In a letter written on July 6, 1799, French envoy Louis-Guillaume Otto used an expression to describe the vast changes that were going on all around him.

He chose the words "Industrial Revolution," and historians say this is the earliest recorded use of the term, which marked the tumultuous period when machines began to replace the work of human hands.

Related: Analysts overhaul Nvidia stock price targets as earnings address key problem

Cities grew as people moved away from farms to work in factories. And the era saw the rise of the such innovations as the steam engine, the telegraph, and the electric generator.

“It is certainly the most important event in the history of humanity since the domestication of animals and plants, perhaps the most important since the invention of language,” University of Illinois Chicago Prof. Deirdre McCloskey wrote in 2004.

And now the world appears to be heading into another cultural upheaval, as artificial intelligence is likely to have an impact on just about every blessed thing that people do.

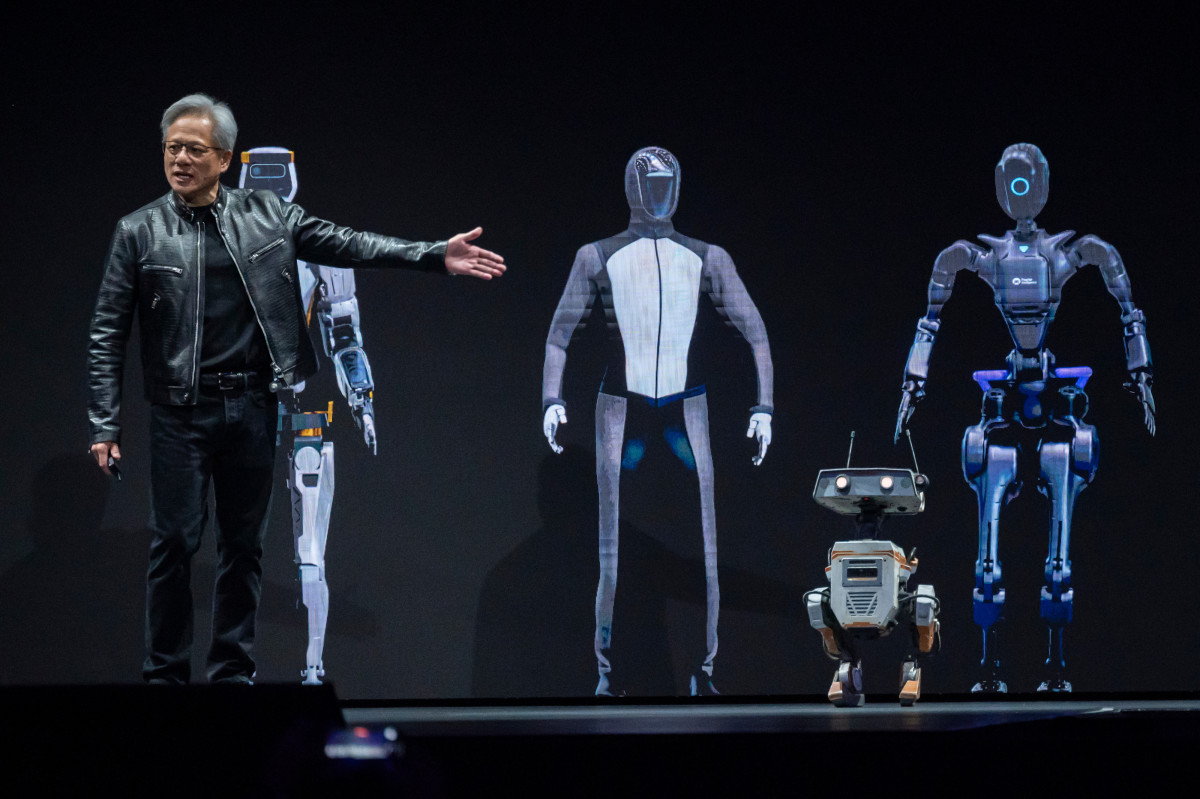

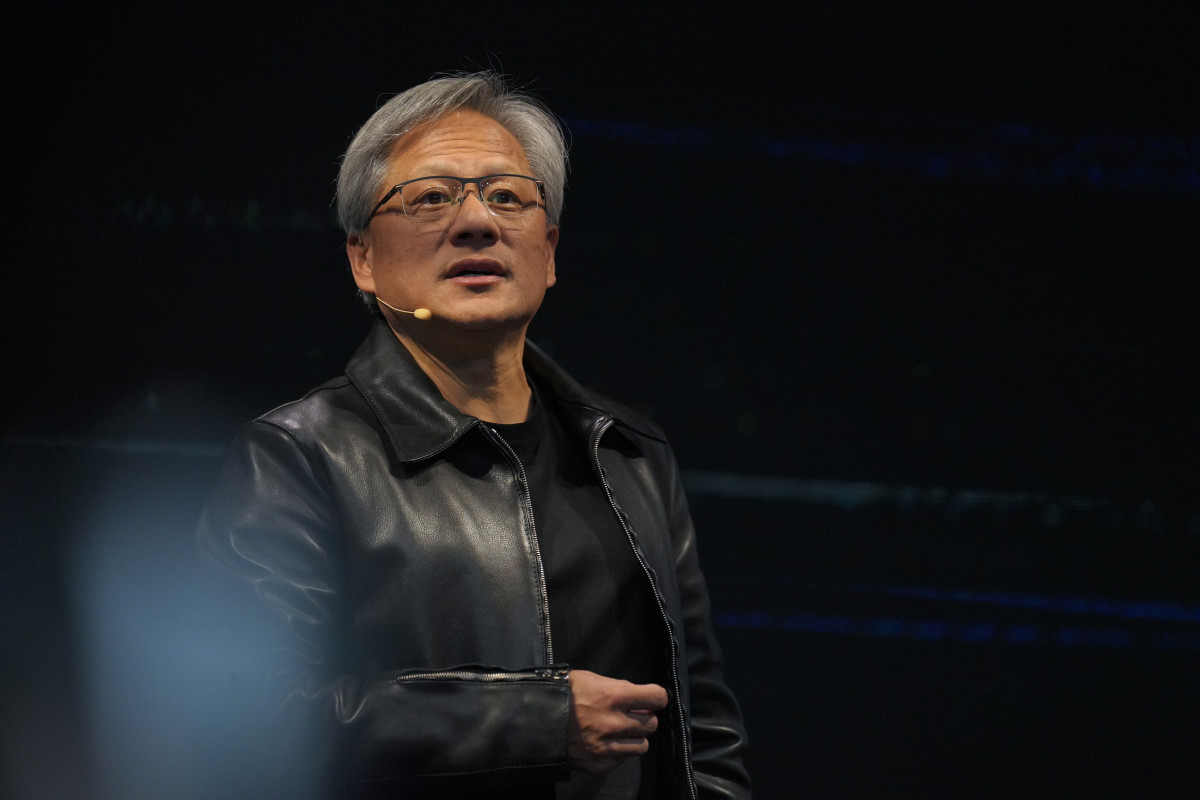

Nvidia CEO: 'We are changing what computers can do'

Nvidia (NVDA) , the biggest name in the massive AI shift with a $2.6 trillion market capitalization, posted a blowout fiscal-first-quarter report late Wednesday.

"The next industrial revolution has begun," the Santa Clara, Calif., Ai-chip maker's chief executive, Jensen Huang, told analysts during Nvidia's earnings call.

"Companies and countries are partnering with Nvidia to shift the trillion-dollar installed base of traditional data centers to accelerated computing and build a new type of data center, AI factories, to produce a new commodity, artificial intelligence."

Related: Single Best Trade: Wall Street veteran picks Palantir stock

Huang, who co-founded the company in 1993, said that "AI will bring significant productivity gains to nearly every industry and help companies be more cost and energy efficient while expanding revenue opportunities."

Nvidia earned $6.12 a share, well ahead of the $5.60 analyst consensus estimate. Revenue more than tripled (up 262%) year over year to $26.04 billion, easily clearing the $24.59 billion market forecast.

Data-center revenue, which includes the company's key AI offerings, surged more than fivefold from a year earlier to a record $22.6 billion, while group gross margin expanded to 78.9%.

"From today’s information retrieval model, we are shifting to an answers and skills generation model of computing," Huang said. "AI will understand context and our intentions, be knowledgeable, reason, plan and perform tasks."

Nvidia said current-quarter revenue would rise to around $28 billion, with a 2% margin for error, even as it said its new Blackwell system of processors and software wouldn't start shipping until the second half.

