The US Federal Reserve is widely expected to keep its key lending rate unchanged again on Wednesday, as policymakers continue discussions over when to start rate cuts and launch the next phase in their long-running battle against inflation.

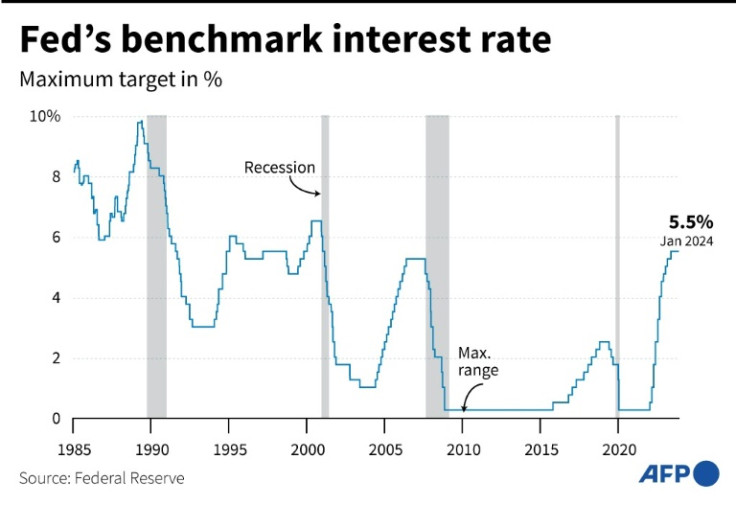

The Fed has raised interest rates to a 23-year high of between 5.25 and 5.50 percent as it looks to return inflation firmly to its long-term target of two percent.

After making significant progress against rising prices last year, 2024 has been more challenging, with the US seeing a small uptick in the pace of monthly inflation.

At the same time, the unemployment rate has remained low, wage growth has eased, and economic growth for the final quarter of 2023 came in above expectations -- all indications that the US economy remains in good health despite higher rates.

After two days of discussions, the Fed will publish an updated summary of economic projections (SEP) alongside its rate decision on Wednesday, which will include policymakers' views of where they expect interest rates to be at the end of this year.

"The pace of disinflation, the slowdown in employment growth, [is] not happening as fast as we thought it did a few months ago," Wells Fargo senior economist Michael Pugliese told AFP. "And so they're gonna fine-tune their policy outlook accordingly."

In December's SEP, policymakers penciled in three interest rate cuts for 2024, as the Fed moves to ease monetary policy while continuing to push inflation down towards its long-run target.

The March update published Wednesday is unlikely to show a significant shift, although some analysts see a chance that the policymakers could reduce the number of cuts they expect to see this year.

Wells Fargo still expects the Fed to pencil in three interest rate cuts for 2024, Pugliese said. This is one less than the bank's own prediction of four rate cuts this year.

However, policymakers are more likely to lower their expectations for rate cuts on Wednesday than they are to raise them, he added.

"Looking at the projections, we do think there is a risk that we see two rate cuts instead of three," EY Senior Economist Lydia Boussour told AFP.

"We've got a lot of noise in the inflation data and some upside surprises," she said. "So there may be some Fed officials that are inclined to adopt a bit more of a hawkish posture."

In recent weeks, officials at the US central bank -- led by Fed chair Jerome Powell -- have urged caution about cutting interest rates too quickly, and have instead said they will follow a "data-dependent" path.

"The economic outlook is uncertain, and ongoing progress toward our two percent inflation objective is not assured," Powell told lawmakers in Washington earlier this month.

He later confirmed that he still expects cuts to begin this year.

Futures traders currently assign a probability of around 55 percent that the Fed will start cutting interest rates by June 12, according to data from CME Group.

This marks a significant shift from the run-up to the Fed's last rate decision in January, when traders were still widely anticipating the first would come in May.

"We were thinking May; we've moved that back to June," Kathy Bostjancic from Nationwide told AFP. "And if it's not June, I think July."

"I think they're really going to be inclined to remain in this wait-and-see mode, and wait for more data to really make that move," said EY's Boussour, who also expects the Fed's first rate cut to come in June.