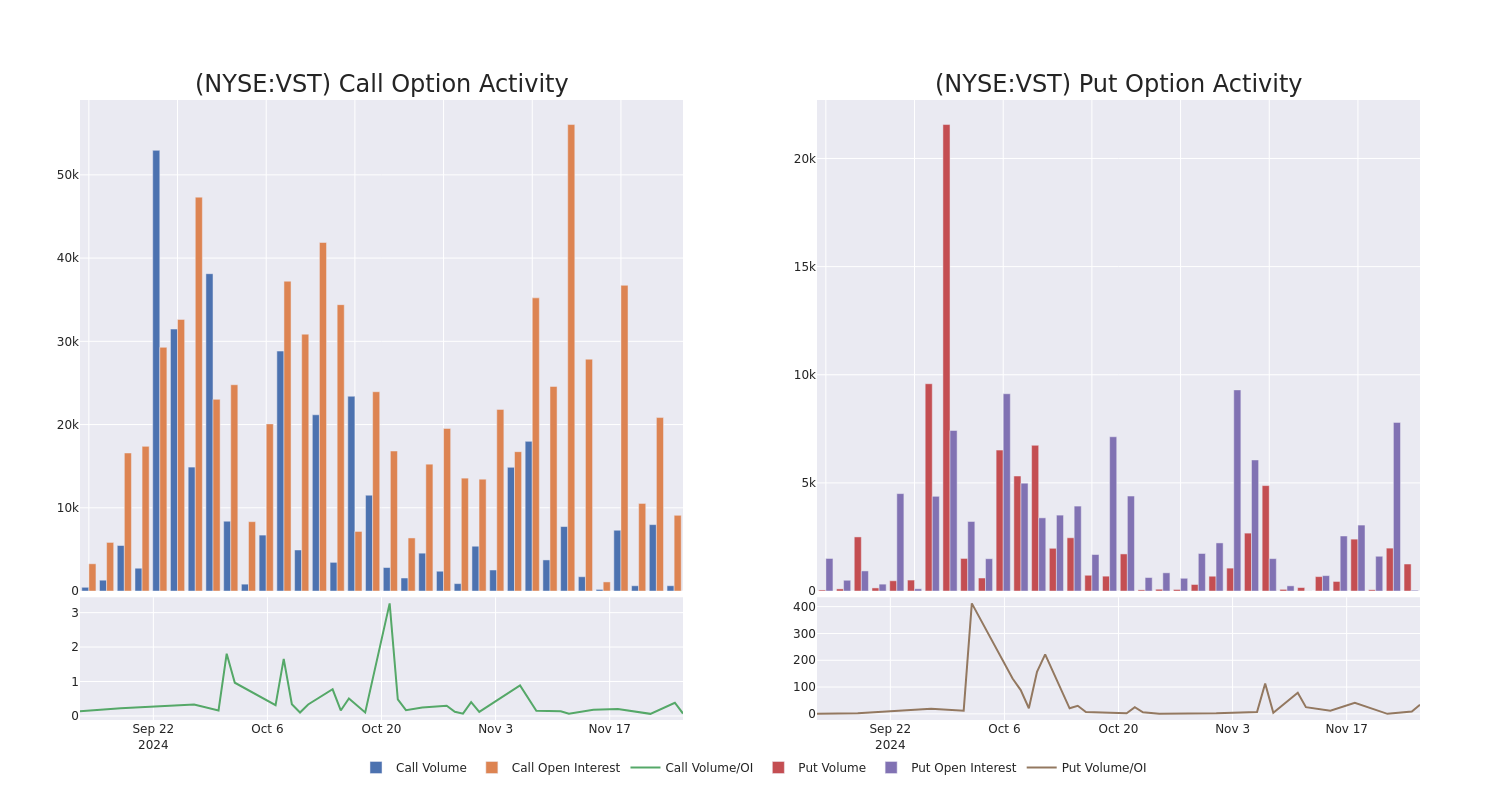

In the following chart, we are able to follow the development of volume and open interest of call and put options for Vistra's big money trades within a strike price range of $100.0 to $195.0 over the last 30 days.

Vistra Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | TRADE | BEARISH | 12/19/25 | $74.1 | $71.5 | $72.47 | $100.00 | $362.3K | 126 | 50 |

| VST | CALL | SWEEP | BULLISH | 02/21/25 | $9.2 | $9.0 | $9.2 | $195.00 | $127.8K | 325 | 139 |

| VST | PUT | SWEEP | BEARISH | 12/13/24 | $0.8 | $0.75 | $0.8 | $137.00 | $100.0K | 37 | 1.2K |

| VST | CALL | TRADE | BEARISH | 01/17/25 | $15.7 | $15.2 | $15.2 | $160.00 | $76.0K | 2.8K | 66 |

| VST | CALL | TRADE | BEARISH | 01/17/25 | $51.3 | $50.4 | $50.4 | $110.00 | $50.4K | 858 | 10 |

About Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

In light of the recent options history for Vistra, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Vistra Standing Right Now?

- Currently trading with a volume of 2,278,343, the VST's price is down by -0.22%, now at $153.8.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 92 days.

Professional Analyst Ratings for Vistra

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from Morgan Stanley persists with their Overweight rating on Vistra, maintaining a target price of $169. * An analyst from BMO Capital has decided to maintain their Outperform rating on Vistra, which currently sits at a price target of $147.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Vistra with Benzinga Pro for real-time alerts.