KEY POINTS

- US-listed spot Bitcoin ETFs bled a total of $541.1 million on Monday – Fidelity's $FBTC lost $169.6 million

- US Ethereum ETFs saw $63.2 million in outflows on Monday – majority of which was on Grayscale's $ETH

- Bitcoin dipped below $67,000 at one point in the day, but has since slightly recovered to challenge $69,000

Cryptocurrency exchange-traded funds (ETFs) had a negative day Monday, coinciding with Bitcoin's dip, as crypto traders and users brace for the impending impact of the U.S. elections on the broader financial market.

Both spot Bitcoin and Ethereum ETFs suffered huge blows Monday, with BTC ETFs at the lower end of the line, seeing hundreds of millions in outflows in a single day.

US Bitcoin ETFs Lose $500 Million in 1 Day

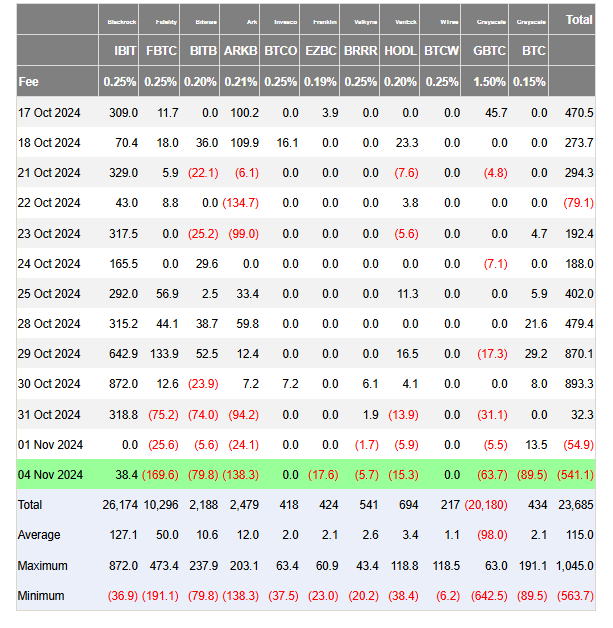

Data from London-based investment management firm Farside Investors showed that on Monday, U.S.-listed spot BTC ETFs collectively shed a staggering $541.1 million, with Fidelity's FBTC leading the pack ($169.6 million in outflows).

21Shares/ARK Invest's ARKB was also a bleeder Monday, seeing $138.3 million out, followed by Grayscale's BTC, which saw outflows of $89.5 million. Bitwise's BITB didn't escape the bloodbath, as it also suffered outflows of $79.8 million.

All other spot Bitcoin ETFs in the United States saw outflows, except BlackRock's IBIT, Invesco's BTCO, and Wisdom Tree's BTCW. In fact, IBIT had a $38.4 million inflow, being the only U.S.-listed BTC ETF that had a positive flow on Monday.

US $ETH ETFs Also Lose Steam

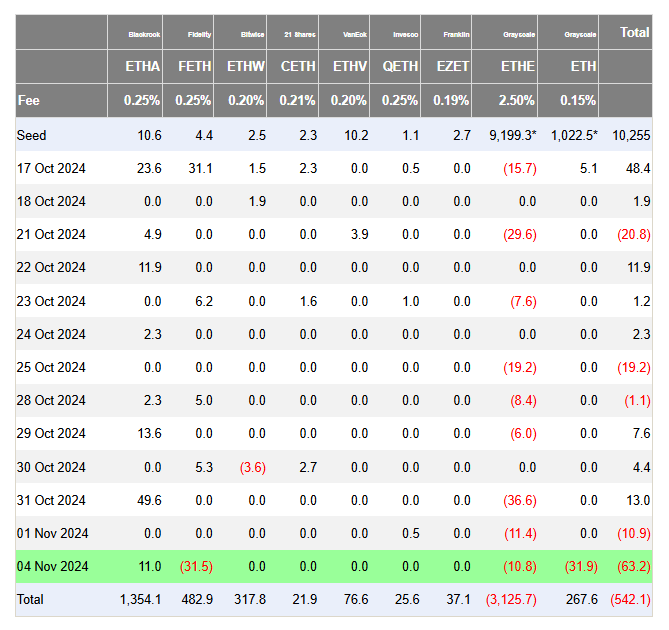

Ethereum ETFs listed in the U.S. also suffered a similar fate on Monday, with outflows reaching $63.2 million, led by Grayscale's ETH, which bled nearly $32 million.

On the other hand, ETH ETFs were not as battered as their Bitcoin counterparts, as the majority of the funds saw zero flows – a much better scenario than experiencing massive outflows.

BlackRock continues its dominance road even in the Ethereum ETF circle, as it was the only U.S. ETH ETF that saw an inflow ($11 million) Monday, while Fidelity's FETH lost $31.5 million, and Grayscale's ETHE shed $10.8 million.

Crypto ETFs Perform Poorly Amid $BTC Slump

The crypto ETFs' poor performance in the lead-up to the elections came as BTC prices had a volatile day. At one point on Monday, Bitcoin dipped as far down as $66,800, as per data from CoinGecko.

The world's largest cryptocurrency by market value has since recovered slightly and is trading at around $68,800, but remains down by 3% in the last seven days.

Meanwhile, on decentralized market prediction platform Polymarket, the event contract for the 2024 U.S. presidential election winner has reached a whopping $3.2 billion bet. Donald Trump is leading Kamala Harris at 60.9% to 39.2% as of early Tuesday.

Berstein analysts retained their earlier projection that BTC prices can surge to $90,000 if Trump wins the elections and potentially drop to $50,000 before recovering if Harris wins.