KEY POINTS

- Trading volume among spot BTC ETFs are 'definitely' on a downtrend: Bloomberg's Seyffart

- An X user questioned whether Bitcoin ETFs are being given 'too much weight'

- Analyst James Check previously noted that BTC ETFs only account for a 'minority share' of the overall market

Since launching in January, U.S. spot Bitcoin exchange-traded funds (ETFs) have become a major point of discussion in the cryptocurrency industry. However, the funds have reached a stagnant state, and trading volume is down, reawakening earlier concerns about BTC ETFs being an overrated crypto subsector.

On Tuesday night, senior Bloomberg analyst James Seyffart posted a Bloomberg Intelligence chart that showed U.S. BTC ETF flows "have mostly stagnated." He noted that inflows and outflows are modest. While net inflows since the funds launched stand on "a very healthy $14.7 billion," trading volume has "definitely" started to hit a downtrend. Since mid-May, the funds have not reached $3 billion in trading volume.

US #Bitcoin ETF flows have mostly stagnated. Not seeing tons of inflows, not seeing tons of outflows. Net inflows since launch sits at very healthy $14.7 billion

— James Seyffart (@JSeyff) July 2, 2024

BUT the trading volume for the group is definitely on a downtrend. The group hasn't hit $3 billion since mid May pic.twitter.com/SDkoE2Lqyf

One user on X raised a question that many in the crypto space may not have given much thought due to the early success of the much-anticipated ETFs: "We give it [spot BTC ETFs] too much weight, maybe?"

@Pledditor, who is followed by some of the most prominent figures in the crypto space, said in November that the "spot ETF narrative is overrated." For the pseudonymous crypto observer, there are alternatives for Bitcoin exposure, such as BTC mining giant Marathon Holdings and Michael Saylor's MicroStrategy.

Spot ETF narrative is overrated.

— Pledditor (@Pledditor) November 10, 2023

Giving institutions a new vehicle to invest in doesn't necessarily mean that they will invest

Other forms of bitcoin exposure have been available such as BITO, GBTC, MSTR, COIN, MARA, etc

Pledditor pointed out further that just because traditional institutions like BlackRock and other BTC ETF issuers are in on the craze doesn't mean they have actually given "a shining endorsement of Bitcoin itself." Instead, such players are just "rational actors who see a potential market to make money on fees."

Another user commented on Seyffart's post, saying it now seems as if "ETFs are old news" and the crypto community is in need of a "new narrative" for the Bitcoin market.

Despite a few concerns about Bitcoin ETFs possibly getting a lot more weight than they should, most Bitcoiners are still positive that the funds are in for a "bullish" turnaround as soon as the digital currency's price moves up.

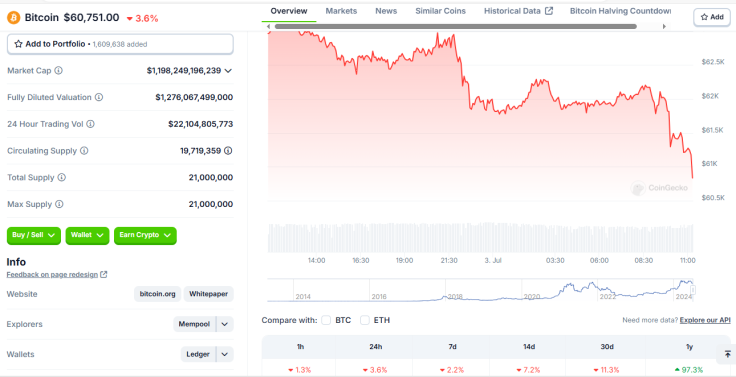

$BTC started the week strong, jumping to $63,000 at one point Sunday night before settling in above $62,000. As of late Tuesday, the world's largest cryptocurrency by market value has plunged back to $60,000, according to CoinGecko data. It has been down by 3.6% in the last 24 hours and declined by over 7% in the past week.

Regardless of how crypto investors view spot Bitcoin ETFs, it is worth noting that the funds make up a "minority share of the Bitcoin market," as emphasized by BTC analyst James Check last month. "Whether by size, volume, inflows, or outflows, they are small relative to the rest of the market."

Outside the U.S., several countries have also been approving more BTC ETFs, including Australia. The funds' approval also triggered a wave of applications for an Ethereum ($ETH) counterpart, and just recently, VanEck filed to issue what could be the United States' first Solana ($SOL) ETF.

Bitcoin ETFs may have been overhyped by some issuers looking to get a bite off Bitcoin's success through management fees, since their launch, the funds became a catalyst for wider recognition of the broader burgeoning crypto sector.