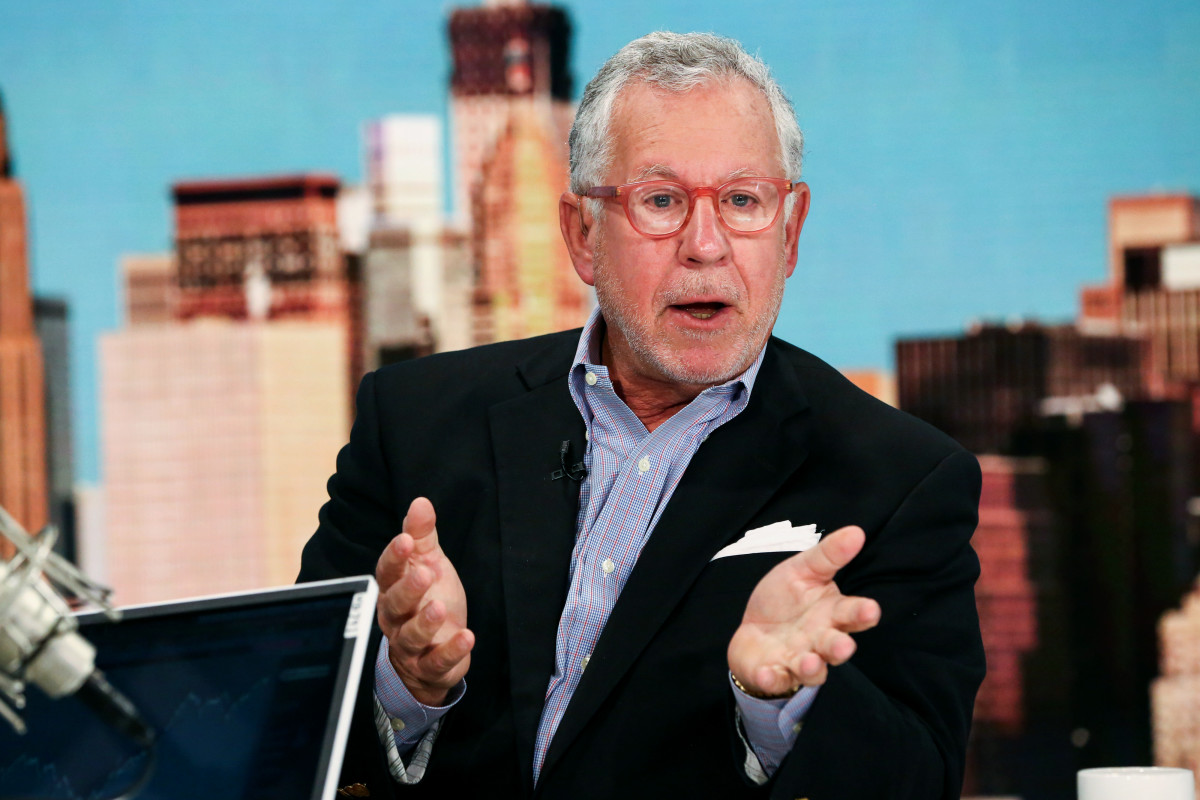

That's going to be a hard no from Doug Kass.

The veteran hedge fund manager shared his thoughts on government investing in his recent TheStreet Pro column, and they were less than kind.

💵💰Don't miss the move: Subscribe to TheStreet's free daily newsletter 💰💵

"There is no worse allocator of capital than the U.S. government," he said. "They should not be in the investing business. Yet it happens with every administration, and all they do is light money on fire."

Kass said each administration seems to follow what is cool at the moment or what favors its big donors and usually cancels what the last administration was doing.

"There are a lot of bad investors in the world, but none are worse than governments," he said. "They pile in at the top more than retail. And at least retail is smart enough to use short-dated call options to limit the amount of money they can flush down the toilet!"

Kass cited governments worldwide that invested in alternative energy, noting that "the stocks themselves have been an utter mess after the initial frenzy."

Shutterstock

Hedge fund manager blasts wasted investment

"The valuations were pushed to absurd levels that the businesses could never grow into, the underlying fundamentals of these businesses and the industry were never good, never economic, and never worked well, and because of all the capital that flooded into the space, there was ultimately too much competition, which destroyed pricing for everyone," he said.

As a more recent example, Kass pointed to the Project Stargate AI initiative that President Donald Trump announced on his second day in office. He promised it would be "the largest AI infrastructure project by far in history.”