Related: Wall Street veteran trader revamps SoFi stock price targets

However, Huang said that clients can “easily transition from H100 to H200 to B100,” adding that “Blackwell systems have been designed to be backwards compatible.”

"We are fundamentally changing how computing works and what computers can do," he said.

Undoubtably, skeptics who believe the AI revolution is little more than a heap of hype are out there, but they're hard to come by on Wall Street.

Analyst cites Nvidia's confidence

Analysts responded enthusiastically to Nvidia's numbers, with one declaring that the group "is such a unique growth property that investors will continue to support the company’s premium valuation multiples."

TheStreet Pro's Chris Versace raised his price target on Nvidia's earnings report to $1,250 from $1,100 following the company’s results.

More AI Stocks:

- World's biggest hedge fund boosts its stake in Nvidia stock

- Analysts update Dell stock price targets on Tesla-server win

- Microsoft delivers a blow to Nvidia

"Sweetening the results and guidance, Nvidia announced a 10-for-1 stock split effective June 7 and an increase in its dividend to $0.01 per share on a post-split basis," Versace said.

"We’ll admit that dividend appears to be more for show when you look at it on a post-split per share basis, but when viewed across Nvidia’s forthcoming share count, it equates to returning $1 billion per year to shareholders vs. $100 million before the stock split," he added.

Versace, who began his career in equity research before founding Versace Management in 2005, holds an MBA from Fordham Gabelli School of Business. He co-authored a book called “Cocktail Investing - Distilling Everyday Noise into Clear Investing Signals for Better Returns.”

"While we can’t call Nvidia a dividend stock, that move speaks to the company’s confidence in its business prospects as we move past the early innings of AI adoption," he said.

Versace noted that the surging data-center revenue reflected higher shipments of the Nvidia Hopper GPU computing platform.

The platform is used for training and inferencing with large language models, recommendation engines, and generative AI applications across enterprise and consumer internet companies.

He added that at about 87% of revenue, the data-center segment “is the clear driver of Nvidia’s revenue and profits and one that should continue to benefit from ramping AI and data-center spending from the likes of Big Tech and others.”

"As generative AI makes its way into more consumer internet applications, we expect to see that translate into AI compute demand," he said.

Related: What is Jensen Huang’s net worth & salary as Nvidia CEO?