KEY POINTS

- VanEck said it has been engaging with regulators over the fund since early 2021

- VanEck's Arian Neiron said the fund helps manage the 'back-end complexity' related to BTC acquisition

- The US investment firm is among the applicants waiting for US SEC approval to issue a spot ETH ETF

American investment firm VanEck will launch the first spot Bitcoin exchange-traded fund (ETF) on the Australian Securities Exchange (ASX) after it overcame "hurdles" to provide Australian investors with regulated access to the world's first decentralized cryptocurrency.

The U.S. investment firm revealed in a blog post Monday that it has been engaging with Australian regulators to bring the first spot Bitcoin ETF to the ASX since early 2021. It resubmitted an application to the ASX in February.

With the green light to offer access to Bitcoin through its ETF, VanEck is set to become "the first fund manager to work with the regulator and exchange on mechanics, and the first to formally lodge a submission for a Bitcoin ETF to ASX."

VanEck has provided a form for investors where they can "register your interest" in the BTC ETF that's due to launch on the ASX Thursday.

"Notwithstanding that crypto investing is a polarizing topic, we recognize Bitcoin is an emerging asset class that many advisers and investors want to access," VanEck's CEO and Managing Director for Asia Pacific, Arian Neiron, said of the launch, as per a press release. He went on to note that VanEck's spot BTC ETF for ASX, VBTC, should help manage "all the back-end complexity" that comes with acquiring and storing the digital asset.

The cryptocurrency community on X (formerly Twitter) welcomed the news, with many saying it is a bullish development for the expanding digital assets market. One user noted that while the news is "positive" for Bitcoiners, "the size of Australian capital market is just 3% of the U.S. capital market," so observers shouldn't expect the launch to have "much impact" on the digital asset's current price action.

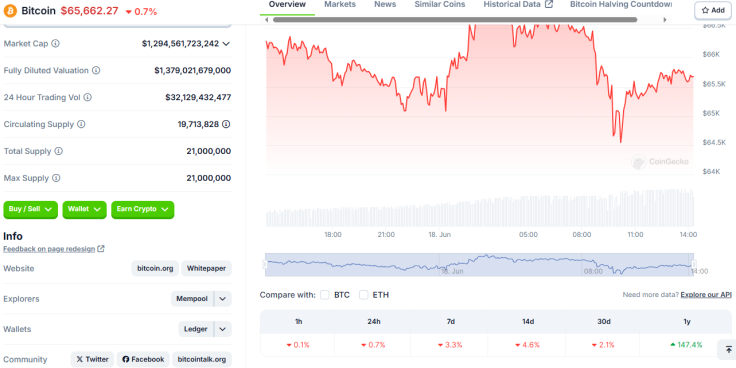

Bitcoin has been on a downturn in recent weeks. As of writing, the world's largest crypto by market cap, was trading at around $65,600. It has been on a 3.3% decline in the last seven days, as per CoinGecko data.

Other users remain bullish, saying the development only indicates that "this is no time to be bearish." Another user said it is a "solid step" for more mainstream crypto adoption.

Meanwhile, VanEck continues to wait on the U.S. Securities and Exchange Commission (SEC) for the approval of its S-1 filing to issue a spot Ether (ETH) ETF. The fund was partially approved when the SEC gave the green light to exchanges seeking to trade and sell the ETFs last month.

SEC Chair Gary Gensler previously said the approvals for spot ETH ETFs will depend on how responsive applying issuers will be.