And it came to pass that Odysseus was forced to make a choice.

The famed Greek hero of the epic poem The Odyssey encountered all manner of perils in his 20-year struggle to get back home.

Related: Analyst who forecast Palantir's rally makes another bold call

In one particularly hazardous situation, the King of Ithaca had to navigate his ship between the monsters Scylla and Charybdis on opposite sides of the Straits of Messina.

One choice would cost him six men, while the other would take his entire crew and destroy his vessel.

💰💸 Don’t miss the move: SIGN UP for TheStreet’s FREE Daily newsletter 💰💸

It was time for Odysseus to make a decision.

Fortunately, today's investors don't have to face mythological creatures when deciding what stocks to buy.

But some monstrously big companies are out there, particularly in the tech sector, and one hardy Wall Street veteran is sailing between them.

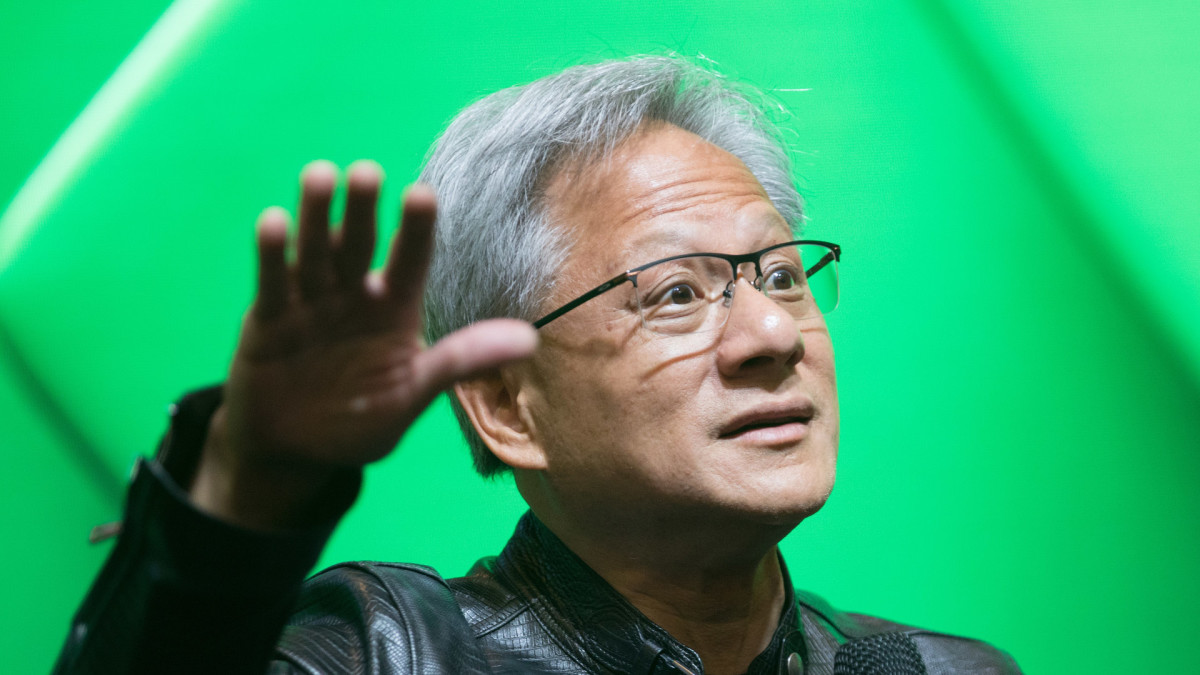

On one hand, we have Nvidia (NVDA) , the reigning AI chipmaking heavyweight, which has seen its shares soar a vertigo-inducing 232% from this time last year and whose co-founder and CEO Jensen Huang believes that "the world needs more dreamers and doers, not just talkers."

On the other hand, we have Palantir Technologies (PLTR) , the data analytics company with a market capitalization of $93.70 billion and shares that have skyrocketed 183% from a year ago.