More 2025 stock market forecasts

- Veteran trader who correctly picked Palantir as top stock in ‘24 reveals best stock for ‘25

- 5 quantum computing stocks investors are targeting in 2025

- Goldman Sachs picks top sectors to own in 2025

- Every major Wall Street analyst's S&P 500 forecast for 2025

The $500 billion venture between OpenAI, Oracle (ORCL) , Japan's Softbank and MGX, a tech investment arm of the United Arab Emirates government, aims to construct sites throughout the U.S. to develop, power, deploy and maintain AI technology.

Tesla (TSLA) CEO Elon Musk, who is also Trump's biggest donor and head of the Department of Government Efficiency (DOGE) advisory team, promptly flipped Stargate the bird, claiming "they don’t actually have the money."

OpenAI CEO Sam Altman, who called Musk the "most inspiring entrepreneur of our time," nonetheless said he was wrong about Stargate and told the world's richest man that "I realize what is great for the country isn’t always what’s optimal for your companies, but in your new role I hope you’ll mostly put [America] first."

Kass pointed out that shortly after the Stargate project was announced, the Chinese startup DeepSeek unveiled a low-cost AI model on par with some of the most advanced in the world. It was reportedly created with far fewer high-end chips from Nvidia (NVDA) , the reigning champion of the AI chipmaking universe. As a result, it cost less to build and uses less power.

Shares of Nvidia and other tech names tumbled on Jan. 27 as DeepSeek's AI assistant took over OpenAI's ChatGPT spot as the most-downloaded free app in the U.S. on Apple’s (AAPL) App Store.

"Chip projections will be grossly overstated, as are projections for power consumption, which is good," Kass said. "The couple hundreds of billions that U.S. companies spent over the last few years will have been mostly wasted, although in my view a lot of that investment will have been wasted anyway regardless of what the Chinese may have done."

And just like with alternative energy, Kass added, this was inevitable.

"A dis-economic product offering, capital floods the space, technology changes over time but never works great or becomes more economic than existing alternatives, etc." he said.

DeepSeek raises question marks

Let's not forget that Nvidia chips had become so valuable that some tech firms were using the company's AI-enabling GPUs as collateral for loans, the Financial Times reported.

"All those lenders that took chips as collateral for their loans," Kass said. "OOPS! this could only end one way."

Related: Top analyst overhauls Nvidia stock price target as DeepSeek impact lingers

Meanwhile, software giant Microsoft (MSFT) and OpenAI are investigating whether data output from OpenAI’s technology was obtained in an unauthorized manner by a group linked to DeepSeek, Bloomberg reported.

Microsoft’s security researchers observed individuals they believe may be linked to DeepSeek exfiltrating a large amount of data last fall using the OpenAI application programming interface, or API, Bloomberg said, citing people familiar with the matter.

Trump said DeepSeek "should be a wake-up call” for America’s tech companies and Sen. Josh Hawley (R-MO) introduced legislation that would ban exports or imports of AI technology from China, forbid American companies from conducting research there, and prohibit any U.S. investment in AI tech companies in China.

"Every dollar and gig of data that flows into Chinese AI are dollars and data that will ultimately be used against the United States," said Hawley in a statement. "America cannot afford to empower our greatest adversary."

Not everyone believes this marks the end of the road for Nvidia

Nvidia is down 13% over the three trading days ending Jan. 29, but some investment firms see a bright spot in the DeepSeek debacle.

Related: Fund manager who predicted Nvidia’s selloff makes a bold move

Tigress Financial analyst Ivan Feinseth upgraded Nvidia to strong buy from buy on Jan. 28 with a price target of $220, up from $170, according to The Fly.

The analyst said that he viewed the selloff as a “major buying opportunity.”

Feinseth said he believed DeepSeek's R1 AI model's actual capabilities are unknown and that there are "tremendous concerns about security."

AI and the data centers they run on will be a multiyear ongoing investment in buildout and development. Nvidia will be a key beneficiary as it continues to be the number one supplier of AI-driving graphics processing units, the analyst contended.

Kass, however, remained unmoved in his disdain for government investing in the space.

"While it seems unwise on the surface to fight government policy, it may be more wise than people think," he said. "Fighting both government policy and government investment may be the wisest thing of all. Governments seem very good at piling in, right at the top."

Related: Veteran fund manager issues dire S&P 500 warning for 2025