Veteran analyst praises Nvidia and Palantir

Huang is only the second U.S. CEO after Amazon’s (AMZN) Jeff Bezos to cross the trillion-dollar valuation mark for a company they co-founded.

Related: Legendary billionaire tech investor makes an amazing claim about Nvidia's stock

The company is helmed by co-founder and CEO Alex Karp, who, among other things, can solve a Rubik's Cube in less than three minutes and who said, "We have to find places that we protect away from government so that we can all be the unique and interesting and, in my case, somewhat deviant people we'd like to be."

In the middle stands Stephen Guilfoyle, whose career goes back to the floor of the New York Stock Exchange in the 1980s. He describes himself as "a day trader, long-term investor, and anything in between."

When it comes to investing, Guilfoyle likes to blend economic, fundamental, and technical analysis to determine which stocks are worthy of his hard-earned money. He shares his stock ideas and analysis daily on TheStreet Pro and has written extensively about both companies.

In August, he said that Nvidia was one of the very few stocks that could significantly impact "the broader market" simply by showing up.

Related: Nvidia to reap billions in AI spending as Mag 7 peers ramp investments

He also noted more recently that Nvidia is the main company that has "really prospered on this AI gold rush."

Guilfoyle is also a longtime supporter of Palantir, stating back in September that "this stock is for my children, grandchildren and the generations of Guilfoyles whom I will never meet."

In May, Guilfoyle named Palantir his single best trade, stating that the company "seems driven to succeed and better able to work with less highly polished data than supposed competitors."

“Palantir Technologies is consistently growing sales and its footprint,” he said at the time.

“It's seemingly in a class by itself as the AI-driven leading provider of data-supported, data-focused software platforms purposefully crafted to serve the needs for both security and privacy, resulting in potential solutions for both public and private sector clients," he added.

Strong recommendations for both companies, but what if Guilfoyle had to choose one stock over the other?

Analyst picks favorite stock between Nvidia and Palantir

That question came up during a recent interview with TheStreet, where Guilfoyle shared his thoughts on a variety of topics.

Related: Nvidia stock will replace former tech titan in Dow Jones Industrial Average

He believes the country faces some headwinds going into 2025, regardless of who wins the presidential election.

More AI Stocks:

- Analysts update Meta stock price target with Q3 earnings in focus

- Veteran trader who called Palantir rally unveils new price target

- Open AI is burning cash (and losing billions!)

"I know Goldman has been cautious in their forward outlook," Guilfoyle said. "I don't usually like to side with Goldman, and I'm not going to say they're right off the bat, but I am certainly going to be cautious as we begin the new year going into the end of this year and as we begin the new year."

The biggest risk for the upcoming year, he said, would involve the U.S. getting dragged into war in such hot spots as Asia, Europe or the Middle East.

"I think that would be a black swan event if the United States got into a hot war with somebody that could punch back," he said. "I think that would be a devastating blow to the US economy and to the market."

Food for thought, no doubt. But what about that choice between Nvidia and Palantir?

"They both had tremendous balance sheets," Guilfoyle said. "But for such a young company, Palantir's balance sheet is probably the best balance sheet I've ever seen for a young company. I mean, this is a solid balance sheet, as solid as you'll ever see."

Guilfoyle acknowledged that the CEO "sometimes he sounds a little wacky, sometimes he doesn't."

"But that's perfect to have someone who's somewhat who's a genius, but maybe somewhat eccentric running your tech company," he said. "There's not a shred of debt on it. I mean, no offense to anyone, but I'm taking Alex Karp."

He said his current target price on Palantir is $48, adding, "if and when it gets to $48, I'll take a little bit off because I promised myself I would because that's discipline."

Guilfoyle stressed the importance of discipline in trading.

"Folks at home, this is important," he said. "You want to have a target price. You want to have a panic point. You want to have points where you'll add you want to have all these things because in the heat of the moment, you're going to be nervous."

"If you lay it out like a plan, it's all cold as ice," Guilfoyle added. "You just execute, baby."

Related: Veteran fund manager sees world of pain coming for stocks